As app marketing gets more sophisticated, there’s an increasing focus on metrics of every sort. Having a clear understanding of your unit economics is extremely important specifically customer acquisition cost (CAC) and user lifetime value (LTV) - how much a customer costs to acquire and the expected value of that customer over time from your app or game.

Marketers are rightly highly focused on these metrics, but sometimes fail to see the bigger picture of what that data is telling them in terms of how to visualize growth potential.

This article is part one of a three part blog series intended to answer three key questions…

- Is my spend on customer acquisition ROI positive?

- How should I finance my ad spend?

- How do I keep scaling until I max out the opportunity?

Achieving positive unit economics is hard. App marketers strive to get a clear understanding of their LTV which requires in house analysts or online modeling tools.

It’s also important to put thought and effort into defining audiences and optimizing user acquisition (UA) spend, and recognize how this might change as soon as the business looks to scale.

In this post, I want to look beyond the pure unit economics and focus on how to leverage a positive ROI formula to grow your business through efficient deployment of capital on UA, recognizing that not all forms of capital are created equal.

Do I have a machine and does it print money?

Let’s step out of our skin as app marketers for a moment, and analyze our UA numbers like an investment manager. Perhaps an analysis of my headline metrics for the acquisition of a particular audience in a particular country looks something like this…

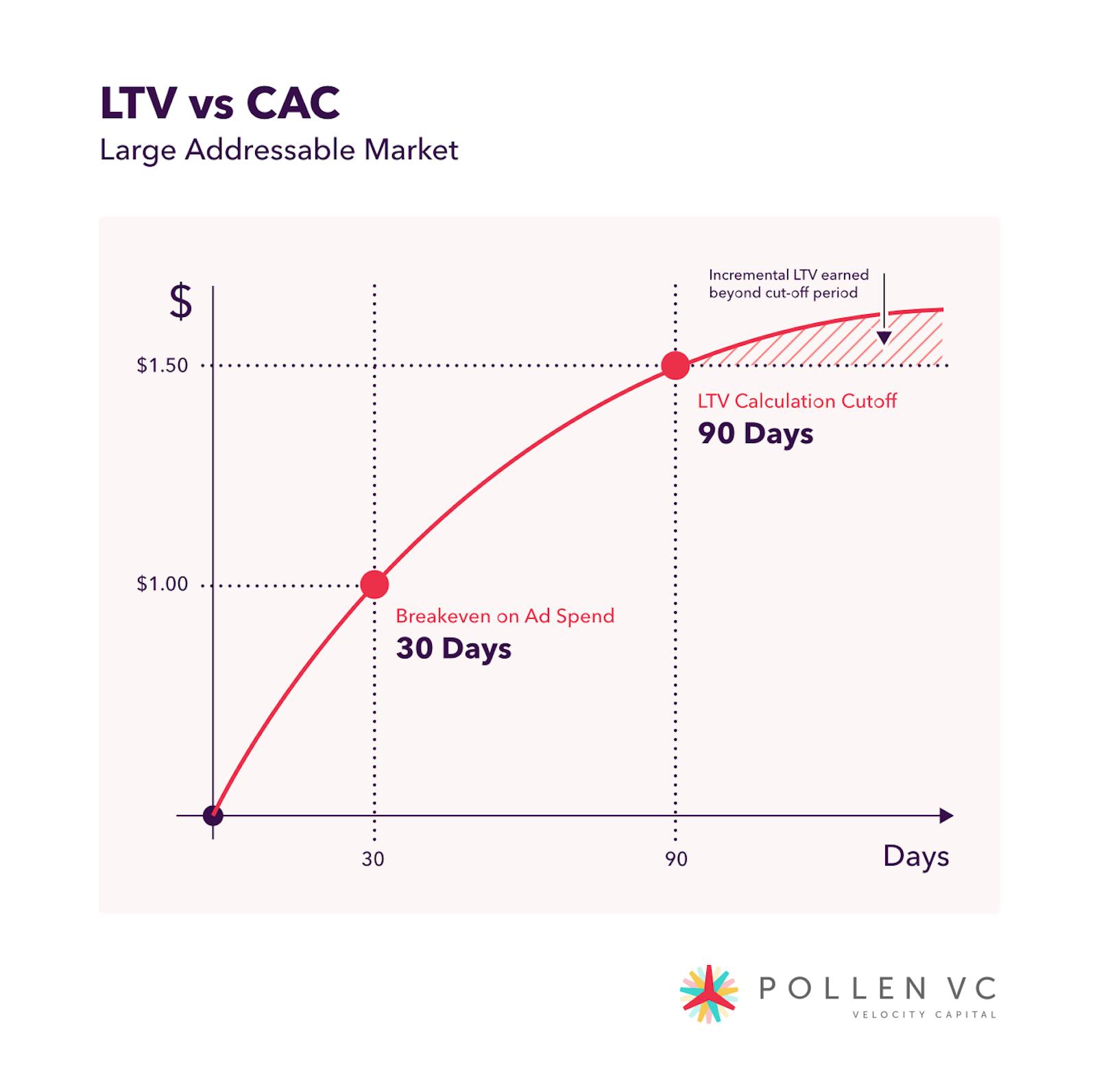

CAC - $1.00

LTV - $1.50

It is also very important to look behind just the numbers and into the timings of certain events.

For example, you don't earn all of your revenue at once, you earn your customer LTV over time. How this value is distributed is important. Your customer LTV may be front loaded, so you earn most of it quickly, or it may be gradually earned over time.

So LTV is in fact a curve, and it’s important to think through the key points on the curve.

- How many days is it before I breakeven on my ad spend?

- When should I determine the cutoff day, the point at which the majority of LTV has been recovered, and anything beyond becomes just a bonus? Understanding this will help you calculate your overall ROI formula.

This information will help you plot an LTV curve and will set the tone for how long it takes to go ROI positive on ad spend and ultimately to recover your profit.

All too often LTV is thought of as just a metric rather than a journey, so it’s important to understand the points that matter along the way.

Typical LTV Curve

Examining the ROI, we then work out that we are making a 50% return after 90 days, where I set my LTV cutoff.

In order to get a standardized measure of ROI, an investment manager would look to annualize this figure - looking at how much a dollar invested would yield over a 1 year period.

My $1.00 invested results in an LTV of $1.50, and I can do roughly 4 cycles in a one year period. So my “annualized ROI” is actually 200% (making a $0.50 profit four times in year, turning $1 into $3 over 12 months).

In reality, this number should also be compounded but in the interest of simplicity I’ve not done this here.

If this investment process is repeatable at scale, not just in a small scale test environment, then congratulations, you have built a money printing machine.

Understanding these core unit economics and timeframes is essential to building a scalable app or gaming business.

This post is part 1 of a 3-part blog series on funding mobile growth:

Part 2 - The Capital Stack: How to Optimize User Acquisition Funding

Part 3 - When to Double Down or Stop Your User Acquisition Campaigns

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!