As trends in mobile gaming move towards extended LTV games where players stick around for longer, it’s important to understand their behaviour over time. In this post we're going to explore the issue of convexity in LTV curves, and how to correctly factor this into your wider UA and growth planning models.

What is Convexity of an LTV Curve?

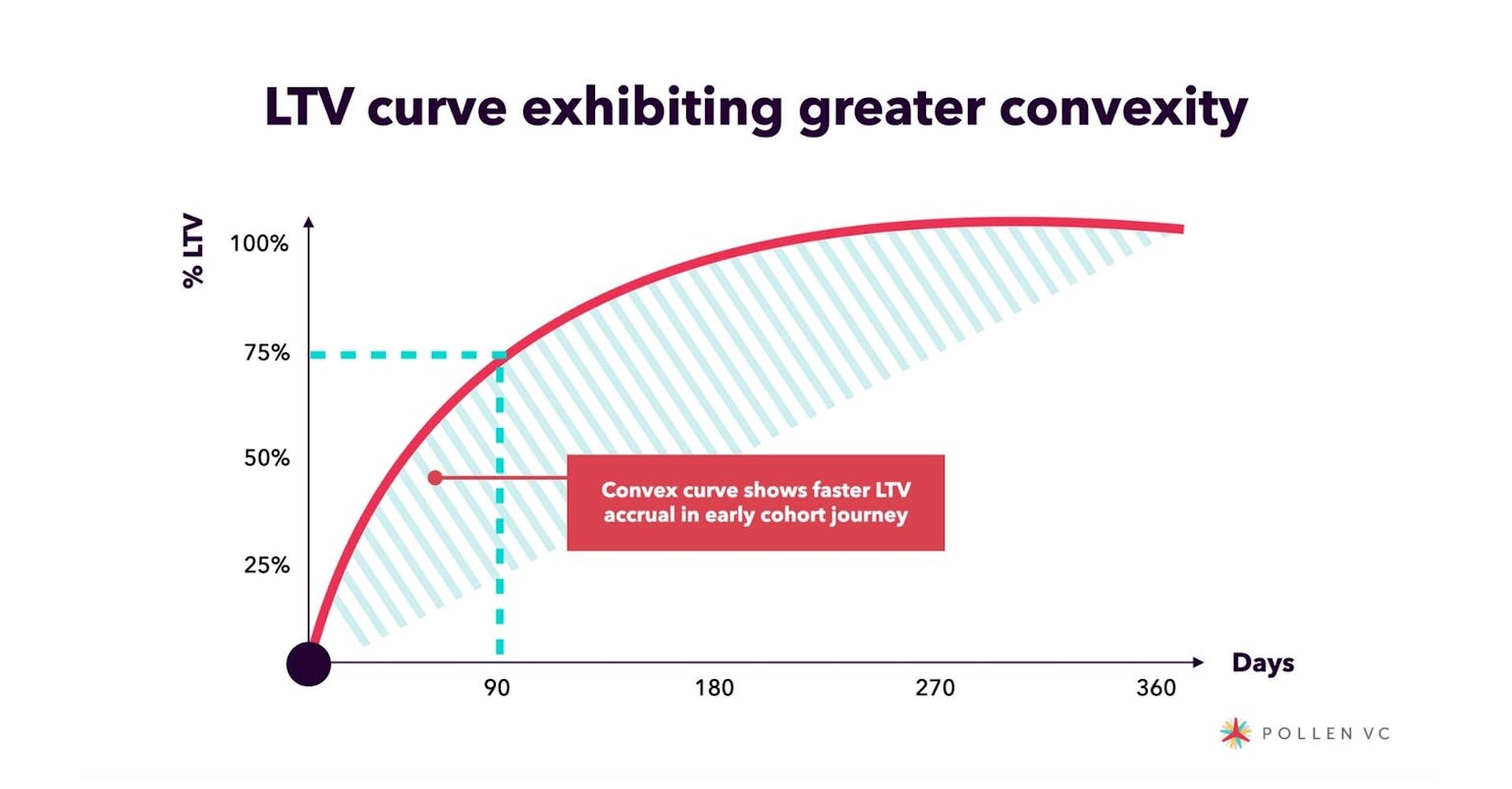

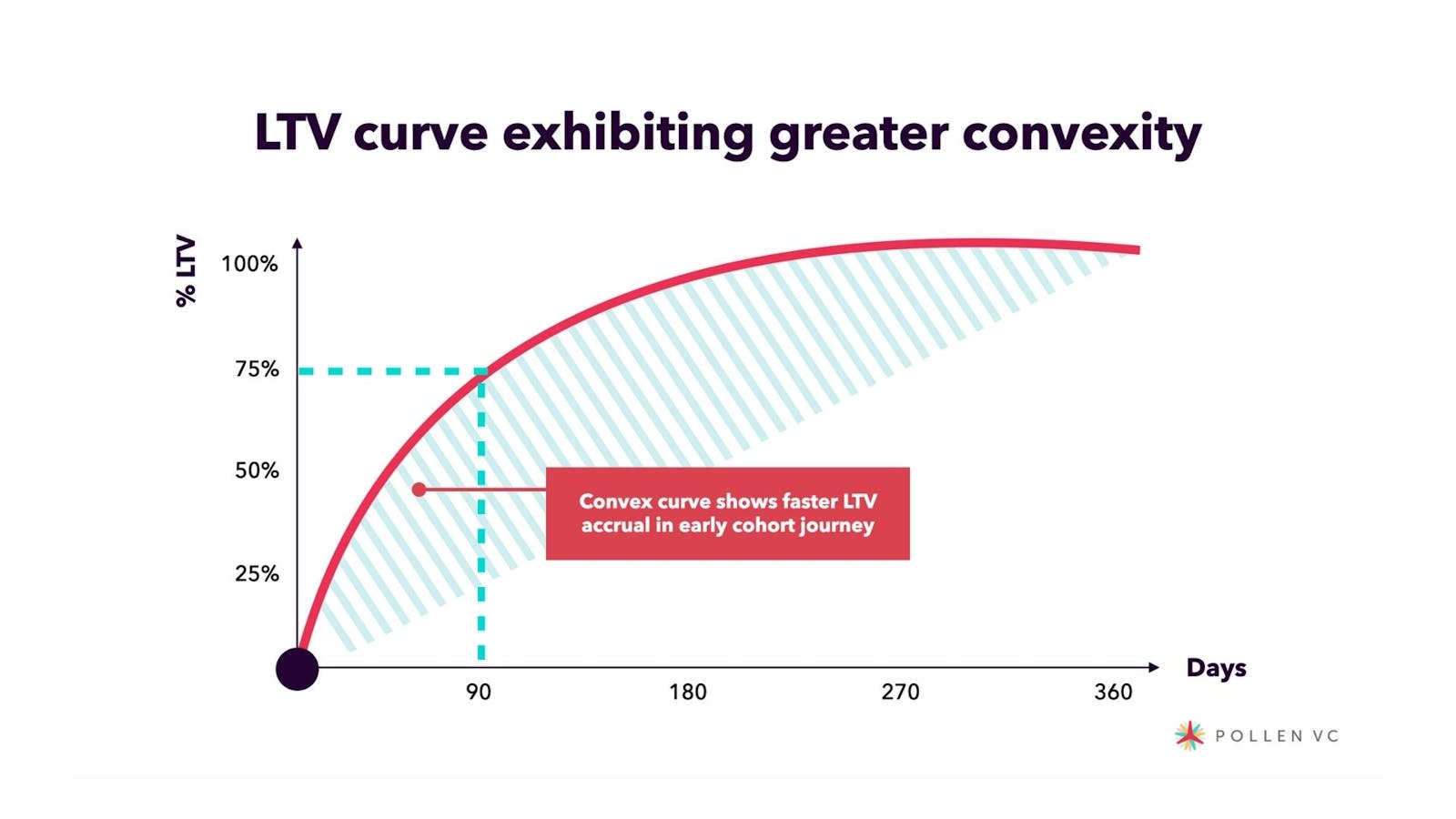

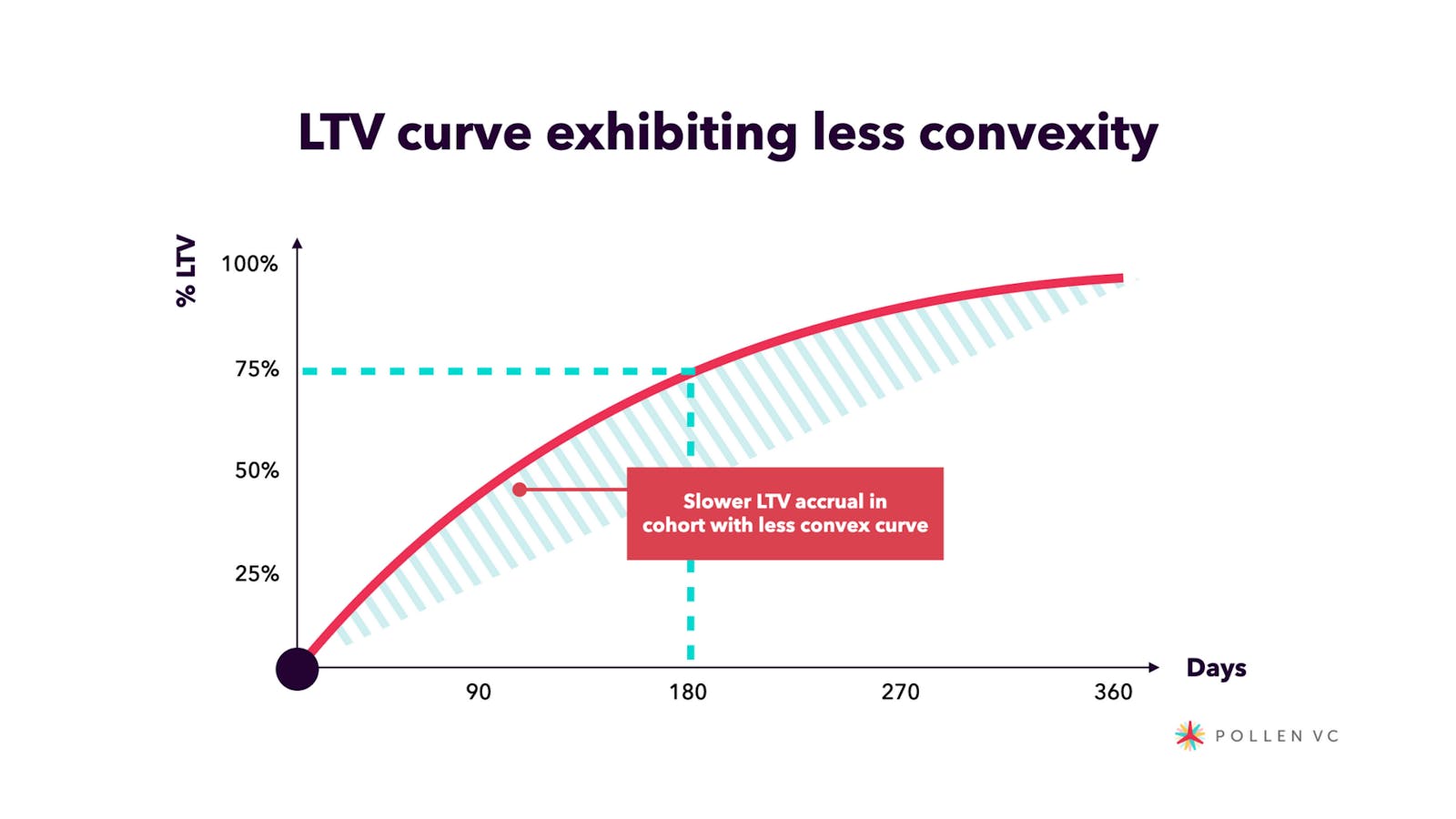

When looking at cohort behavior, players of free-to-play (F2P) mobile games typically exhibit a path of greater spending in a shorter period of time. This then flattens out over time, and, if you're lucky, continues on an upward trajectory. The term convexity refers to the shape of the curve, and the fact that the journey to lifetime value (LTV) is not a straight line. Here, we have two example LTV curves, one more convex then the other, representing different player behaviors, perhaps across different genres of game, but over the same time period.

In both examples, it takes 360 days to achieve 100% of the LTV of the game.

The first example achieves a total of 75% of LTV after just 90 days, indicating a more convex LTV curve, steep at first, then flattening off quickly.

Contrast this with an example that returns 75% of the LTV after 180 days. This example has a much less convex curve as it takes longer to earn revenue from players.

The more convex LTV curve game is accruing revenue at a faster rate earlier compared with the less convex curve.

As the LTV is realized, it is chalking up revenue faster, which will in turn be turned into cash more quickly when the platforms payout 15-90 days later (depending on their payout terms). This becomes an important consideration if this revenue is going to be reinvested into additional user acquisition, as it will impact the rate at which reinvestment into UA can occur.

Another way to look at it is that if a business is investing heavily in a long LTV game with a less convex LTV curve, it will have to rely on a lot more external capital to fund its scale up plan, as the LTV takes longer to recover.

When looking to calculate financial returns over time, UA managers typically look at the profit achieved from the UA cycle (LTV minus CAC), and represent this firstly as a ROAS percentage, then divide it across the time period to get a monthly return on capital invested into the UA cycle. This assumes the return is generated on a linear basis, which, of course, it is not.

It’s more accurate to look at the returns on a monthly incremental basis so that the benefit of the convexity can be better factored into the UA calculation. This does make the modeling more complex, but if a studio is looking to spend significant sums of capital on UA for longer LTV games it's worthwhile taking the time to do this, as it can significantly impact the financial models and capital planning requirements.

When scaling, the studio can further reduce it's reliance on external capital by using a revolving credit facility to provide further leverage. By being able to borrow against platform receivables or accounts receivables (AR) of IAP and ad revenues, as well as the projected residual value of existing cohorts, this can give the studio significant further firepower to reduce its reliance on external capital in achieving its scale-up plans. UA managers can take advantage of the more rapid revenue accrual of convex LTV curves, and turn it into cash using revolving credit facilities.

The rule of thumb is the greater the convexity of your LTV curve, the more you can leverage your AR in order to reinvest faster into UA to scale faster.

As VC funding across the tech sector tightens up, it’s very important for CFOs and UA leads to understand the impact of convexity of their LTV curves in their capital planning as they look to scale their games in a leaner funding environment.

This article was first published in May 2022, and has since been updated.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!