Revenue Based Lending (also known as Revenue Based Investing and Revenue Based Finance) is an increasingly popular alternative to raising additional equity at a company’s growth stage. It’s gaining traction in sectors like SaaS and eCommerce where predictable revenues exist that lenders can get comfortable with as a more capital efficient way to fund growth through paid advertising.

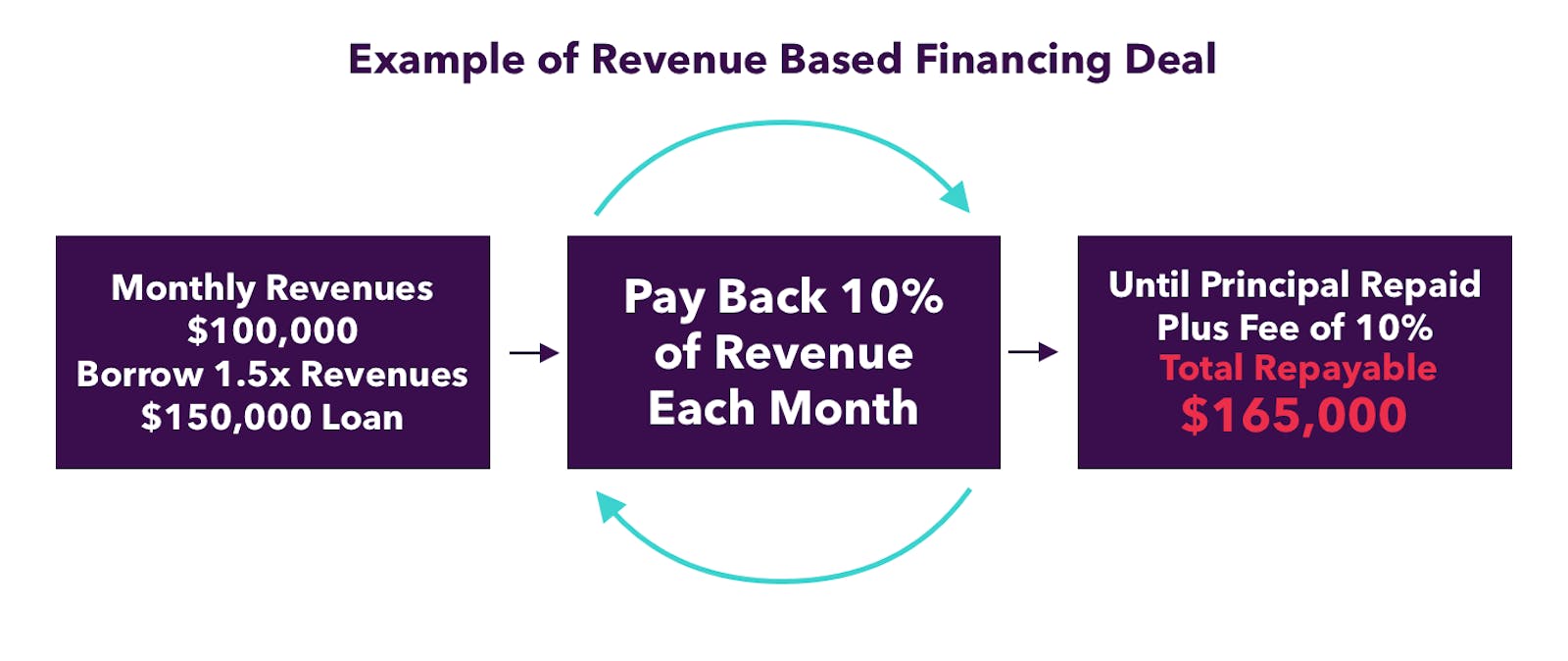

Typically an amount is advanced upfront, say $100k, with the expectation (or requirement) that funds will be used to drive growth through acquiring additional customers via platforms like Facebook and Google. The advance is then repaid via a monthly repayment schedule, of say 8-10% of revenues, until it is repaid in full plus an agreed fixed fee of typically 6-12%.

The revenue based lending model is centered around enabling founders to use debt financing rather than equity to fuel growth in their business. There is an elegant simplicity in the model in that it is very easy for entrepreneurs to digest due to the fixed fee structure.

But sometimes the apparent simplicity hides the reality.

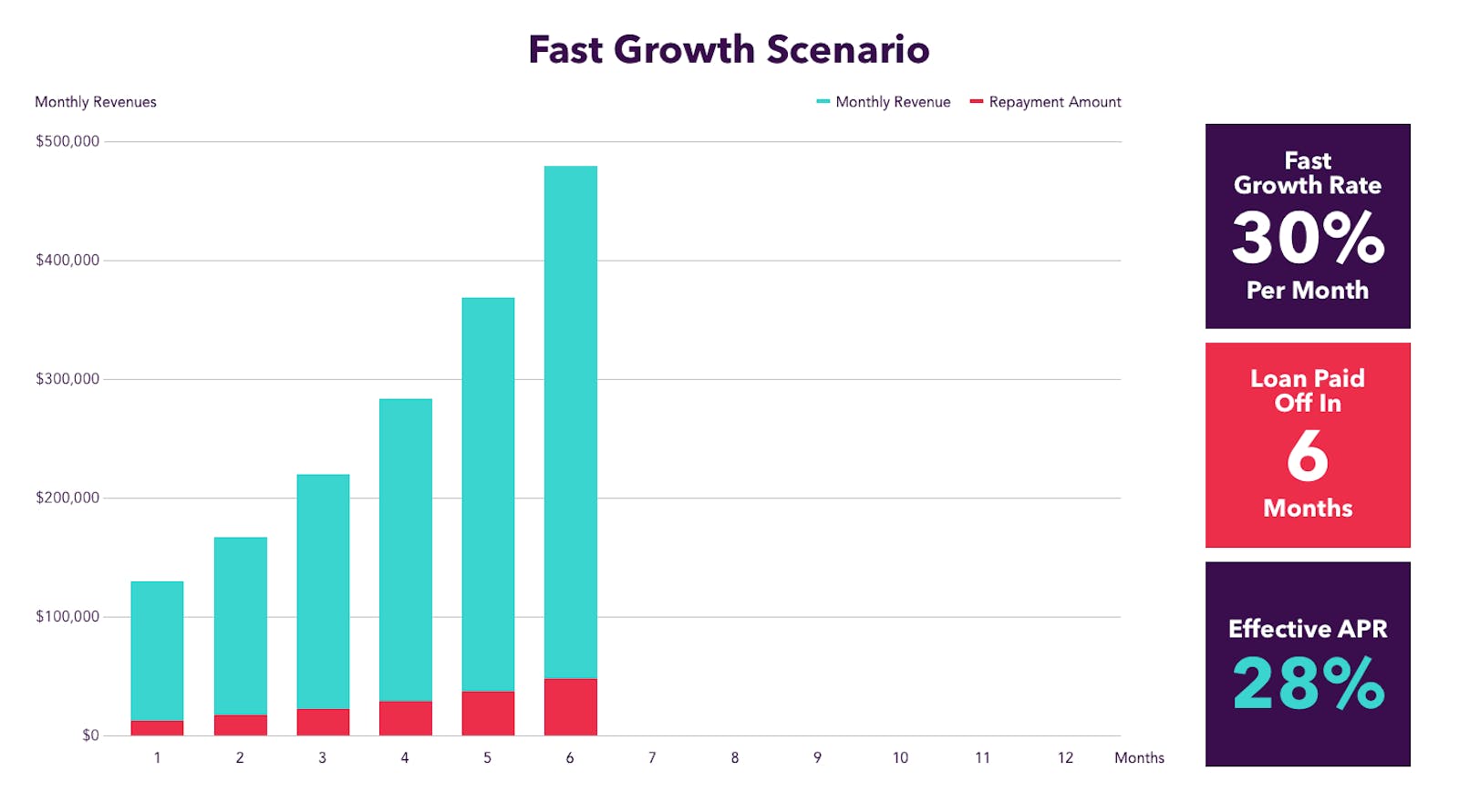

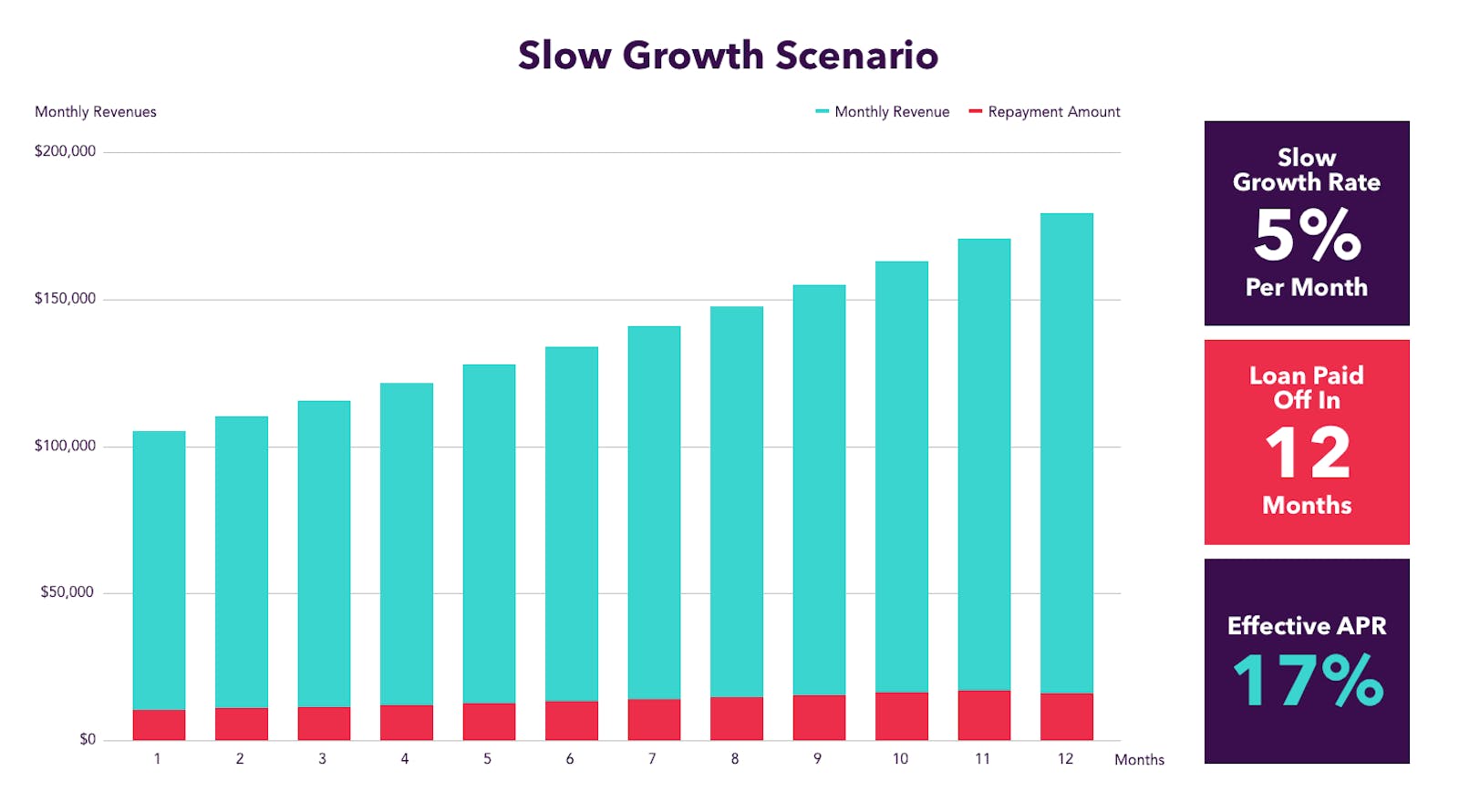

The problem with revenue based finance is that it is inherently paradoxical. Businesses with strong growth will repay the loan plus fixed fee in a very short period of time, sending their effective loan interest rate through the roof. Businesses with weaker metrics, whose growth is slower, will take substantially longer to pay back the loan and fixed fee, thereby reducing the effective interest rate.

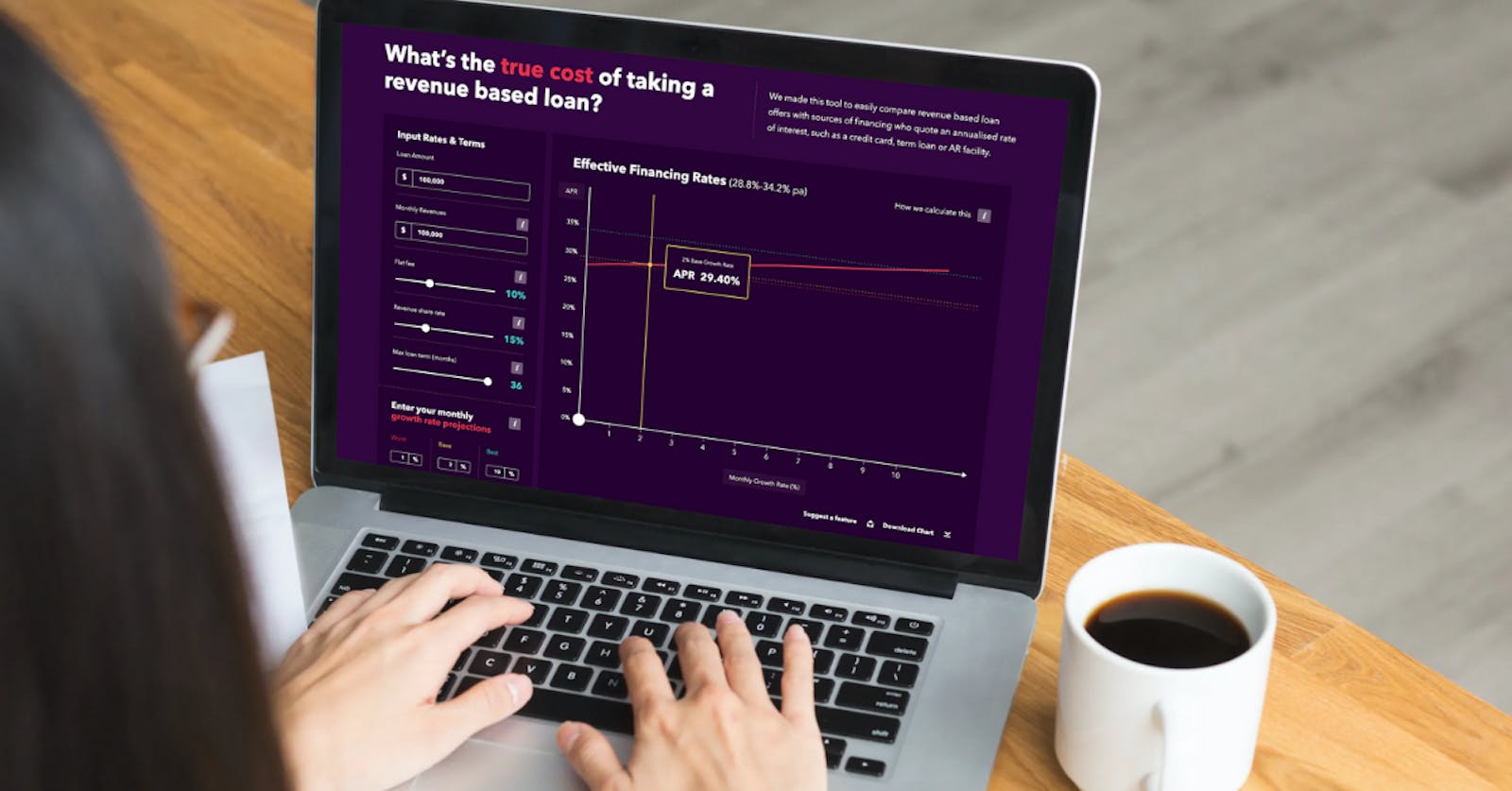

The confusion sets in when entrepreneurs are focused on a fixed fee, rather than considering their true cost of money on an annualised interest rate basis (APR).

As you can see, if you model the cost of funds of a high growth business using RBL to fund customer acquisition versus a business on a slower trajectory, the cost of borrowing on an APR basis will differ wildly, but the fixed fee disguises the true cost.

RBLs are penalising high growth businesses by using them to subsidize those operating less efficiently. Clearly RBL algorithms are biased towards the highest growth businesses where they can make the highest returns - so if you get approved, think about that!

Consider your alternatives - is RBL right for my business?

In any fundraising decision process, there are competing factors at play. Entrepreneurs need to balance multiple factors including timing to close, ease of application/onboarding, dilution impact, and opportunity cost at every step of the way in making their decisions. And let’s not forget that they have to keep their business running in the meantime, so the decision process is not always an easy one.

Revenue based lending may be best suited to companies with high gross margins for example e-commerce or SaaS where they have a relatively low proportion of the cost of goods sold (COGS) vs revenues. In other sectors, such as gaming, sometimes these margins could be much much thinner due to the high cost of user acquisition. Therefore the margins may not satisfy the criteria of revenue based lenders depending on how smart their credit algorithm is and their understanding of the sector they are lending into.

Founders should look at the whole range of financial instruments available, such as “traditional” venture debt, invoice finance, AR facilities, and make an informed decision based on a real understanding of costs as well as factoring in the other parameters including time to close, dilution, security, etc.

Any series of cash flows can be easily computed into an annualized interest rate calculation for comparison (use XIRR in Excel). Once you have modeled the scenarios on a like-for-like basis, you can make an informed decision. This may not always be the cheapest option, but multiple factors will weigh into whether it is the right option.

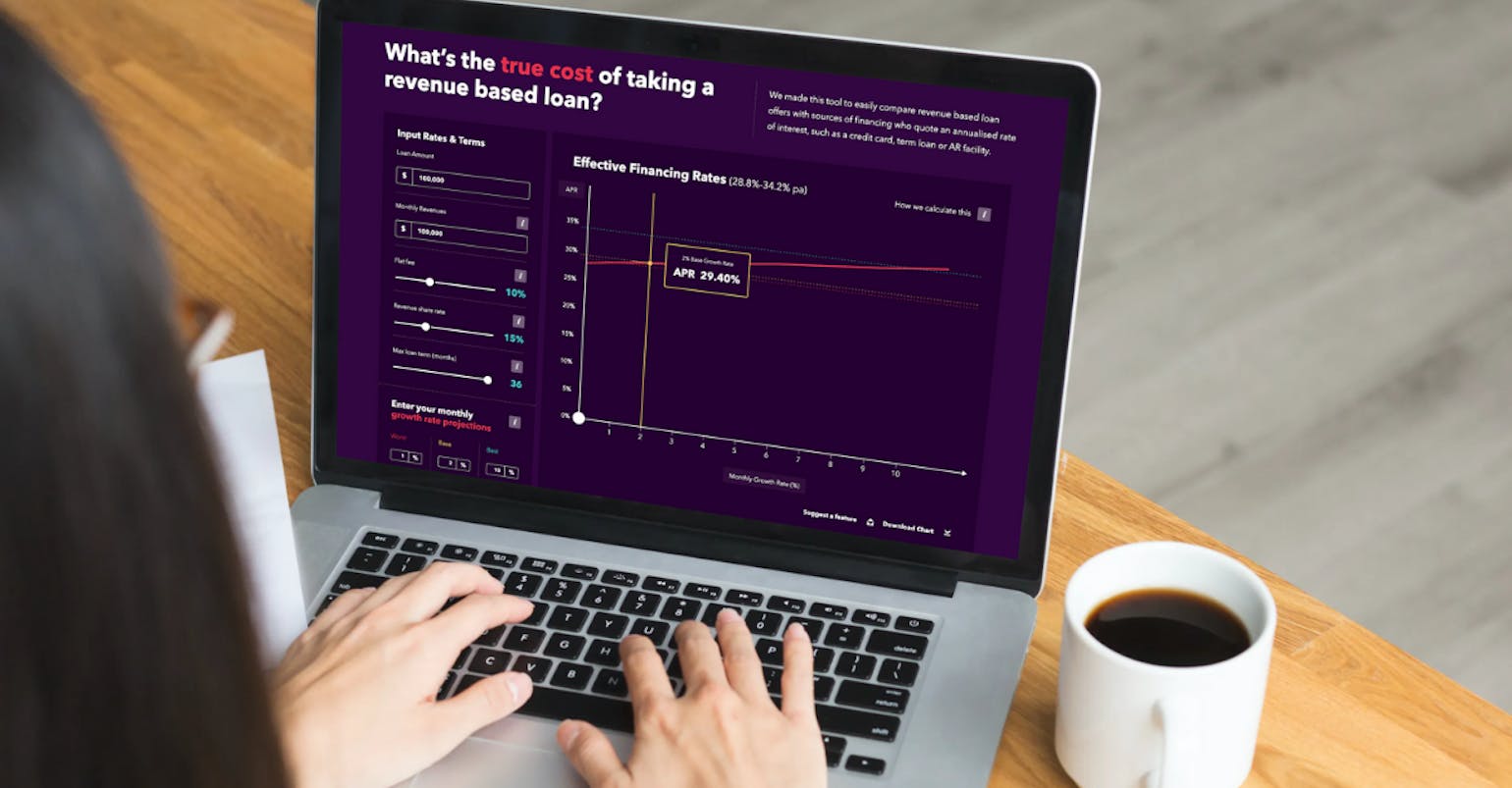

To illustrate the points, we put together this simple Calculator where you can model different scenarios and calculate annualized interest rates based on your own situation.

Is RBL a bad thing?

Absolutely not. RBL can be a great alternative to VC funding and can be a valuable part of the capital mix of a growing company. It’s great as a way of funding growth in a non-dilutive way and avoiding raising VC funding where possible.

But savvy founders need to look at all of their options, learn to price them accordingly, and understand the true costs involved in order to make rational economic decisions. In an attempt to be “founder friendly”, many lenders in the RBF space adopt a slightly patronizing attitude with flashy marketing and fixed fee scenarios to “keep things simple”, whilst sidestepping the question that everyone wants to know - the true cost of funds.

In a future post, I will share thoughts on the importance to founders of understanding LTV horizons and cohort behavior, in order to help make more informed funding choices.

RBL: Revenue based lending

RBF: Revenue based finance

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!