Since we at Pollen VC created the market for digital accounts receivable (AR) financing by allowing app publishers early access to their App Store revenues in 2014, there's one perennial question that keeps coming up - is AR financing the right choice for my app business?

In this post, we cover what is AR financing and the two simple questions you need to ask yourself to see if AR financing is right for you.

What is Accounts Receivable (AR) Financing?

Accounts receivable (AR) is the balance of money due to a business for goods or services delivered but has yet to be paid for by customers. Simply put accounts receivable is the money owed by customers to a business but has not been paid yet, normally represented by a series of invoices.

Accounts receivable, or just "receivables" represents credit extended by a supplier to its customers and normally have fixed terms that require payment to be made within a defined time period, ranging from a few days to a few months.

In the mobile business, AR is payments to the app publisher due from the app stores (Google and Apple), mobile ad networks, affiliate networks, etc. The delay in payment for these accounts receivables can be as long as 60 days from when you first earned the revenue to actually receiving the funds.

Is Accounts Receivable (AR) Financing Right for You?

To figure out whether accounts receivable financing makes sense for you, you need to ask yourself a few simple questions.

- Do you have an ROI positive ad spend formula? That is can you acquire users profitably for your app with a reasonable degree of certainty.

If so, then there is a second simple question to ask...

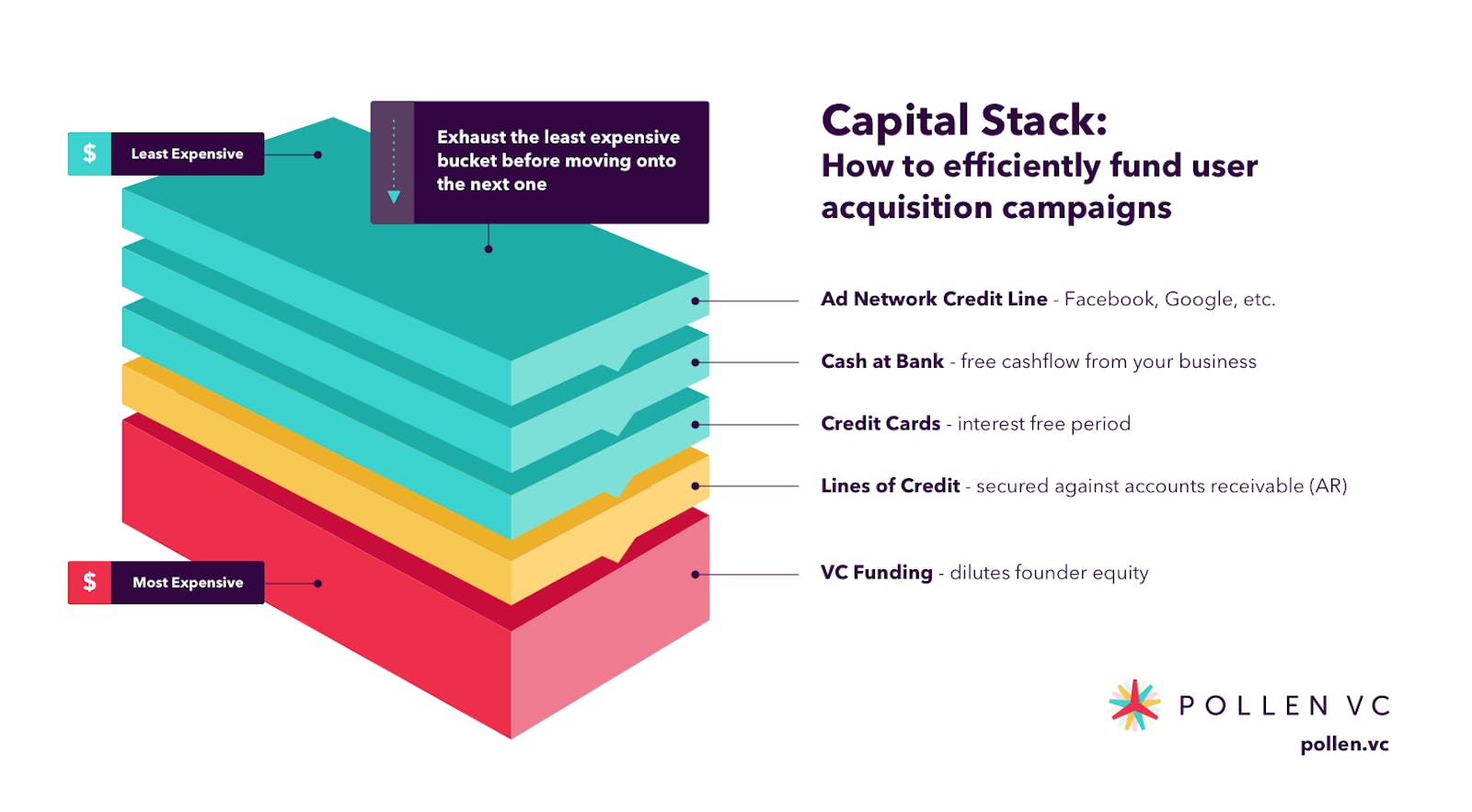

Once you have exhausted your free sources of user acquisition funding (ie ad network credit lines, interest free periods on credit cards), look at your next best alternatives, and price it up accordingly.

For most developers, this comes down to a couple of options.

- AR Financing - borrowing against app store or ad network unpaid receivables

- Raising equity financing from VCs

Each of these financing options has a cost to them, either interest costs, or giving away a percentage of the company and some a degree of control.

Often the seduction of raising equity is a big draw for many entrepreneurs - the comfort of seeing the money in the bank seems worth the dilution. However, more financially savvy founders look to a wider range of options.

Founders need to look dispassionately at just one metric - Return on Capital.

For any investment decision, look at the cost of capital versus the expected return and it should boil down to an easy calculation.

If you have a high degree of visibility and confidence in your user acquisition metrics and lifetime value (LTV) calculations, you should keep investing all available sources of capital (from cheapest to most expensive) until your expected return hits your minimum ROI hurdle.

For example, consider a mobile gaming company who has developed a great game and figured out an ROI positive way to spend on paid UA.

It costs the developer $1.00 to acquire a user for the game, with a fairly stable LTV of $1.60 after 90 days. So the ROI is 60% after 90 days.

The UA/Finance teams looking to create a common demoninator timeframe against which it can make capital allocation decisions. In this case, we break things down to a monthly timeframe, hence our 60% ROI after 90 days, we rationalise down to a monthly ROI on ad spend of 20%. Then that sets a basis of comparison which we can anchor our UA investment case.

Now let's say a developer can borrow funds on a credit card at an APR of 24% (typical APR of credit cards in the US). Breaking it down to our monthly time horizon, this equates to ~2% per month.

If we think about it in pure investment terms, borrowing funds costing 2% is enabling us to make a 20% return on our ad spend. In other words an 18% profit over the monthly cycle.

Now let’s say the financing rate goes up to 3%. The ROI is falling because you have acquired all the high paying LTV users and you are now down into the rung below, so per $1.00 invested in UA is now only yielding a 90 day LTV of $1.45. Now your ROI has dropped to 15% per month, and your financing cost has gone from 2% to 3%, so your profit has fallen from 18% to 12%.

Still worth doing?

Absolutely.

In fact you should keep spending and exhausting sources of available capital from cheapest to most expensive as much as possible until getting to the level beyond which you don’t feel comfortable making the return.

There is a temptation to look around at headline financing rates and compare them to personal loans, credit card fees and push back on the pricing, thinking “I’m not going to enter this financing arrangement at x% because Wells Fargo gave my brother a personal loan at y%”.

Don’t get too hung up on the headline financing rates. Instead ask yourself “what is my next best alternative”?

Side note, if you can get your brother to take out a personal loan and it’s cheaper than other sources of financing for ROI positive then you absolutely should!

Conclusion

The advice is simple - get your financing from your cheapest to your most expensive sources of available capital. For full details, read our post on how to fund user acquisition.

Look at the largest app and gaming companies on the planet who have built huge franchises based on having a really good understanding of LTV and player behavior, and more importantly have incredible skills and discipline over all aspects of user acquisition.

Of course they have teams of number crunchers dedicated to user acquisition, but the underlying principle all boils down to this concept. I remember taking a meeting at MZ when Game of War was topping the charts and omnipresent in everyone’s Facebook feed. Walking across the office floor reminded me more of a hedge fund dealing room rather than a mobile gaming studio. Their rigorous quantitive approach to UA coupled with a deep understanding of LTV made their games dominate the charts at a certain period of time.

In a way the game or the app is just the conduit - it all comes down to a question of investment horizons and returns and adopting a financial mindset to what many still consider as a creative problem. This approach is part of the playbook of the most successful app and game developers in the market.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!