In the early days, app and game developers rely on their credit cards for advertising spend to acquire users. As they start to grow and scale, they can become eligible for lines of credit from the large ad networks like Facebook and Google.

If they have figured out positive unit economics and need to ramp up user acquisition (UA) spend, many believe that getting a line of credit from the ad networks is their passport to scaling up, but on a further look it is only part of the puzzle, and developers need to understand the advantages and the pitfalls if their path to scale is going to be a smooth one.

Let’s get back to basics...

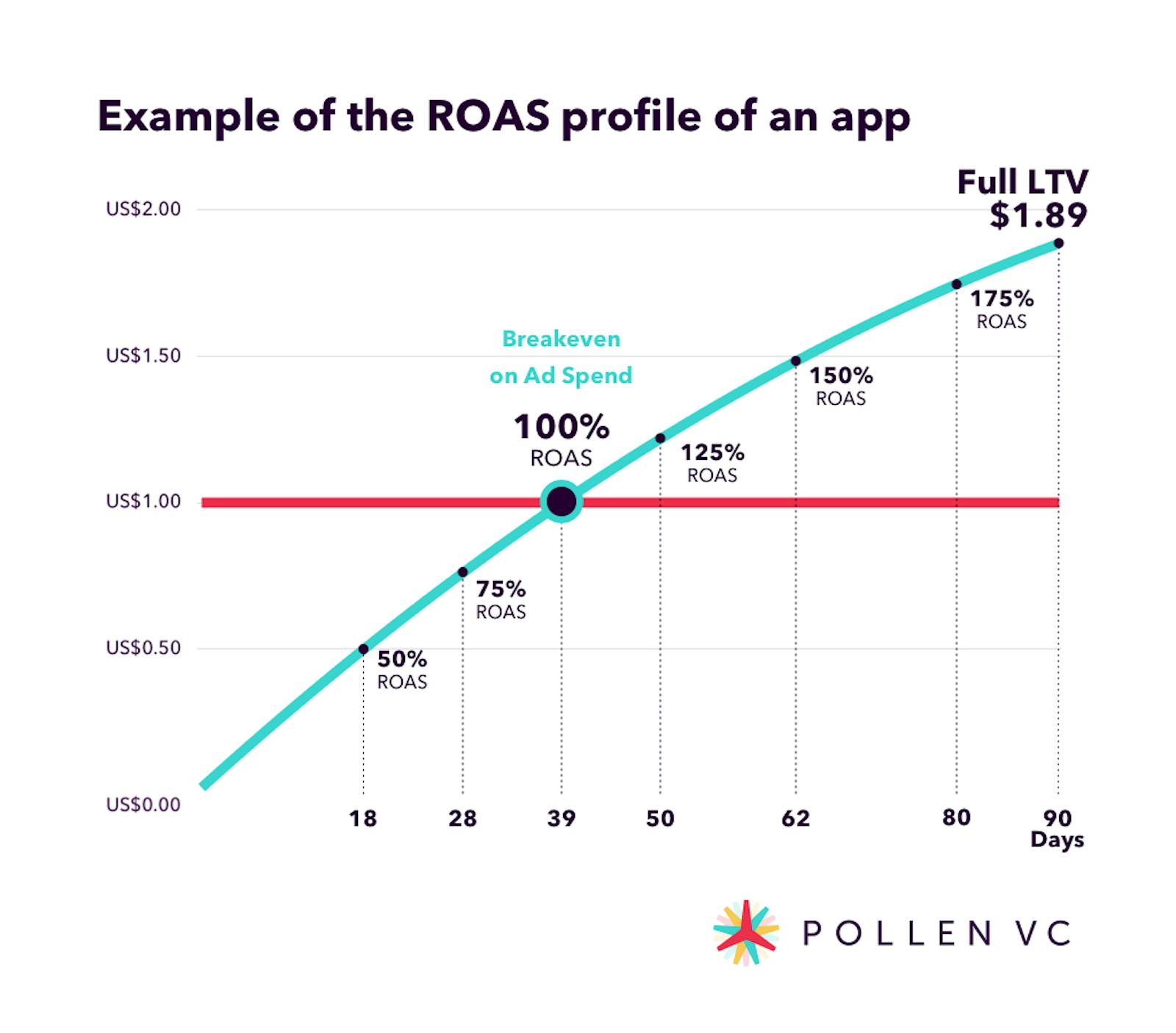

Paid UA with known unit economics can be pared back to being a simple investment equation. For every $1.00 invested you can model out the expected customer lifetime value (LTV) and calculate corresponding return on ad spend (ROAS).

There are two key factors to consider when modeling out your projections:

- ROAS timeframes. How many days is it until the money invested in ad spend is recouped? And how much longer is it before the expected LTV return is recouped?

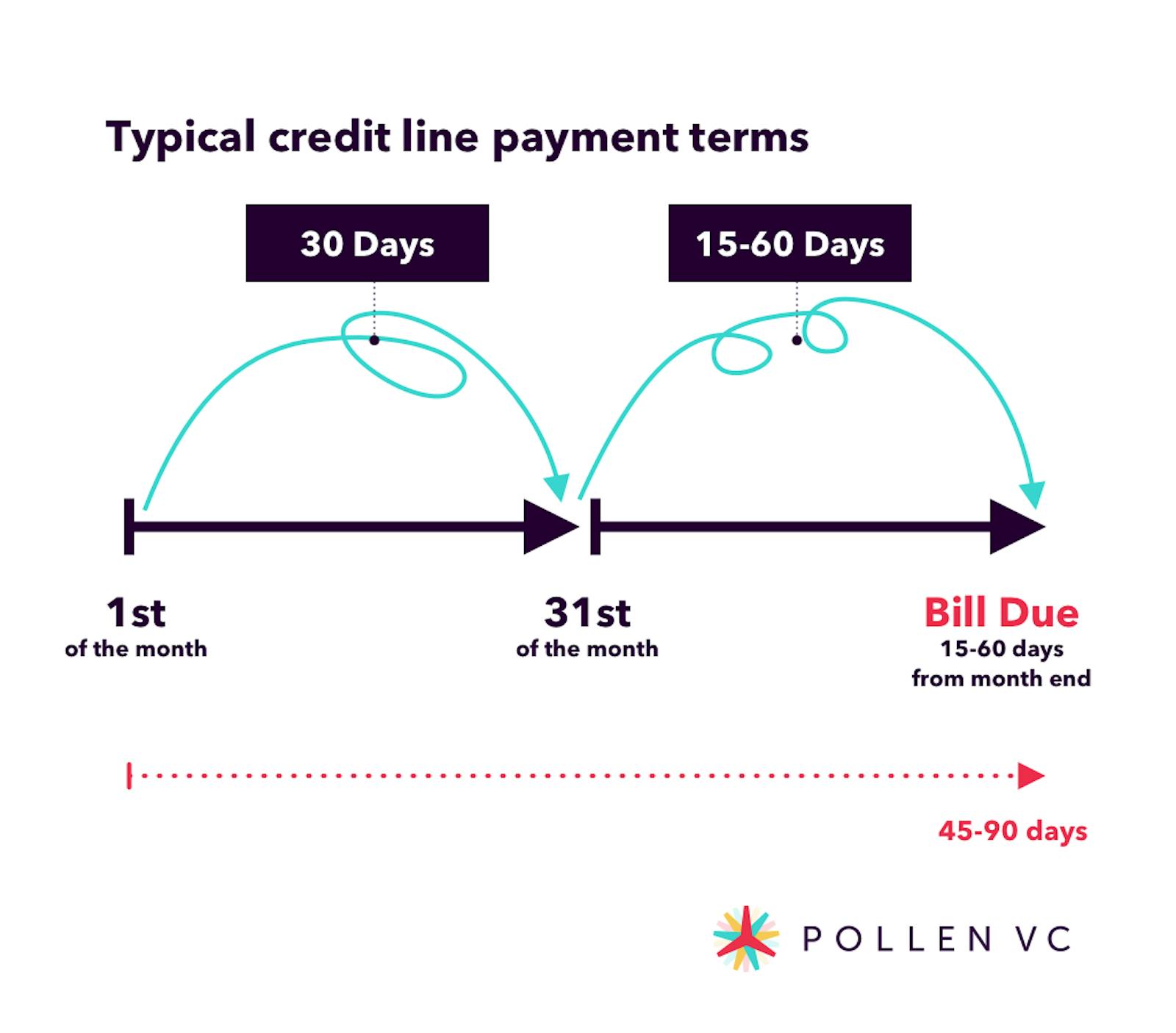

- Cash flow vs P&L. Many UA managers are focused on the P&L metrics and are shielded from the cash flows of their company, but looking at scaling via paid UA involves both. Publishers need to understand when funds are actually paid out by the app stores and ad networks and factor in the time delay post sale (or ad impression) of 30-60+ days depending on their terms of business.

How ad network credit lines work

After app publishers have built up some track record of spending on the platform via credit cards, they become eligible to apply for credit lines.

The starting credit limit will be set depending on the location and creditworthiness of the customer. The platforms want to do this to facilitate more predictable and growing spend, not because they want to take credit risk on early stage start-ups, hence the necessity to build a track record first.

These credit lines have terms associated with them, notably a credit limit which cannot be exceeded and also defined payment dates when the bills must be paid. Typically these have NET payment terms attached which vary between 15 and 45 days from the end of the monthly billing period.

Sounds great, but in reality, developers need to understand their own UA economics to see how much help the credit line really is, which can be very different depending on the genre of the game or app.

For example, successful hypercasual games have a totally different ROAS profile and LTV recovery period typically measured in days versus a successful social casino game which has equivalent horizons measured in months or even years.

To correctly model the impact of a credit line, the first thing to look at is the expected ROAS profile of the app.

In this simplified example, we illustrate a set of unit economics of customer acquisition and LTV recovery. In this example, we breakeven on day 39 – our $1.00 invested has returned $1.00 of LTV after 39 days. Then, we go on to achieve 125% ROAS on day 50, 150% ROAS on day 62, and 175% ROAS on day 80. Finally, by day 90 you recover your full LTV of $1.89.

Let’s now look at the payments timeline over the course of the next 90 days.

Spending within your credit line limit

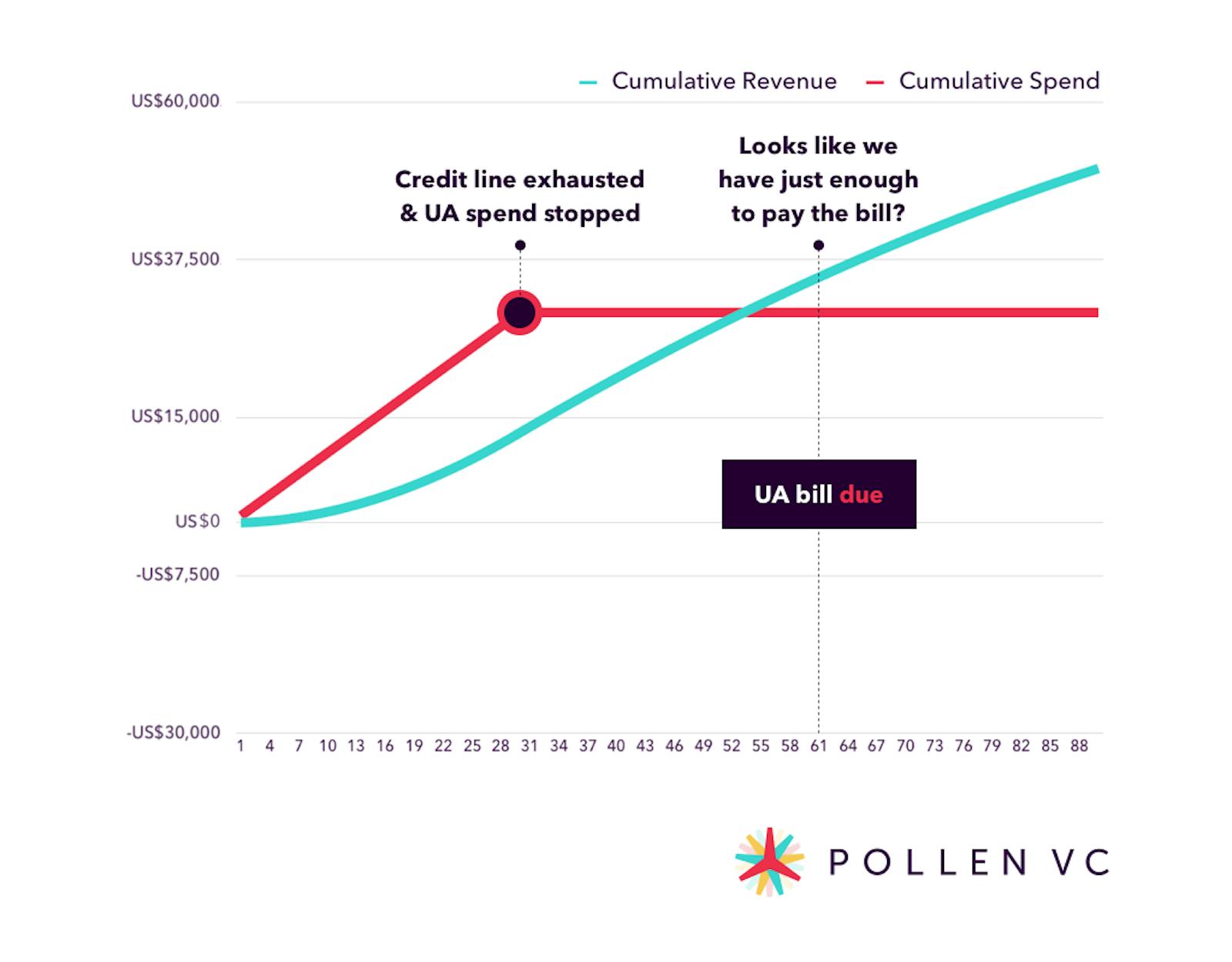

Firstly, let’s assume we have a $30,000 credit limit from a leading ad network. Spending $1,000 per day across a 30 day period (Apr 1 - Apr 30) gives us a $30,000 liability due on May 30th. (This is known as Net 30 payment terms, in other words the invoice is due 30 days from the end of the month where services were provided.)

From an LTV recovery point of view, we earn our $1.00 back after 39 days. So by mid May we have earned $27,800 in revenue if we assume the same LTV recovery profile for each new daily cohort started throughout the period.

Given our ROAS profile we will have earned $30,000 in revenue by the end of May on a P&L basis, i.e. we achieved P&L breakeven. Let’s assume a blended payout from the platforms of Net 30 - this can be as short as Net 15, or as long as Net 60 depending on mix of app stores and ad networks, but Net 30 is a realistic blended working assumption.

We have a $30,000 bill to pay on May 30th, can we do it? Looks like we have just enough revenue to pay it off from a P&L perspective…

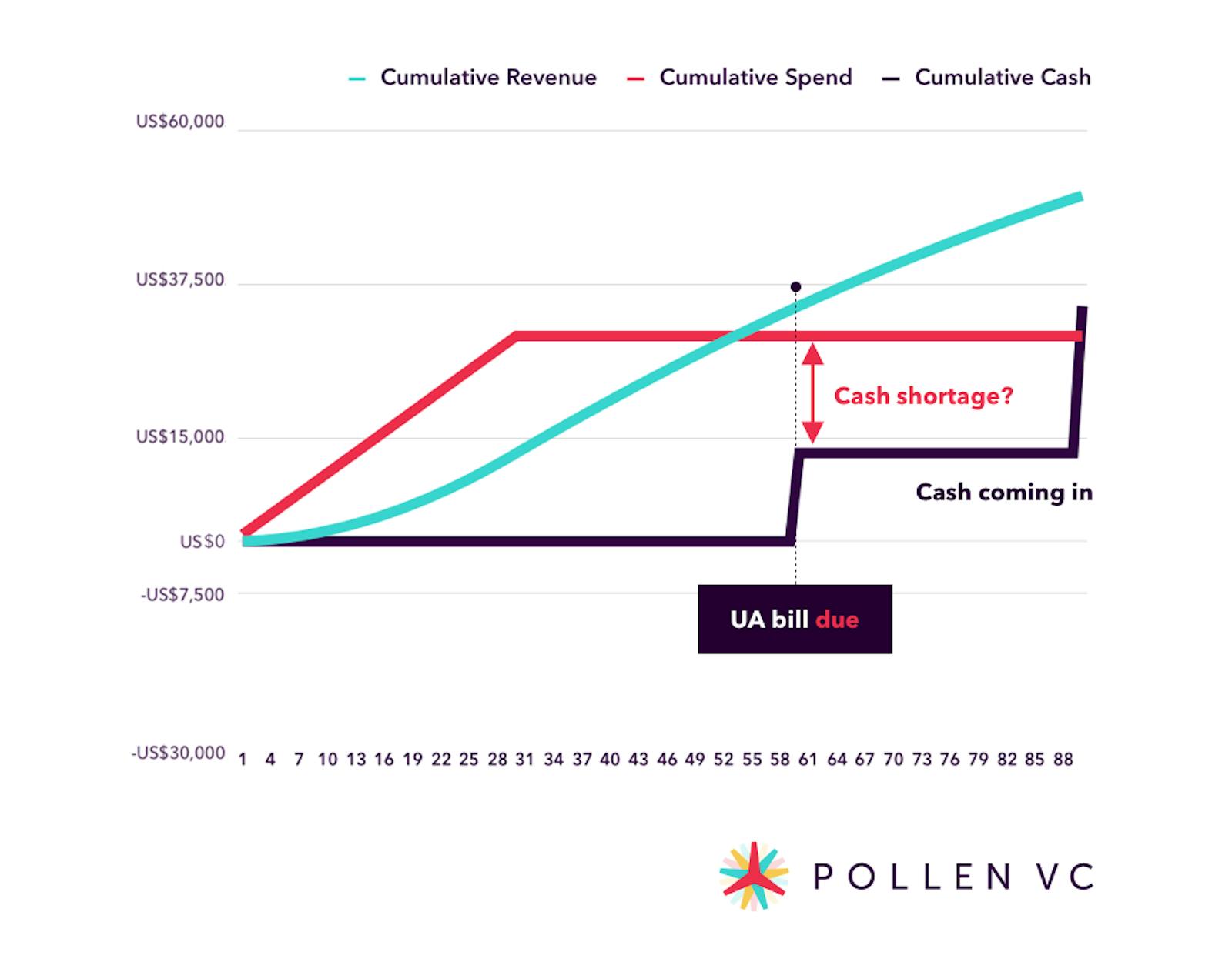

But let’s look at the timings of cash coming in from our IAP and ad revenues:

We only have $12,900 coming in as cash payouts from the platforms, which is less than $30,000 needed.

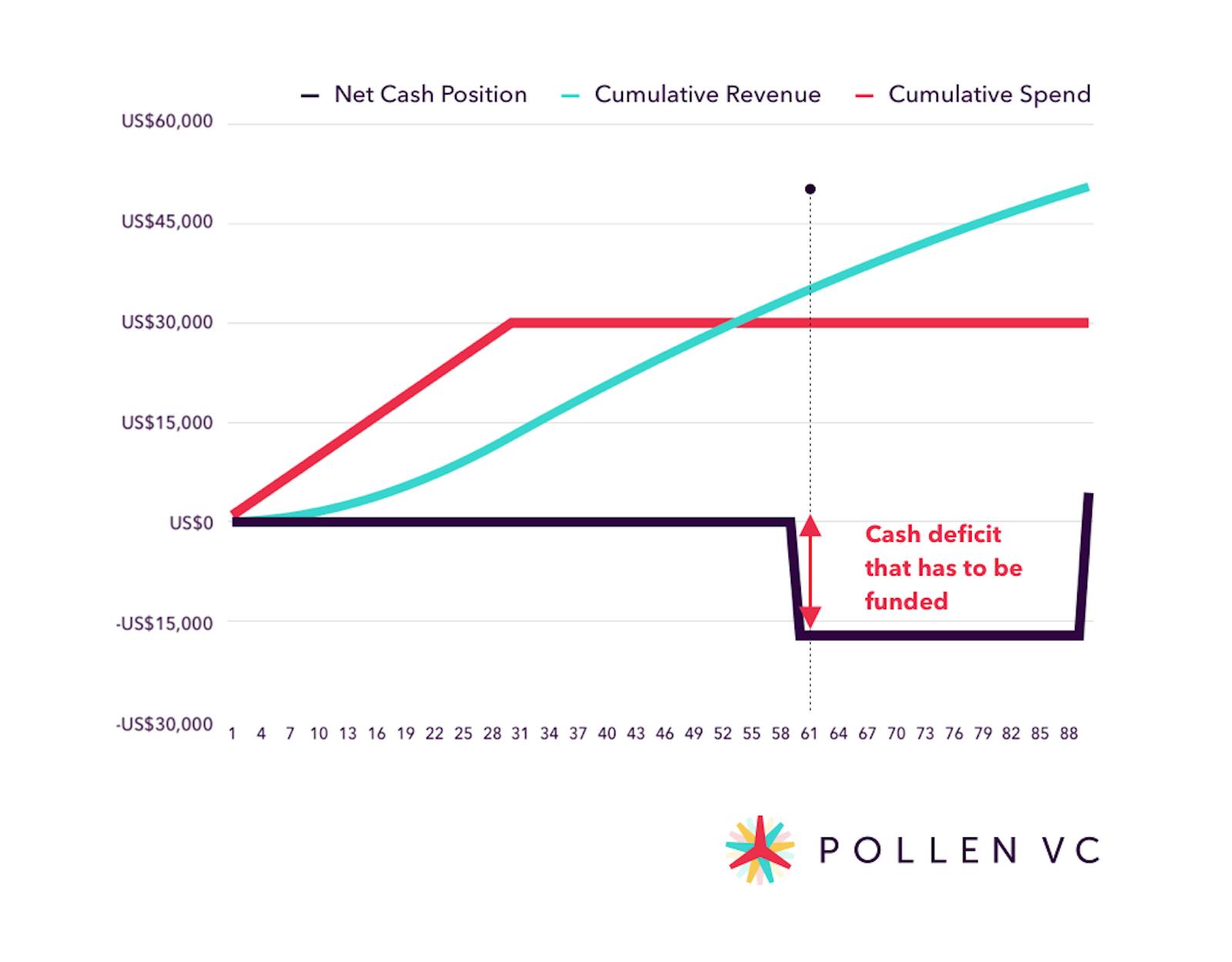

In fact, here is our net cash position:

So, in this instance there is a shortfall of $17,100 that has to be funded in some way or another – even though our earned revenues support the bill from a P&L perspective.

Constant $1,000 daily UA spend

In the previous example, we stopped serving ads after 30 days when we run out of our credit line. However, given the positive economics we discussed in the beginning of the article, why would any rational UA manager want to do that?

Let’s discuss the scenario where we want to continue spending $1,000 per day over the course of 150 days. Constant spend is a scenario that is deceivingly easy to perceive, that is why it is often chosen by companies.

In this particular scenario, we use the credit line of $30K in the first 30 days and then we start relying on self-funding paying for advertising daily.

The credit line is effectively fronting the first 30 days of spend, but we are then reliant on our own cash reserves to fund incremental spend, assuming we want to keep up a constant spend on UA.

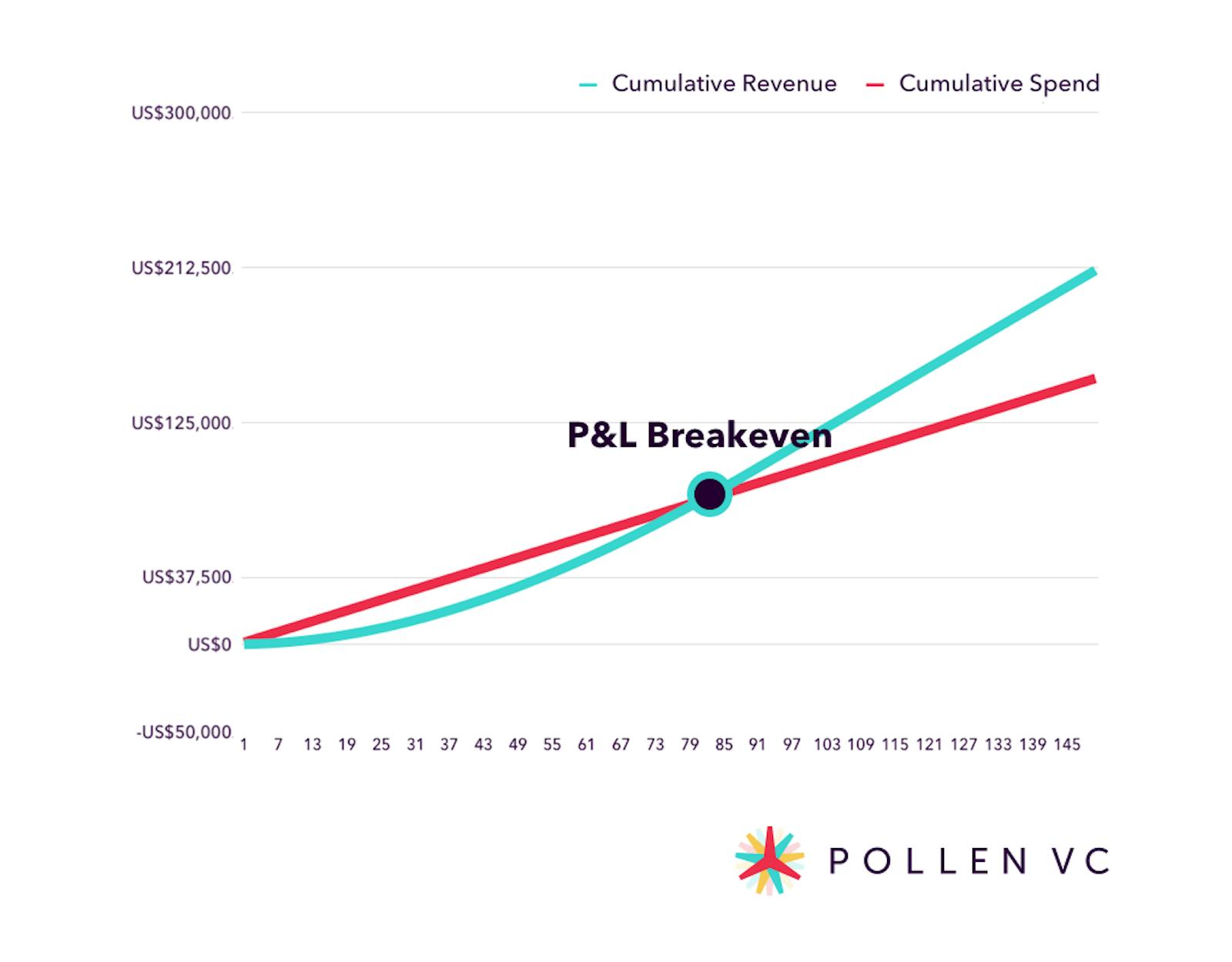

Let’s first look at the revenues and ad spend:

Our revenues look much higher. In fact, by day 90 they are 2x the revenues from the previous example.

Looks like our P&L breakeven happens around day 81 vs day 53 in the previous example. Does this mean our UA became less profitable? No, since by spending constantly we are acquiring many more cohorts that are going to bring us revenues long after we stop the UA (we are going to benefit from the so called “fat tail”).

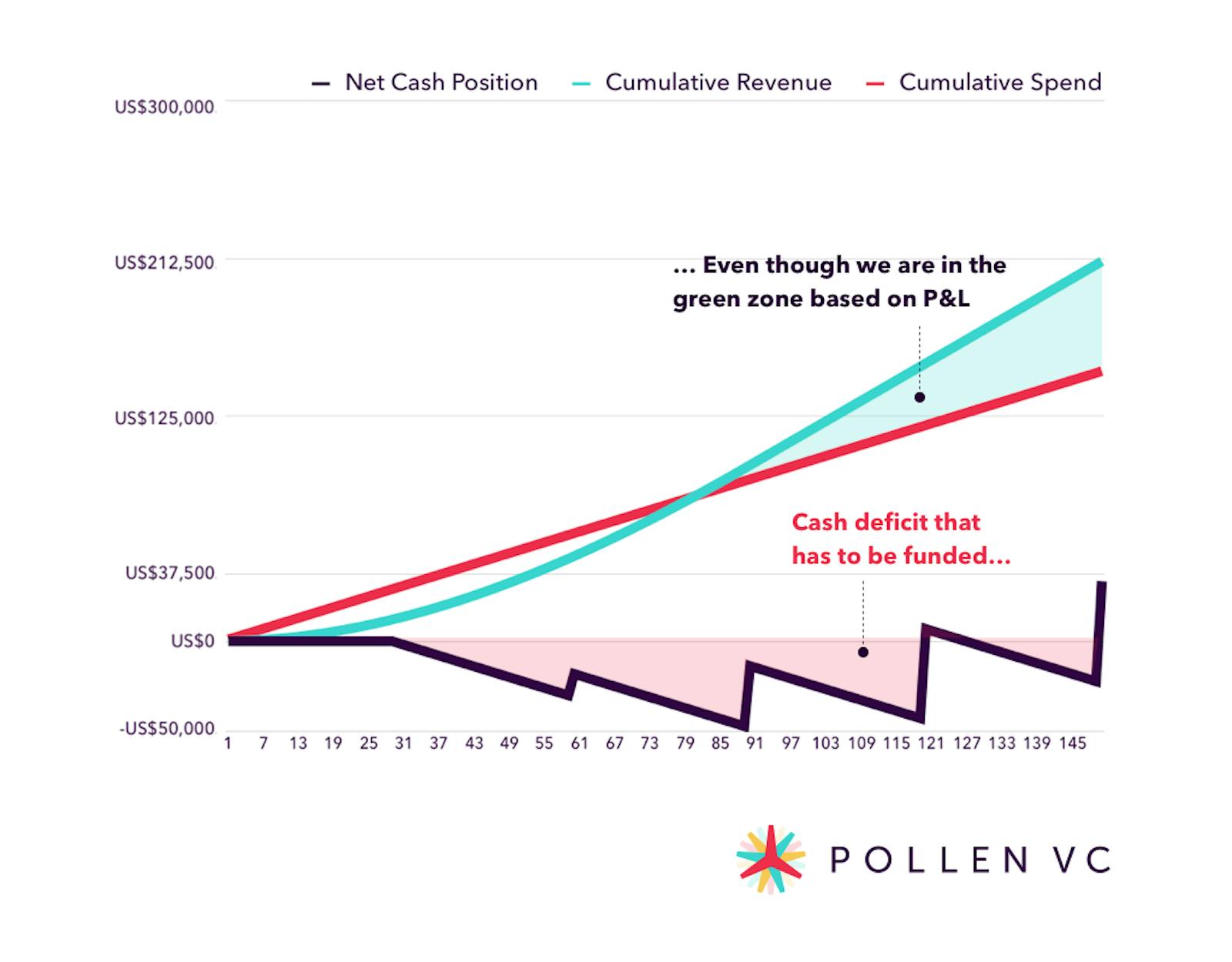

From the previous example we already know that we needed to fund the shortfall of ~$17,100 when we did UA only for 30 days. How much will we need to fund in the constant spend example? Let’s take a look:

We need to fund the cash flow shortfall of $47,100 despite having earned $89,000 by that time.

How is that possible? While we are technically earning the revenues, there is a delay in actually getting paid by the app stores and ad networks of up to 60 days.

The reality is that depending on the mix of payables and receivables days, that ad network credit lines can be a useful part of the capital mix as they are essentially provided at no cost to the developer. However, as we saw in the examples above, they are not enough to max out the opportunity even when you spend within your credit line limit.

AR lines as part of the capital mix - does it help?

Now we revisit the examples above, but we will add AR credit line that effectively speeds up your revenue payouts. AR lines are lines of credit that allow the app publisher to borrow against funds that have been earned but not paid out by the app stores and ad networks. Let’s assume you can receive your revenues every 7 days, instead of having to wait 30-60 days post-sale.

Spending within the credit line limit

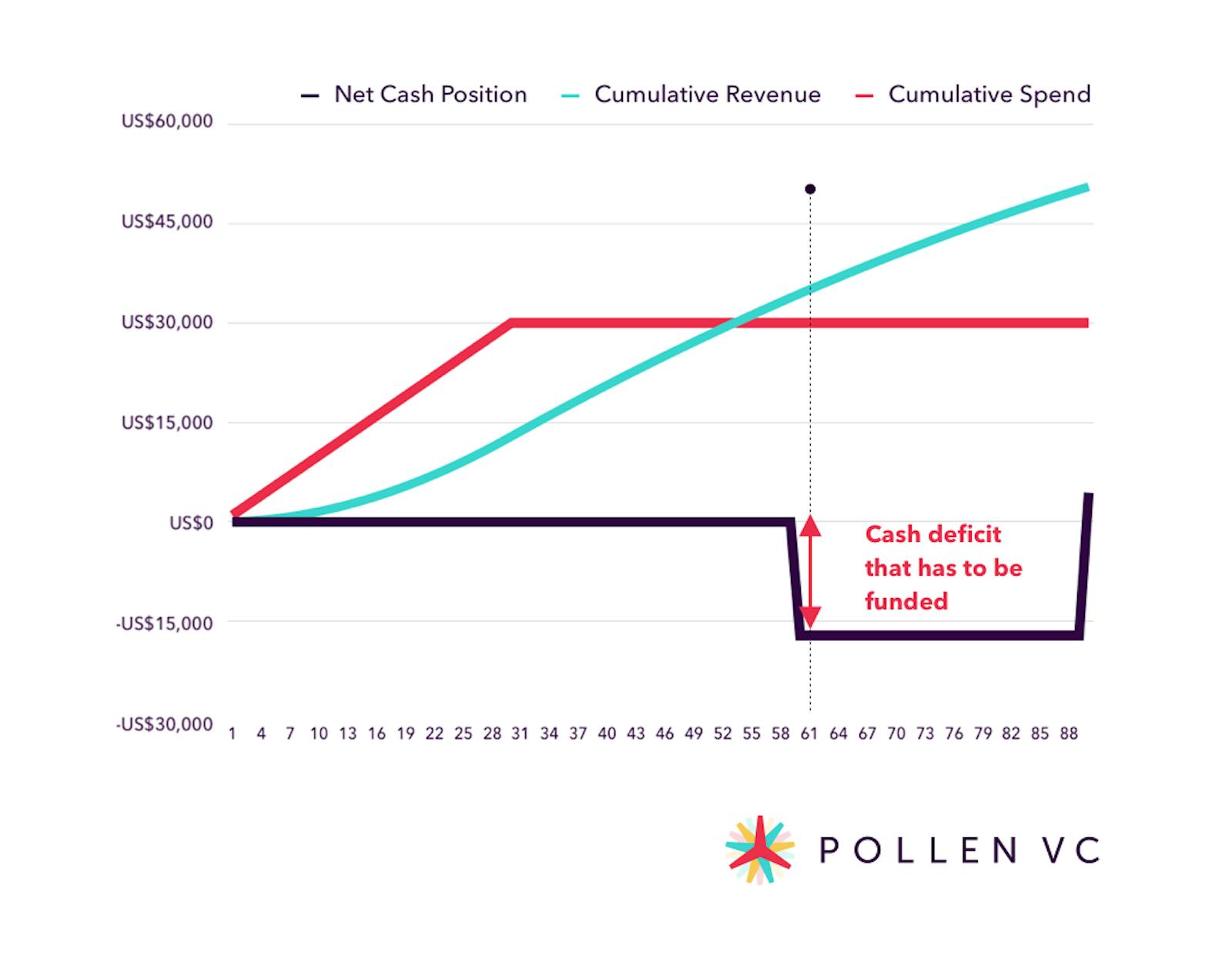

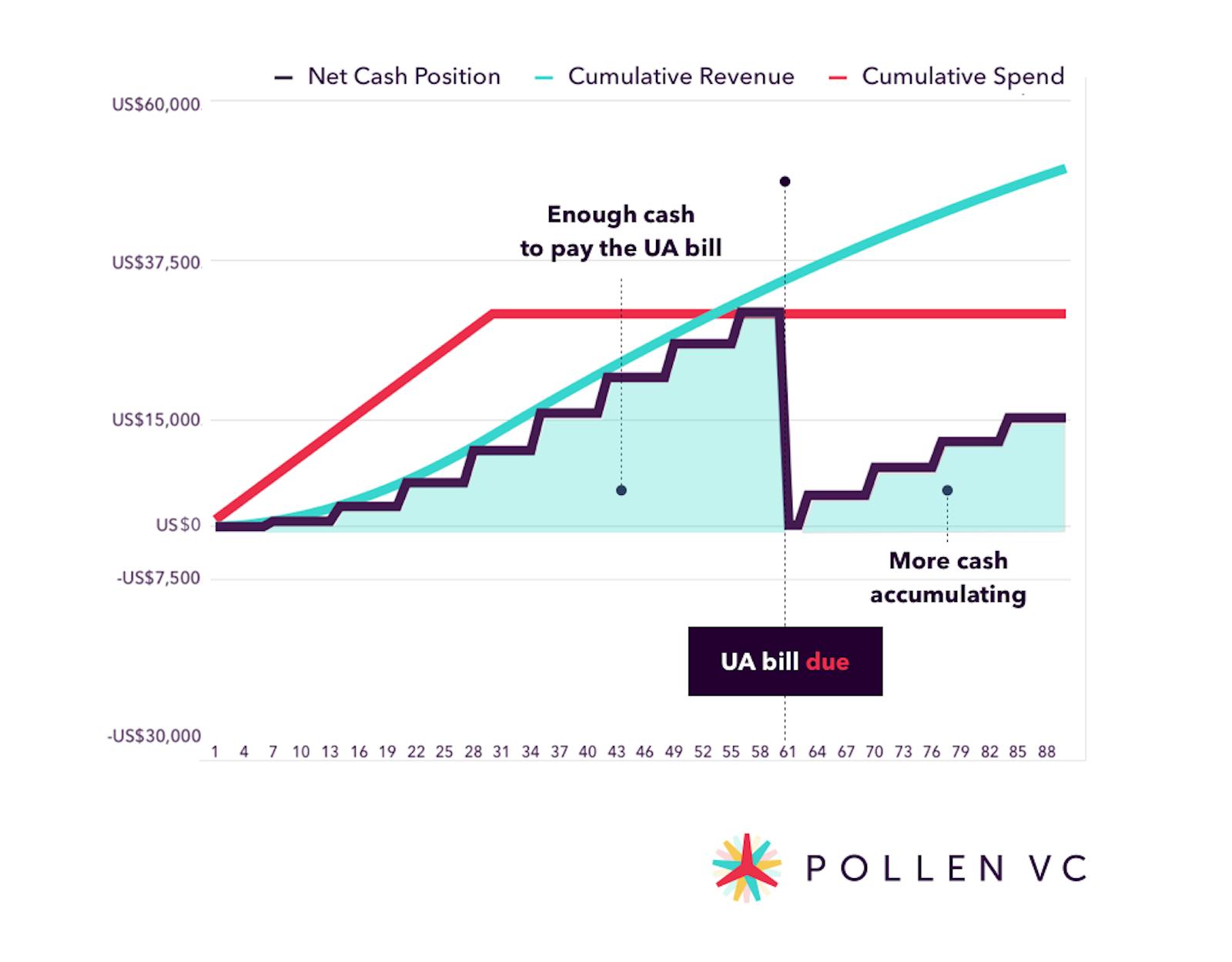

The graph above is the same one that is used in our first example. The graph below adds an AR line as a UA funding method.

On the already familiar graph, our spend and revenues look the same – they are the same since we haven’t changed anything in our UA and our app. However, if you look at the net cash position, you’ll notice that it never becomes negative.

In fact, it follows the revenue closely, and we have enough money to pay off our liability at the end of the 30 days. We don’t have to fund the shortfall of $17,100 because it doesn’t exist.

Notice that from day 62 to day 90 we are starting to accumulate some cash without any UA spend. This cash can be used to reinvest in the development of the app or in another profitable UA channel or even to allow constant spend at the same level without relying on any external capital to fund a cash-flow deficit.

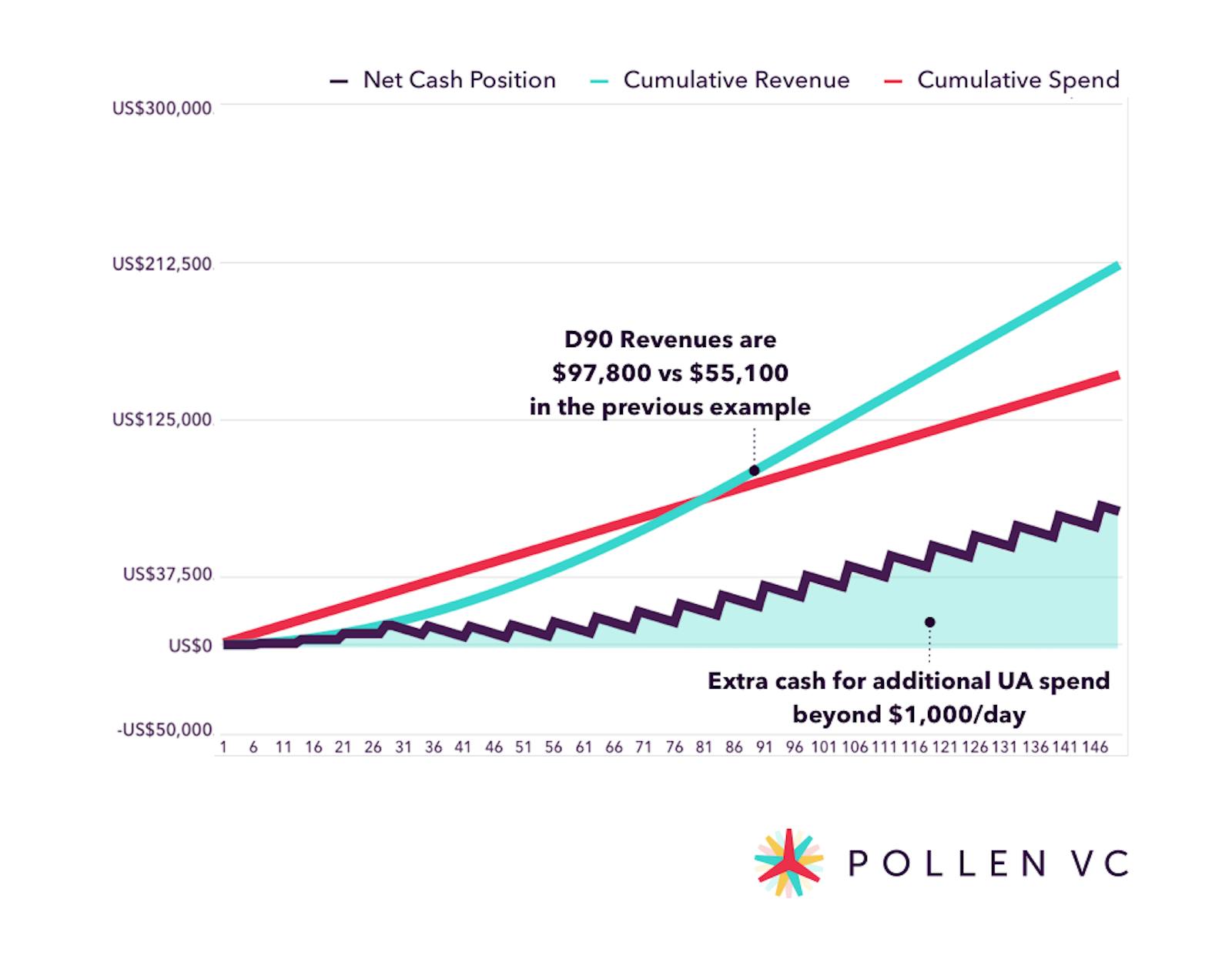

Constant $1,000 daily UA spend using AR Line as backup

As you can see, the net cash position in this case never dips below zero - we are able to support $30K constant spend using an AR line as backup and effectively double our revenues on day 90, as well as put ourselves on the path of explosive revenue growth if the UA metrics continue to hold as we scale.

Looking at the net cash position, you have some extra cash to reinvest, so you can explore how you can maximize your revenue growth by reinvesting every last bit of cash available into profitable UA.

Takeaways

- Don’t spend your ad network credit line too quickly - first, figure out how much cash you have to support the ad spend - especially if you choose a constant spend - and when the bill needs to be paid.

- Use ad network credit lines first, then consider other forms of financing such as AR financing as a backup to allow you to spend consistently as long as the UA opportunity is available.

- Consider the cost of the AR financing (eg 1.95% per month) against the ROAS across an equivalent period to figure out the net profit after financing costs to establish whether putting in place an AR facility is a valuable instrument in your financing armory.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!