As founders get smarter about how they fund their growth, there is an increasing focus on non-dilutive sources of capital as alternatives to equity financing from VCs. As more data points become available, new options such as accounts receivable (AR) financing and revenue-based lending are coming on stream, offering founders and CFOs a wider range of options than ever before.

It's becoming well understood among many app and game developers that there can be significant value trapped in their accounts receivable (AR) from the app stores and ad networks – revenues that have been earned, but not paid out by the app stores and ad networks introducing a delay of 30-60 days before cash is received, in some cases even longer.

Using your AR can be a valuable source of financing for a fast-growing app or gaming business as it enables app publishers to reinvest more quickly into paid acquisition by borrowing against their AR than waiting for platforms to pay out before reinvesting.

When considering different flavors of AR financing, it’s important to make sure that you are comparing different debt-based offerings on an "apples with apples" basis.

As with most areas of financial services, some lenders look to obfuscate true costs of financing with an unclear fee structure or hidden fees, so it’s important to make sure that the various fees can be broken down into a lowest common denominator format.

With any debt product, this is most easily achieved to quote all-in pricing as a simple interest cost, either quoted monthly or annualized - just like a credit card, mortgage or personal line of credit from a bank.

In other words, what is the true cost of the money you are borrowing? Any series of cash flows can be expressed as an interest rate, and any credible provider should be happy to provide pricing on this basis to help you compare.

Flat Fee vs Interest Rate

Some lenders choose to use a flat fee model, common among “traditional” factoring companies. Typically this consists of three components:

- Advance rate - this is the amount that can be advanced against an expected payment and is normally set at 80-85%, in otherwords being able to borrow $80,000-85,000 against an expected Apple/Google payment due of $100,000 at some point in the future.

- Fees - charged as a percentage of the amount advanced, typically around 3% but can vary based on volume and expected repayment terms.

- Residual payment - you will receive a top-up payment when the final amount is paid out by the platform and received by the lender, equating to the amount received less funds advance and fees paid. This mechanism provides cover to the lender for any shortfall in the final amount received. Also, beware that additional fees can be incurred if the expected payment is not received from the app stores or ad networks within the timeframe expected.

The problem with this approach is that it obfuscates the true cost of the funds, and makes it confusing for end-users to compare financing rates.

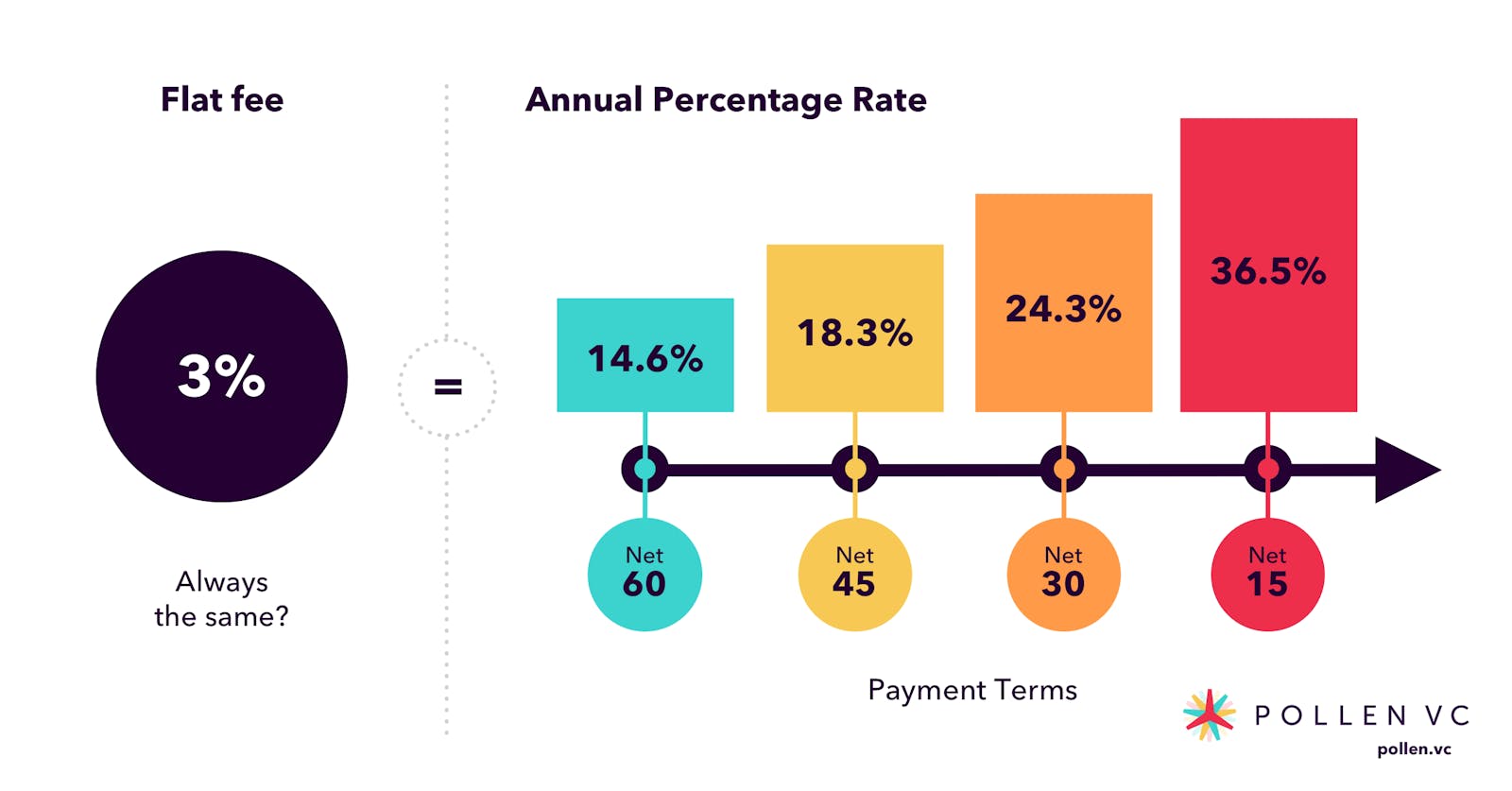

The flat fee is not quoted on an interest rate basis that makes for easy comparison, particularly if the payment terms are for multiple counterparts who pay on different schedules. If fees are quoted as a flat fee, there can be massive swings in effective financing rates given the difference in payment terms.

For example, a 3% fee on a payment that is due 7 days away is equivalent to 156% annualized financing rate, versus the same 3% fee when a payment is due in 45 days comes out at 24%.

Terms such as “simple” and “transparent” when describing flat fee structures are designed to be anything but. Any financing business that has external capital fuelling its lending activities, will always raise their own capital on a traditional interest rate basis, so the concepts are well understood to them.

Interest Rate Based AR Financing

Interest rate based AR financing operates more like a personal line of credit or a credit card, but is secured against your AR, with incoming payments normally being received directly by the lender. The amount of interest charged is based on how long the loan is outstanding for and interest costs are typically calculated daily and applied monthly.

Since payments are received by the lender, you no longer have to wait for the final top-up payments making your company finances much easier to track - with just one simple loan balance outstanding at any point in time.

Typically, fast-growing companies prefer to work with an interest-based facility which provides a transparent approach to fees and makes it easy to snapshot their financial position, but ultimately it comes down a combination of factors around cost, ease of use of the facility and of course being able to clearly understand and price any additional fees.

Questions to ask your capital provider:

- Get all financing fees quoted on a simple interest rate basis. Either monthly or annualized is ok but make sure you compare everything on a like for like basis.

- Understand all the fees apart from the headline financing costs, and factor these into your calculations.

- Consider the Advance Rate - If you are using your AR to reinvest in new users, having a lower cap on advances is throttling the amount of cash you can recycle into more UA spend. Some lenders like Pollen VC will advance as high as 95% of your unpaid revenues, so be sure to factor this into your calculation.

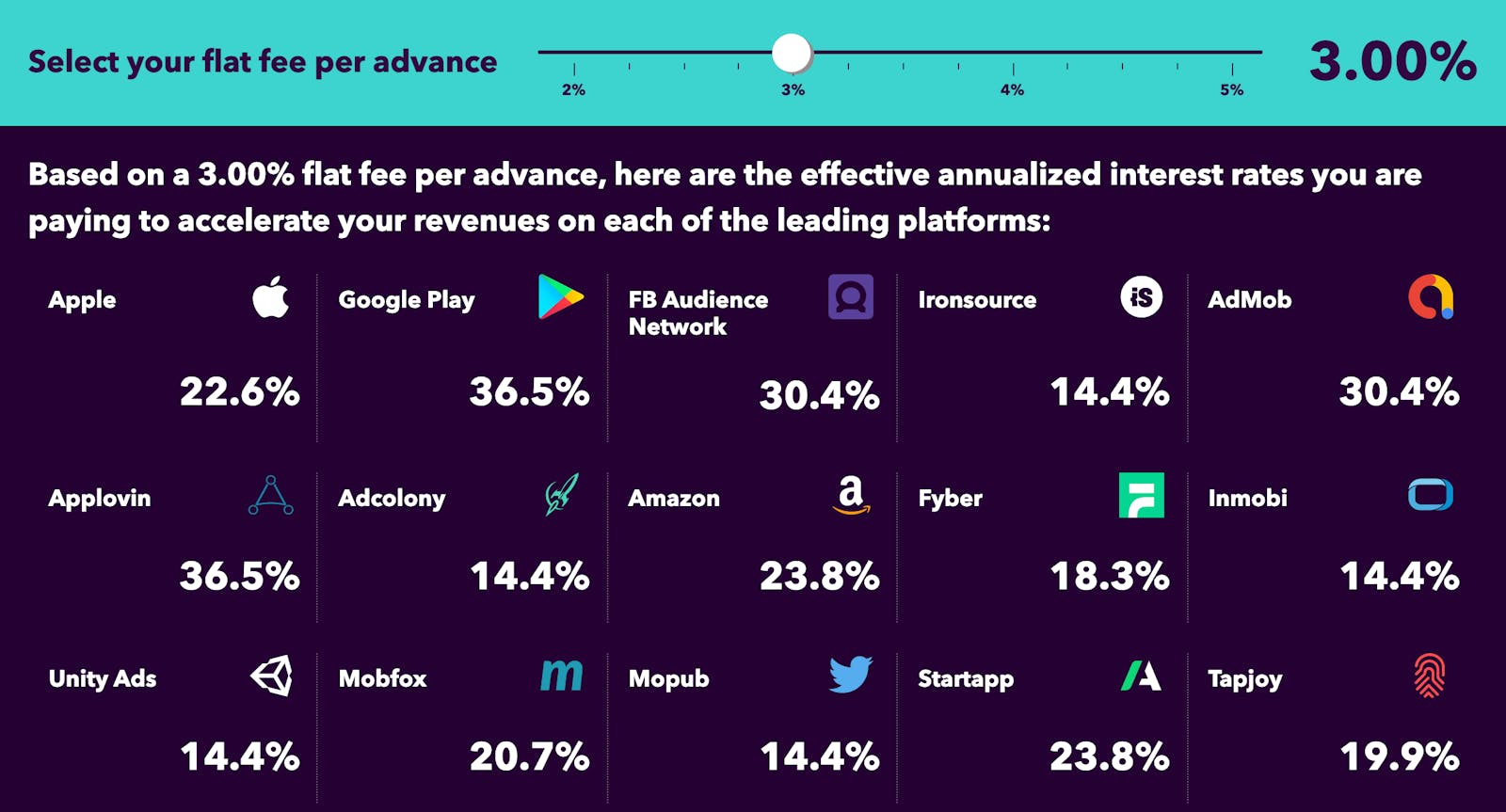

To help compare the difference between fixed fee structures, we’ve created this simple AR financing calculator that shows effective APRs for the leading App Stores and ad networks based on their payment terms so you can compare the rates across both fixed fee and interest-based models.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!