Lifetime Value is prized as a predictive metric, one that yields the value of future cash flows based on calculations tied to the actions and affinities of your users. But users are different and provide a different level of value depending on the category of app you offer and the user journey it enables.

Ask hard questions about your app

Is your game sticky, or strategic? Does your game make it dead-simple for users to spend on in-app purchases? Or does an excess of clicks and friction discourage impulse purchases altogether? Oliver Kern, Chief Commercial Officer at Lockwood Publishing, tells us it’s important to seek answers – not settle for assumptions.

“Knowing whether the lifetime of your game is 30 days, 90 days, 180 days or even longer is a key data point that can distinguish between a commercial hit and a complete failure,” he explains. In his view LTV is an important metric to use “when you want to define and determine the break-even point for your investments in UA.” No matter the lifetime of your app, you want to be sure you recoup your UA investments in that timeframe — or sooner.

Do you want to recoup investment in marketing, advertising and UA in 30 days, 90 days or 360 days? Your app lifetime will answer the question for you.

A longer timeframe gives you more time to recoup investments, but a lot of other things can happen over the course of 6 or 8 months to boost or bust your business. It’s a trade-off, Oliver cautions. “Using a longer lifetime for your model means you will also have to take a higher risk and need to plan for the impact on your cash-flow.” Financial planning for games with shorter lifetimes are also not a walk in the park.

To complicate matters, determining the length of a lifetime isn’t the same exercise for every app because every app and app category is unique.

It’s why Oliver recommends app developers start by examining how well specific app genres engage and monetize their users. “The ability of a game to generate a high volume of in-app purchases also indicates an app with staying power and a longer lifetime.”

He sees a strong relationship between the willingness of a user to spend money in an app and what the user believes will be the likely lifetime of the app in question. “I’m not going to spend $5 on an app when my gut feeling tells me I’m probably going to stop playing in a few weeks time.”

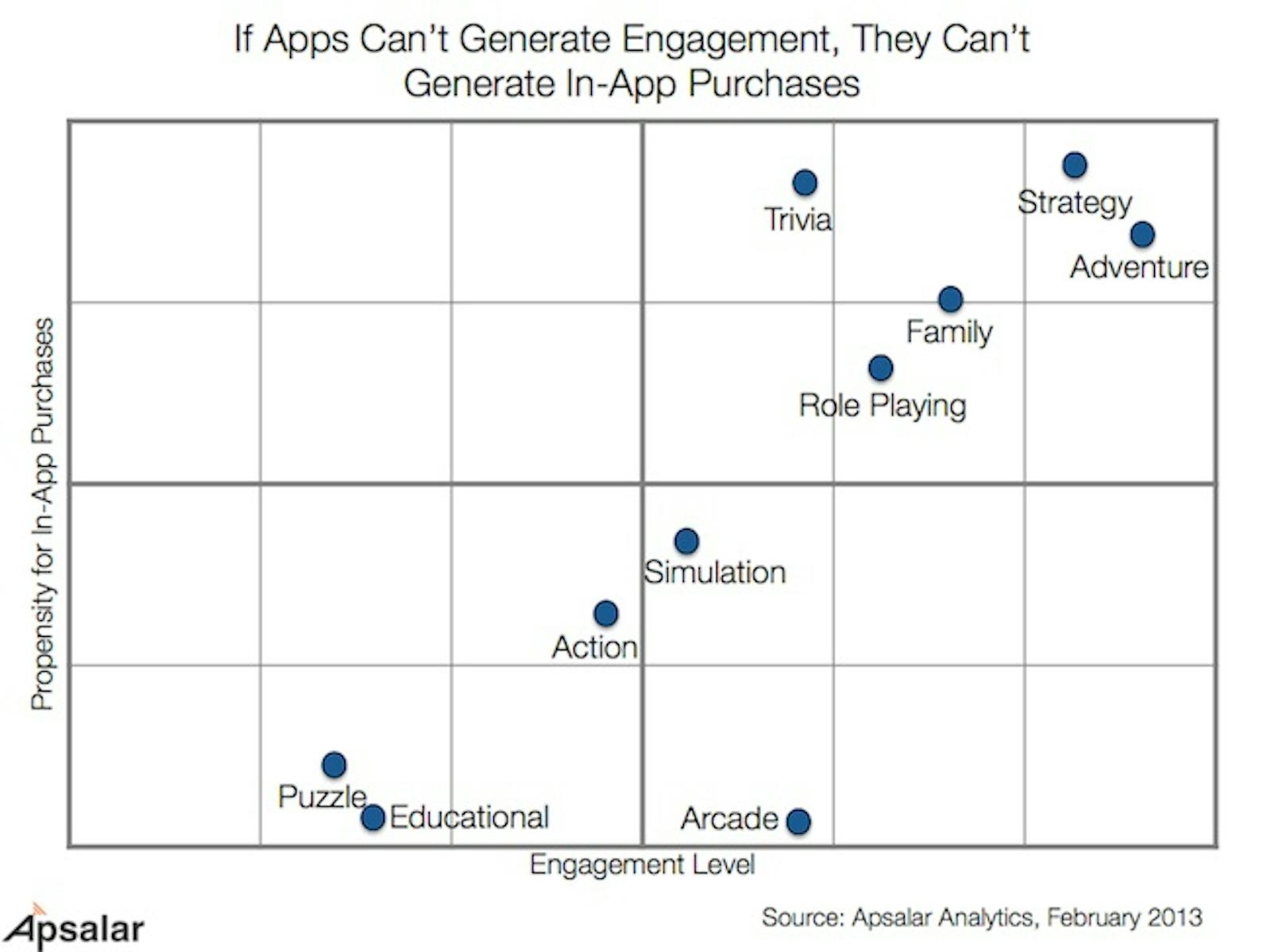

To underline this important point Oliver references Apsalar data that shows highly engaged users are also likely be highly motivated to make in-app purchases — and suggests app developers use this as a starting point in order to calculate the potential lifespan of their app.

Generally speaking, a casual puzzle game doesn’t have what it takes to keep users engaged -and spending – for long. As a rule, games in this quadrant can expect to have a short lifetime and need to plan — and budget — accordingly. (There are obvious exceptions, such as Candy Crush, a casual game that has also become highly addictive and highly successful.)

In contrast, strategy and adventure games that unfold over time tick all the boxes to excite, engage and monetize users for months, not weeks or days. “These are also the games that don’t just offer entertainment,” Oliver adds. “They offer games as a service, and this is also the model that is engaging users and increasing their willingness to invest money.”

The *real* impact of a lifetime

Understanding how much money your customers spend over a given period is not just at the core of all marketing strategy; it’s data that is essential to financial planning and the efficient use of capital that will allow you to move the needle on your entire app business.

LTV is a key starting point to measuring your customer monetary value and deciding on next steps in your user acquisition strategy. However, to fully grasp the return on marketing investment, a developer needs to perform a comprehensive analysis of how their paid UA correlates with the change in organic traffic and use this to calculate the eCPI, or effective cost per app install. You need to understand how an increase in paid UA impacts costs through organic multiplication. The outcome of this exercise allows you to architect an install curve that equips you to calculate and control the return on your investment.

Putting LTV calculations aside, it is also crucial to align game monetization with appropriate budgeting, especially in the early stages of your app. Granted, app developers have insights – based on their deep knowledge of the app design and the user journey – into how much their target users will spend in-app (and over which period they will make these purchases). However, the gap between making a sale and receiving the money from the app store, leaves a huge question mark over what all app developers need to know in order to run their business: when can they count on receiving the money they earn.

It’s a critical question that can’t be satisfied by a hunch or guess. It requires real numbers and real reliability. Proper budgeting is the key to sustainable growth.

Fortunately, there are many tools that app developers can use to map out initial budgeting, based on available funds, cash flow projections and controls. If you find your model is robust but your budget is nonetheless constrained, don’t settle for putting essentials (such as app iterations, marketing and optimization) on the back burner. Instead, consider using factoring, short-term loans or other available financial tools to bridge the gap. Proper budgeting to support an app with a proven and positive outlook can accelerate your growth manyfold.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!