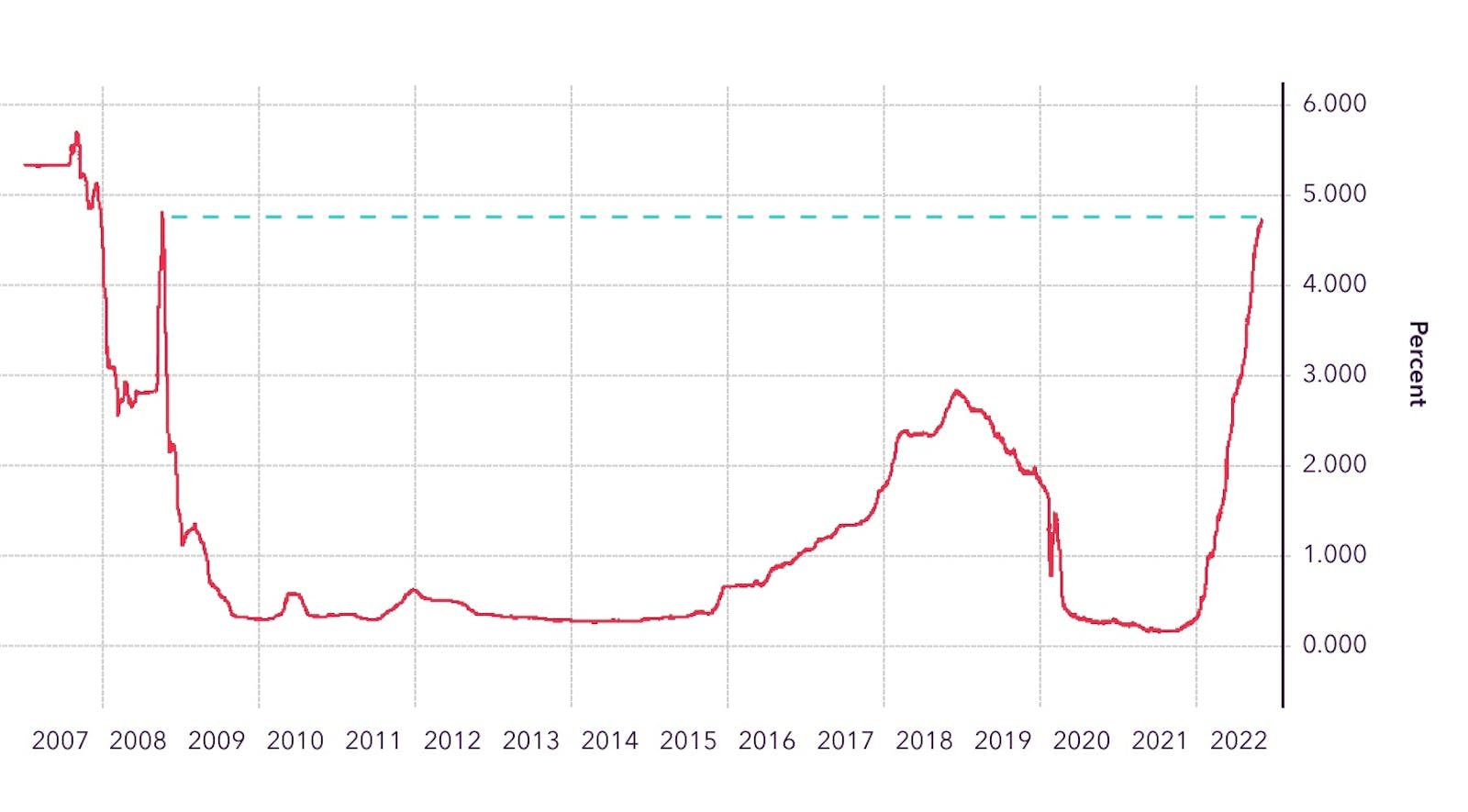

The world is in a very different place to where we were a year ago. After a long period of historically low interest rates, for the first time since the mobile user acquisition space was born in the early 2010s, the rising interest rate is forcing the industry to reconsider financing decisions and growth plans.

Interest rates remained low for an unprecedented period of time as the global macro economy went through an almost 15-year bull run without a correction. Now with a changed outlook, sky-high inflation, and many economies on the brink of recession, the impact is spilling over into the mobile app and gaming ecosystem. There has recently been a dramatic slowdown in VC funding, and volatility in customer acquisition costs/ad CPMs is resulting in a tougher environment for scaling apps and games.

How does the rising interest rate impact a gaming/app studio’s calculations around growth?

It all comes down to the measurement of cost and returns on their UA spend. Studios are being forced to pay closer attention to their unit economics. Founders, CFOs, and UA teams must come together to focus on how their UA is being financed, and what return it’s achieving with much closer scrutiny.

Two key things are happening in the market:

- VC funding is drying up - especially later-stage funding where VCs would invest tens of millions of dollars to fund long-term user acquisition

- Interest rates are rising - so if using debt as part of the capital mix, the impact of the rising cost of debt needs to be understood

Let’s first isolate how user cohorts monetize so we can start to apply a greater level of financial rigor to our calculations.

Assume for a moment we are able finance our cohorts only using external debt, in this case, a revolving credit line such as the type we offer at Pollen VC.

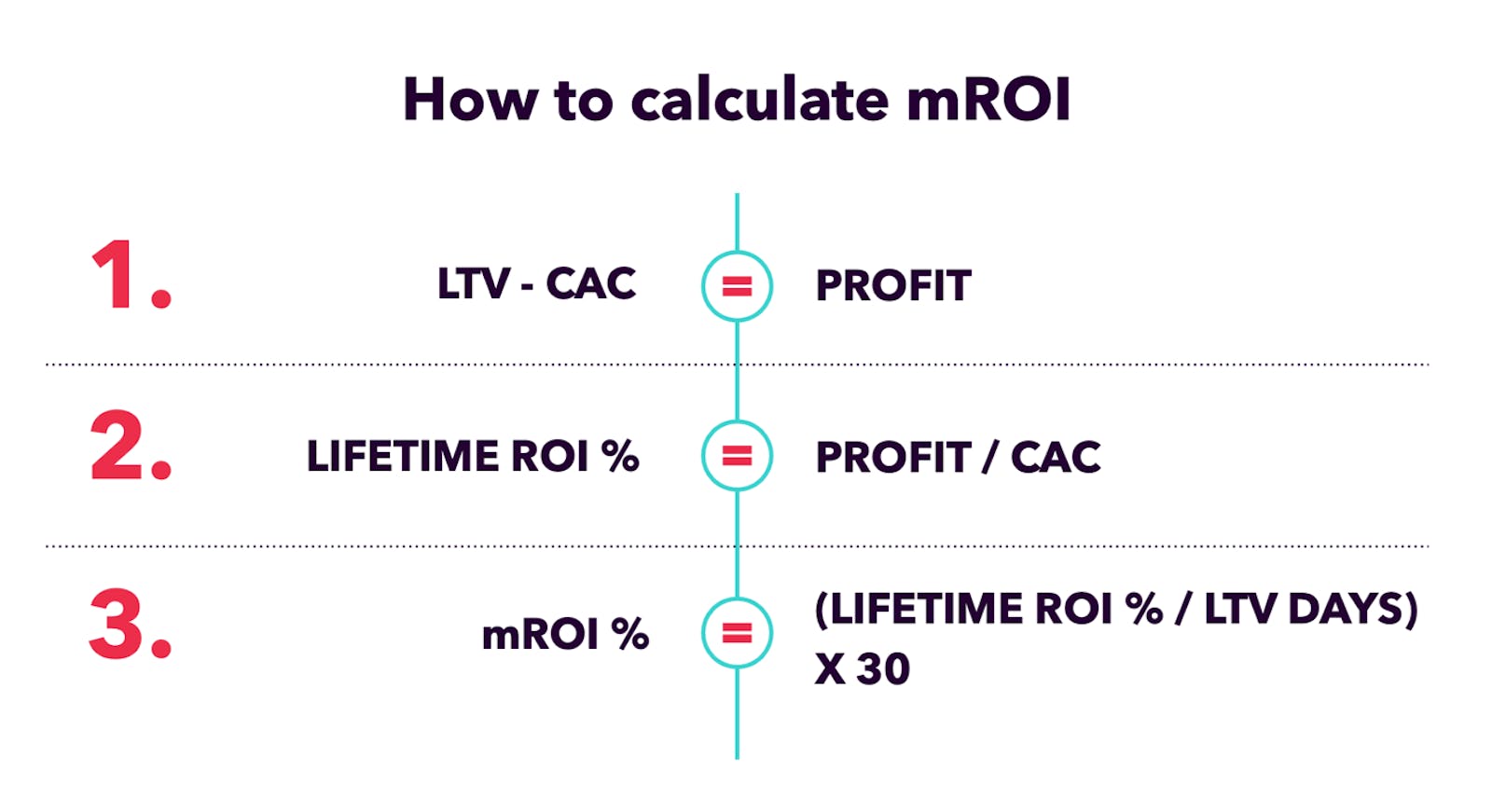

We want to understand the profitability of the cohort and how long it takes to achieve this profit, which is defined as the LTV minus CAC, paying particular attention to the timeframe, to realize the LTV. We then want to arrive at a mROI (monthly ROI) on the UA cohorts so that we can calculate financial returns over time, which we calculate by the following equation:

Read more on understanding convexity in LTV modelling here.

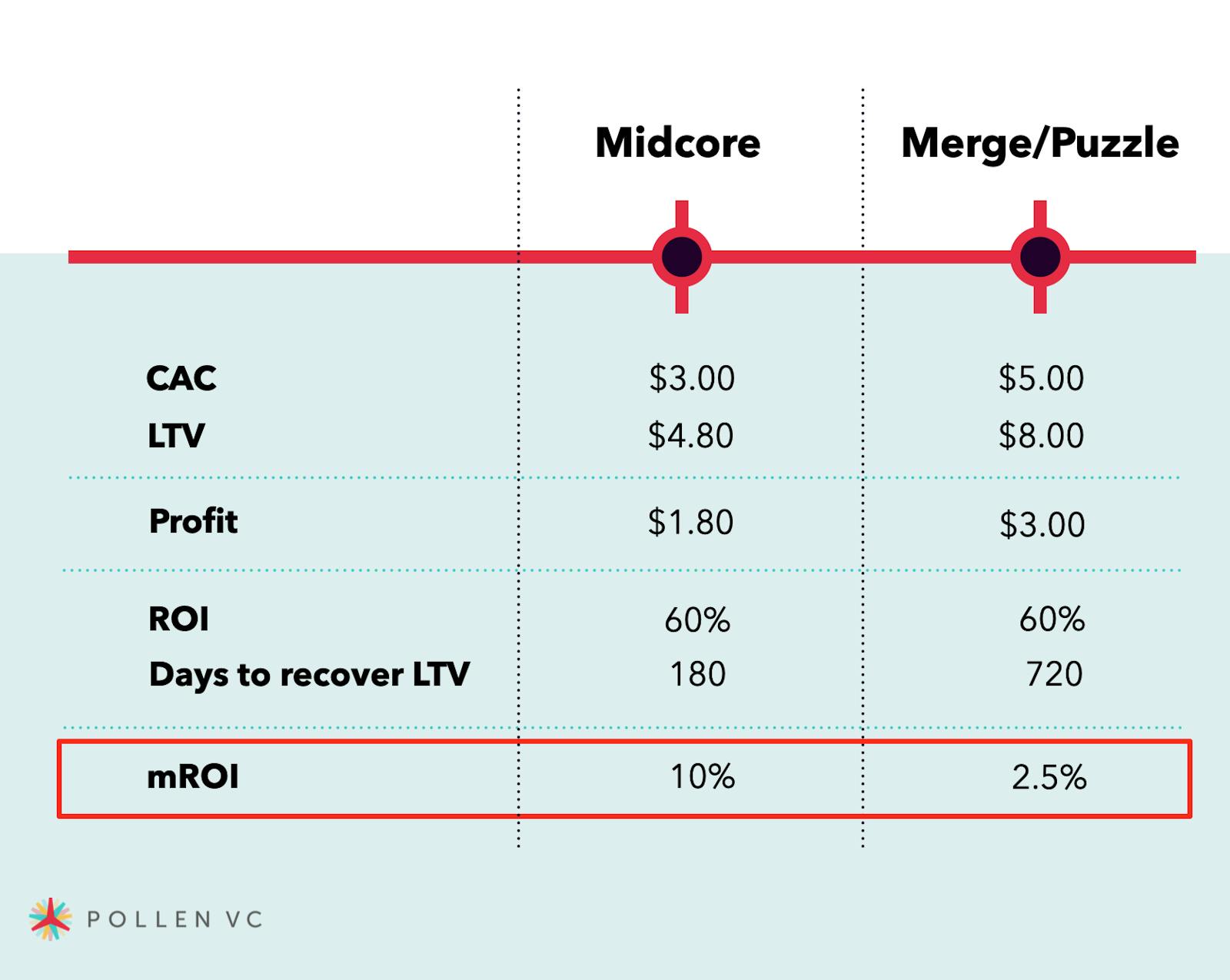

Here are two example scenarios for different game genres with the same overall ROI on their ad spend, but different mROI profiles.

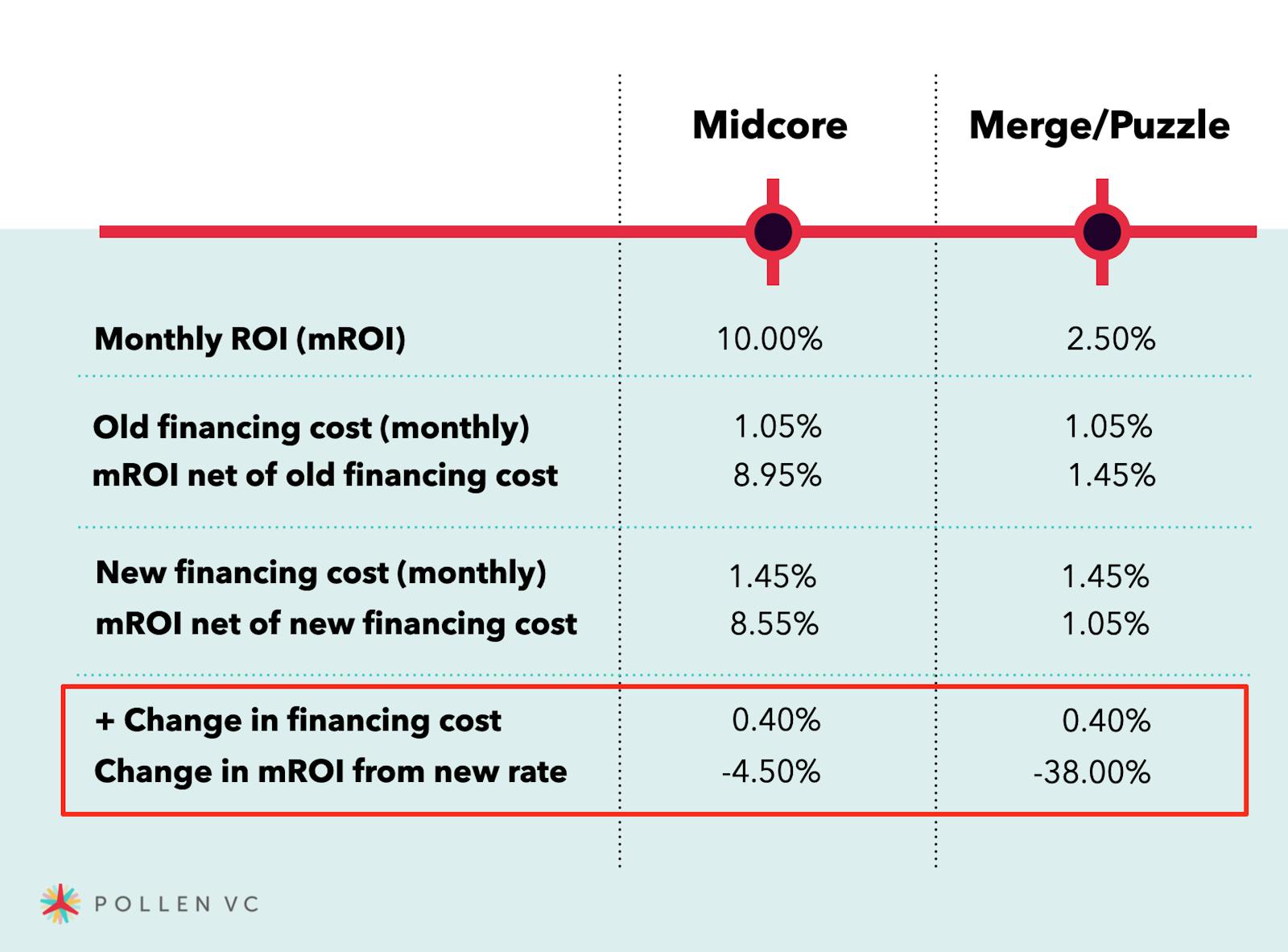

Now let’s assume a cost of funds of LIBOR plus 12.5% per annum. One year ago, this would have equated to a monthly financing rate of 1.05%. As LIBOR has risen by almost 5% over the last 12 months, the new effective rate (assuming credit spreads are unchanged) would be 1.45%.

How does the higher cost of funds affect our financial returns on UA?

So the midcore game with the shorter ROAS/LTV cycle and the higher mROI is only marginally impacted by the increase in financing costs, whilst the merge/puzzle game which has much more finely balanced unit economics sees the financial return drop by 38%.

So there are a few key takeaways from the result of a higher interest rate environment:

- Long LTV games will be impacted more, as UA cycles are financed over a longer period of time, an increase in interest rates brings down the financial returns.

- The M&A market will continue to be impacted, especially for longer LTV games where the financial returns are less attractive due to higher financing costs.

- Shorter LTV, higher mROI games should perform more strongly due to the financial returns from UA still being strong, and remain relatively unaffected by a rising interest rate environment.

- Whilst VCs will continue to invest in early stage studios, later stage rounds predominantly raised for user acquisition will be confined to the history books (at least for now) as encouraging portfolio companies to deploy capital efficiently rises up their priority list.

VCs are now way more selective about the opportunities they invest in and care more about capital efficiency. Founders and CFOs of mobile app and gaming studios have woken up to the idea of using debt as part of their capital mix, and the emergence of alternative finance providers has raised awareness of debt as a more attractive financing tool to fund growth. It's important to remember that not all such products are effective as a mechanism to scale free-to-play games, or subscription apps.

When considering debt solutions, founders should first consider the best-fit product for their needs, allowing them flexible capital to dial-up UA when the right conditions exist, and to pull back their borrowing if conditions turn unfavorable. This is generally achieved using a revolving credit facility in order to deploy debt financing into UA in the most efficient way.

The change in economic realities has forced VCs and founders alike to focus more on capital efficiency as a concept. There are still great returns out there to be made, but building the right genre of apps/games where you can achieve a decent return profile is becoming more important day by day.

Why not check out our free-to-use mROI calculator to help you with your financing decisions?

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!