Hyper casual gaming is increasingly being seen as a “winner takes all” marketplace. Publishers specializing in the space are getting better at spotting games with potential, and pouring vast sums into user acquisition when they see the potential in a game, helping them soar to the top of the charts.

Talented developers pitch their games to publishers who run rigorous tests and model UA scenarios to rapidly learn which games to publish. Publishers apply their user acquisition expertise and provide significant funding to scale UA, in exchange for a rev share — typically 50/50 after UA costs, but this can vary dramatically.

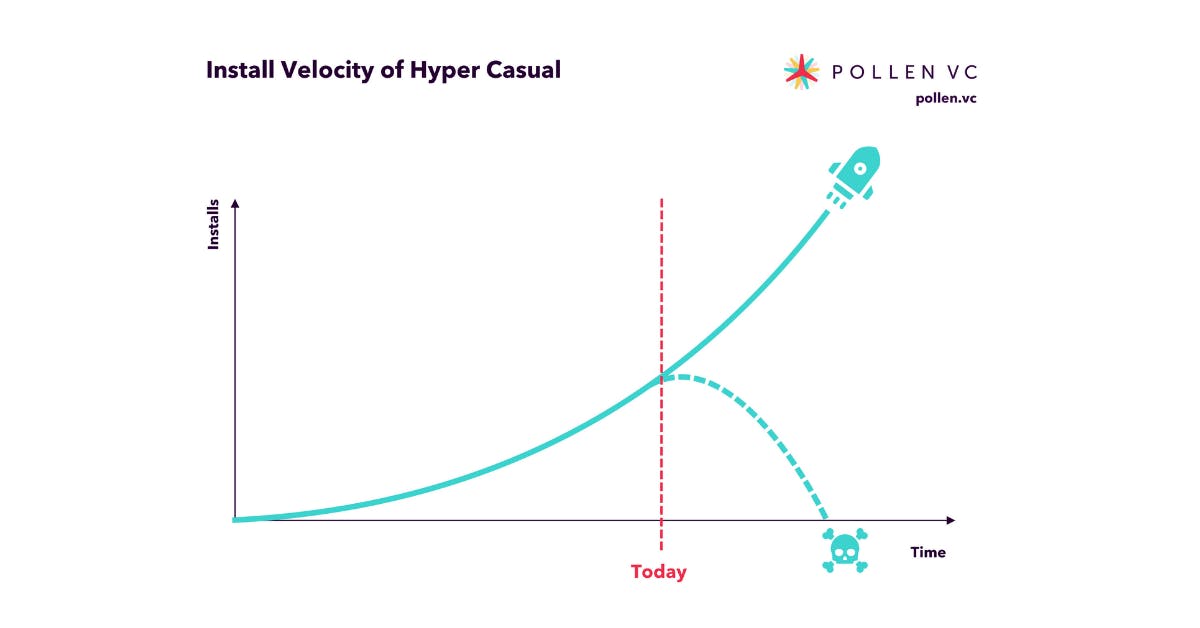

Install velocity is critical. Hyper casual success stories are the games that rocket up the charts, supported by big UA budgets to achieve and sustain a position in the top download charts before eventually falling back down. They are not slow-burn titles which grow steadily over time, meaning that scaling post launch needs to operate at hyper speed.

Why is install velocity important?

Facebook’s algorithms — as well as those of other ad networks — clearly favor new games with fresh creatives and rapid user uptake. This is not surprising, as it means publishers spending large amounts on Facebook as a user acquisition channel for more players in a short period of time. CPI’s are generally low, to begin with, helping the publishers unit economics of UA work and enabling them to make a decent profit. Over a period of days, or normally weeks, the CPIs will start to rise, killing the UA opportunity for the game, as new games with new creatives are launched, helping save Facebook’s users from ad-fatigue and keeping them engaged.

Self-publishing — planning for success

In order to ride the hyper casual rocket ship without the resources of a publisher, developers looking to self-publish need to be 100% on top of their UA metrics and also be able to build financial models to enable them to envisage how they could scale, and what capital is required to achieve this.

It’s critical to achieve ROAS break-even as fast as possible. The quicker you reach the break-even point on the ad spend, the faster capital can be reinvested into additional UA.

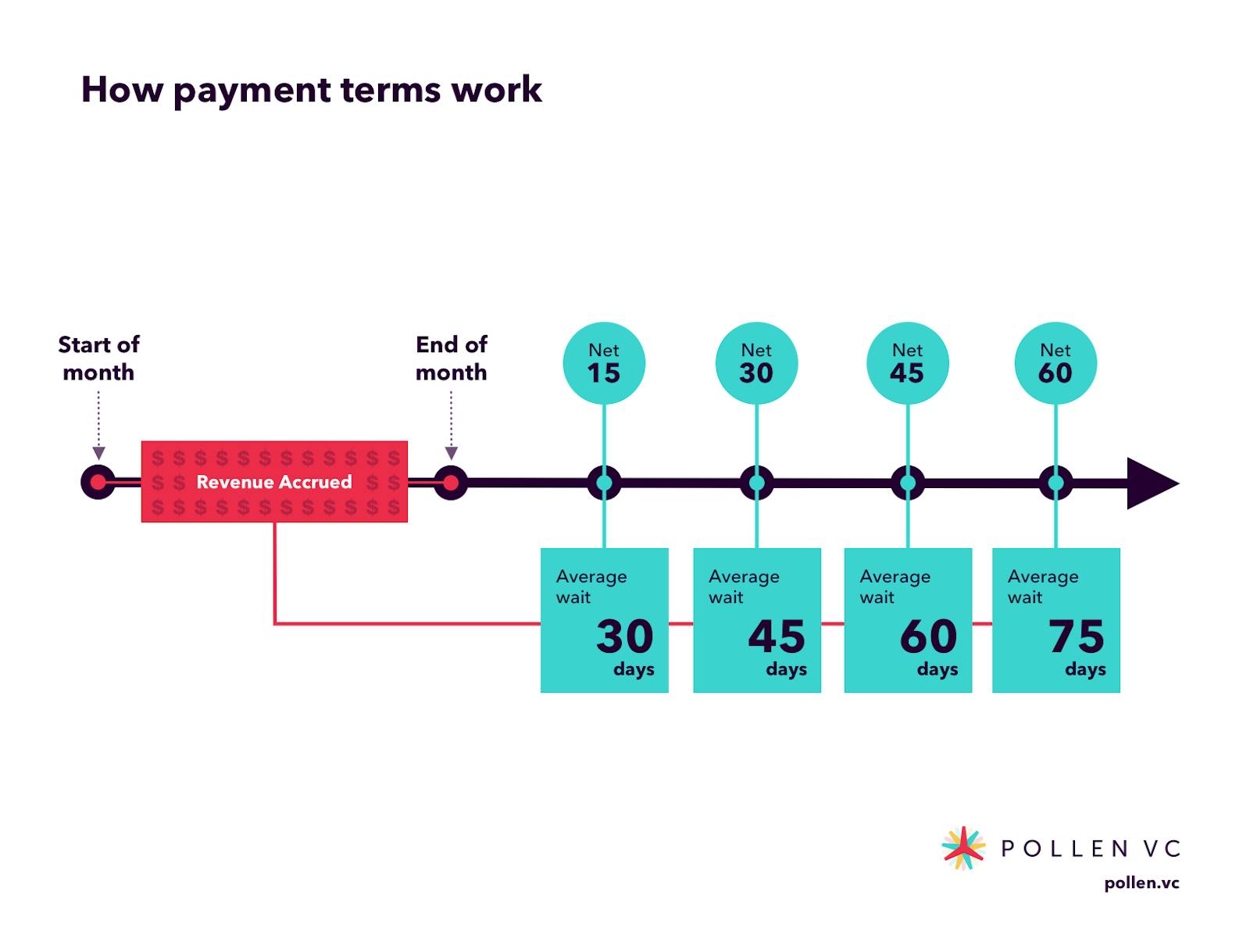

One of the biggest inhibitors to success comes from a lack of understanding and financial planning expertise. Not recognizing the importance of ad network payment cycles is a key point here. Payment terms of ad networks can have a significant impact on throttling install velocity, as they restrict the availability of earned ad revenue to reinvest back into UA.

For example, ad networks typically pay on a Net15 or Net30 day cycle, meaning that the developer will receive proceeds 15 or 30 days from the end of the month when the ad impressions were served. So in reality for ads served at the start of the month, the payout delay could be up to 45 days (Net15) to 60 days (Net30), or even longer. For more technical info on payment cycles, check out our post here, and use it to help calculate your net payables days as the basis for modeling your projections.

The money that you are earning from ads served in the early days post launch will not arrive until weeks later. So you have to pour in more and more hard cash every day into your UA spend without seeing any funds hitting your bank account. Unless the developer/publisher has sufficient financial resources to bridge the financing gap between when ad revenue is generated and when it is paid out, it will not be able to keep investing into UA and climbing the charts, becoming just another hyper casual game that flamed out, regardless of its original potential.

Savvy developers seeking to self publish, and publishers themselves often use AR financing in order to help them scale rapidly and in a capital efficient way. These credit facilities, such as those provided by Pollen VC, enable publishers to borrow against their ad network unpaid receivables, one or two days in arrears, rather than wait until the 30-60 days it typically takes the ad networks to make payments. These proceeds can be immediately invested back into UA spend, reducing or even eliminating the need for external funds to support the growth.

Many developers try to solve the problem by nagging Facebook, Google and the other UA platforms for credit lines. They are very unlikely to give significant credit to new developers without a reasonable trading history and evidence of consistent UA spend, and oftentimes the opportunity is lost, resulting in frustrated client partners at the ad networks and developers.

At this stage the developer is most likely dead in the water. By the time you’ve figured out the financing, you won’t get a second bite at the cherry… The algorithms view your game and creatives as stale, CPIs have risen to the point that UA won’t be possible/profitable. There is a new kid on the block, better financed, better prepared, ready to benefit from the low CPIs and a chance at hitting the jackpot.

Check out our Hyper Casual Velocity Calculator to model the impact of payment delays on your ability to scale.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!