As the concept of using debt to fuel user acquisition in mobile gaming enters the mainstream, there are an increasing number of revenue based lenders looking to operate in the space. The revenue based loan (RBL) model normally involves an upfront loan that is repaid across either a fixed or variable number of monthly installments, until the loan is repaid with an agreed fixed fee.

As recession looms and free-flow of venture capital into mobile gaming studios dries up, the logic of using debt rather than equity to fund user acquisition is becoming more obvious to founders. But not all debt products are created equal, and it’s important to make the right choice of product to help you scale your game effectively and avoid a scenario where you can’t scale as planned.

How Do Revenue Based Loans Work?

Revenue based loans can either be made on a fixed repayment schedule (just like a short term bank loan), typically paid off in around six to eight months, or in an agreed revenue share format (if the company has less certain cashflows) until the loan is repaid plus the agreed fee. This lending instrument has become popular in the SaaS and eCommerce sectors, where lenders such as ClearCo, Uncapped, and a host of others operate.

Fixed term loans are easily understood - just a number of equal installment repayments plus the agreed interest. Revenue based loans take a fixed percentage of monthly revenues until the loan has been repaid in full plus an agreed fee (for example 15% of monthly revenues until the loan has been repaid and with a 10% fixed fee). It’s a more flexible choice if the company has less certainty over its near term revenues, as if revenues don’t meet expectations the repayment is smaller.

Do They Work For Scaling F2P Games?

In order to answer this, you have to look at the repayment schedule of the loan and consider the LTV profile of the game. In other words, look at how a game earns revenue over time. This will give us the best sense of whether these loans are an effective product for financing UA scaling on F2P games.

The question we need to ask is “Does the LTV profile of the game fit the repayment schedule of the loan?” There are two key elements of revenue generation in the game that we need to understand.

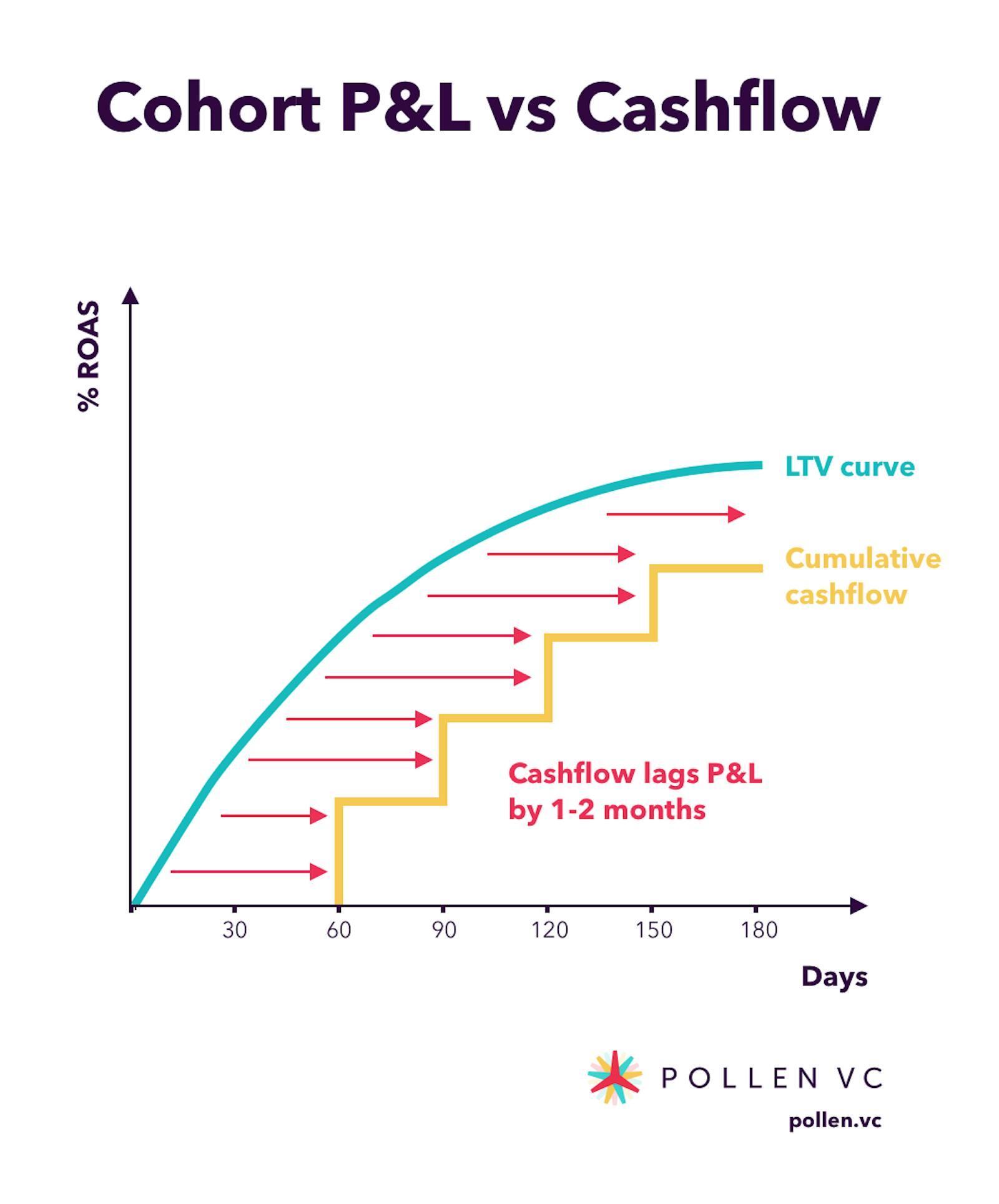

1. Cash Offset

In order to figure out how a revenue based loan gets repaid, let’s first consider the payment terms of the platforms. To model this correctly, you need to offset the time period between revenue being earned and when it is actually paid out. This can be anything up to 90 days after the player transaction has taken place. So, it’s necessary to offset either one or two months before funds actually hit your account. This is important because it impacts the ability to repay the monthly installment of the loan taken. If you have to repay 1/6th of the loan from month one, but won’t have the first cash back until month three, then you will have to find two months of loan repayments from elsewhere. In effect, the loan is being repaid using your existing cohorts, not future ones as anticipated.

2. ROAS/LTV Duration

Next we need to consider what the ROAS/LTV profile of the game is and how we think about this with respect to repaying the loan. Are we going to have enough expected cash to make the loan installments?

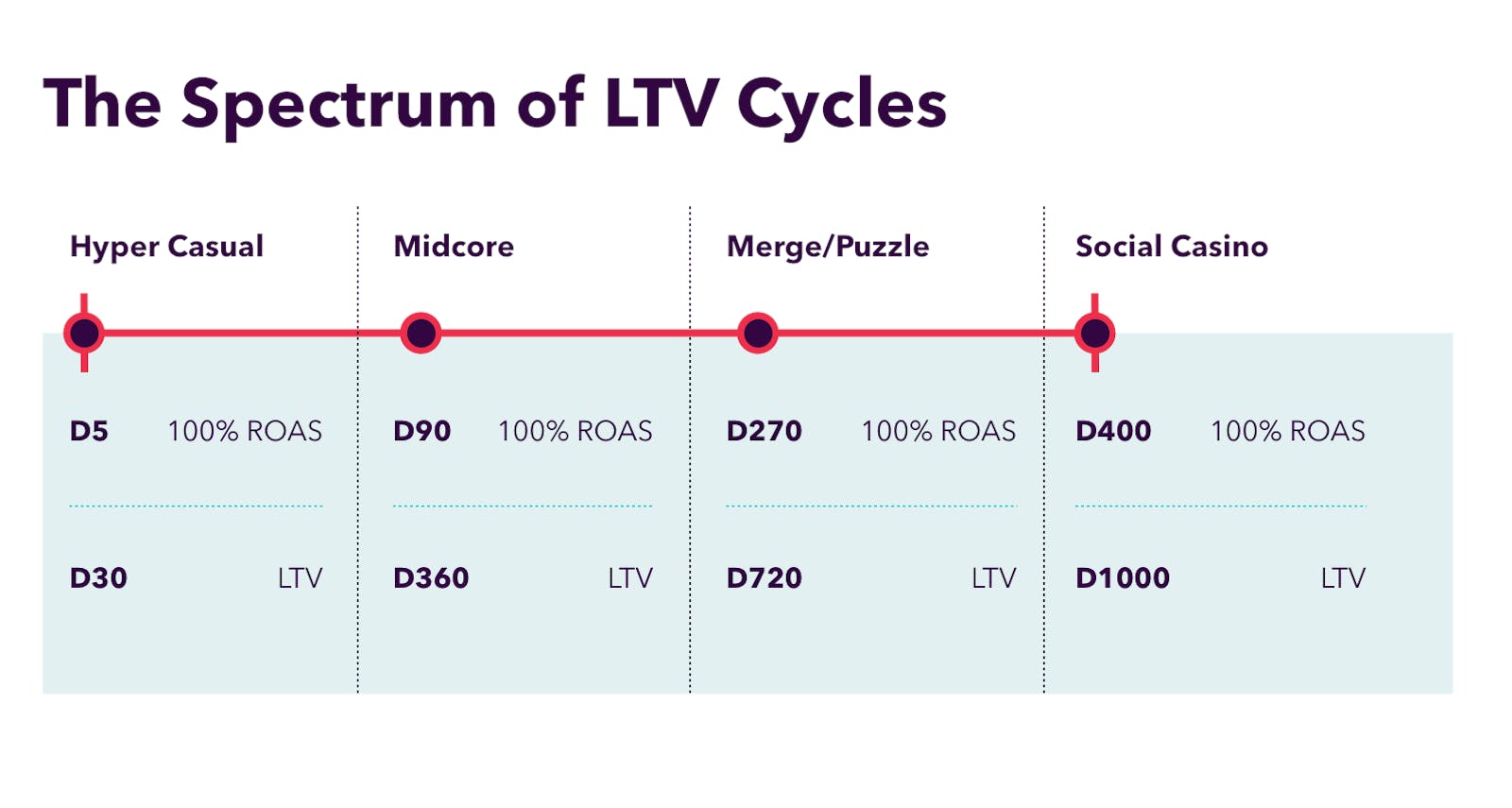

This very much depends on the genre of the game. On one hand, hyper casual LTVs are typically measured in days, with Day 30 being a realistic LTV cutoff point. Contrast this with a merge/puzzle game which may have a 2 year LTV horizon before all expected revenue is collected, with 100% ROAS achieved after 9 months. There can be huge variances in the breakeven period which need to be taken into account when considering the optimal type of financing product to use.

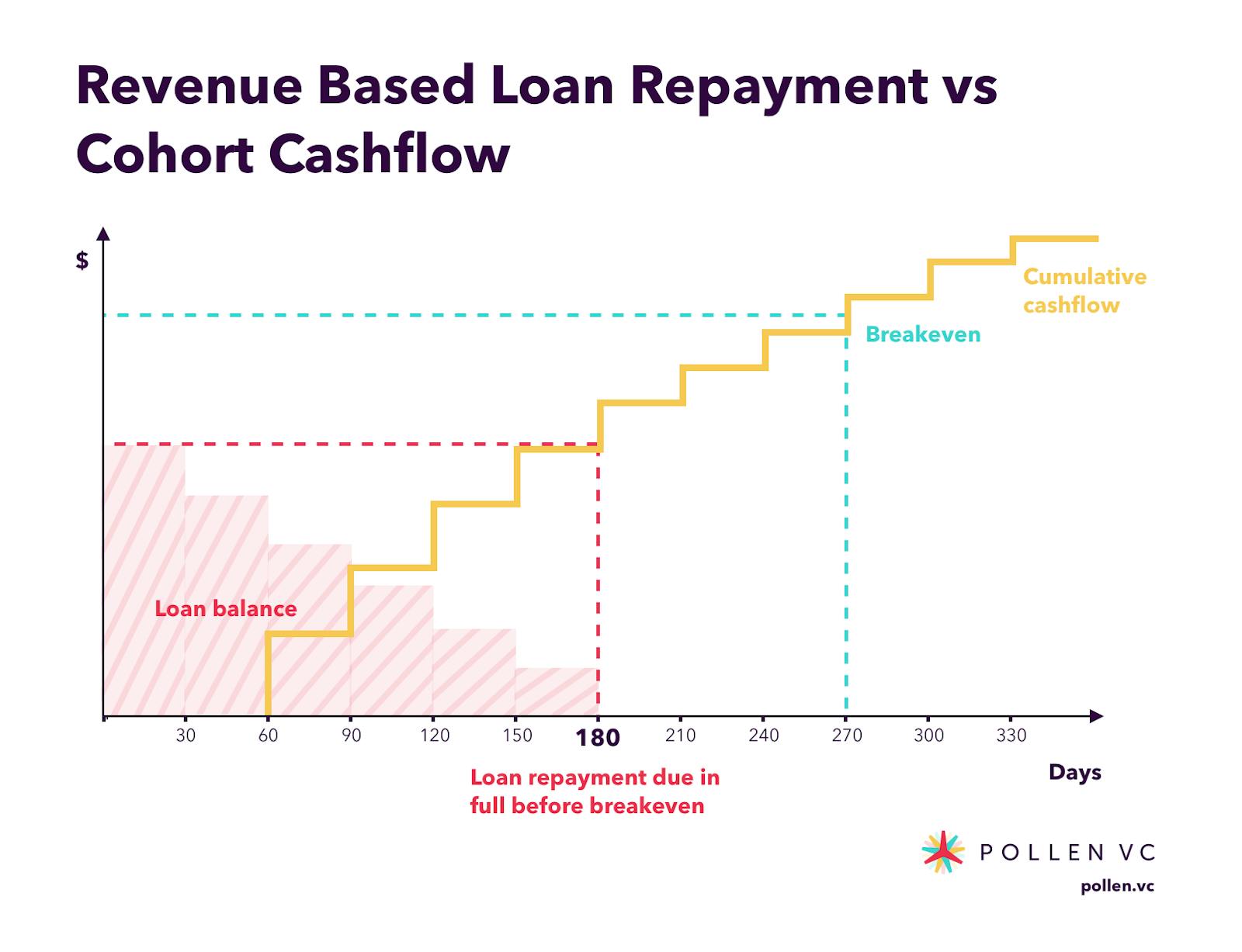

In this graph it’s important to note two things.

- The cash offset automatically pushes the cash received two months to the right, meaning that the first couple of loan repayments must be funded by an alternative source (existing cohorts, equity etc.)

- When the LTV generated (as net cashflow) is compared against the repayment schedule of the loan, we see that the revenue based loan is expected to be fully repaid by the time that just ~66% of the customer acquisition cost has been recovered.

In practice, the repayment of the loan just does not match the payout profile of the game from LTV generated, and so creates a structural mismatch. This mismatch needs to be funded from an alternative source, such as the company’s VC funding, or working capital - exactly what it was meant to avoid!

What Happens If I Want To Keep Scaling?

For companies that want to continually reinvest ever greater amounts into user acquisition, the timescales when using revenue based loans are inconsistent. You want to keep doing more month-on-month, not just spending the funds from an initial term loan in one hit. Unless you can spend the full amount of the loan on UA within a very short period of time, say 30 days, you’ll be repaying the loan before you’ve been able to deploy it, let alone actually receiving the cash from the platforms. This is a highly inefficient use of cash.

Consider this scenario. You spend a $100k loan over a 30 day period on user acquisition. You are confident that the UA spend will return the expected ROAS profile to break even in say 120 days and want to keep spending. The problem comes that in month two you want to double down and spend more, not sit tight and wait six months until your revenue based loan is repaid and you are able to take out a new loan. After all, UA needs to be done consistently in order to achieve the best success.

Of course, some lenders may allow you to apply for new loans - but here’s the rub - most insist that the existing loan is settled before a new loan is taken. In effect, the fixed fee charged by the lender is repaid much quicker than expected, which means the interest rate earned by the lender on the loan is much higher, which of course is why they want you to keep taking new loans. This is one of the oldest tricks in the book for lenders looking to juice their own returns at the expense of their customers, destroying their unit economics of UA.

Let's Talk About Interest

Shiny VC-backed fintechs often talk about how their financing is not a loan and somehow have created a new model of financing (spoiler alert - they haven’t!) quoting “fees”, “revenue share”, etc. These terms are merely a way to come across as more founder friendly, looking to dumb down the true cost of capital into something more palatable on the face of it. This makes it harder to track your real cost, which can only be expressed as an interest rate - a familiar concept if you are comparing products like credit cards, mortgages, etc.

The only way to properly compare financial products is on an “apples-with-apples” basis using an interest rate. Any series of cash flows can be expressed as an interest rate, and any alternative model can also be illustrated as an annualized interest rate (APR) for clarity.

Revenue based lenders typically target interest rates of 25-35% when the various different fee structures are unpacked, which is why all the VC funds have been backing these lenders! To calculate the true cost of a revenue based loan expressed as an interest rate, check out our RBL True Cost Calculator.

What Happens If Things Go Wrong?

So what happens in the scenario where things go south - does the lender just write it off as a bad job? Of course not. They will look to recover their loss by any means possible, either through invoking a security interest, or by lining up with other unsecured creditors as part of a bankruptcy proceeding. Most probably a bad outcome for both the studio and the lender, caused at least in part by the studio selecting a financing product that was not fit for purpose.

What's A Better Alternative?

Studios looking to scale need to be able to spend consistently to enable best acquisition costs as UA networks favor consistency. Big peaks and troughs in ad spend make things difficult to model and throw off a predictable scale up plan.

If your unit economics of UA are positive then rationally you should want to continue to invest into the UA equation as long as it is returning a positive return, right up until the point that UA costs equal the expected LTV. Check out our video explainer on demand economics of mobile UA.

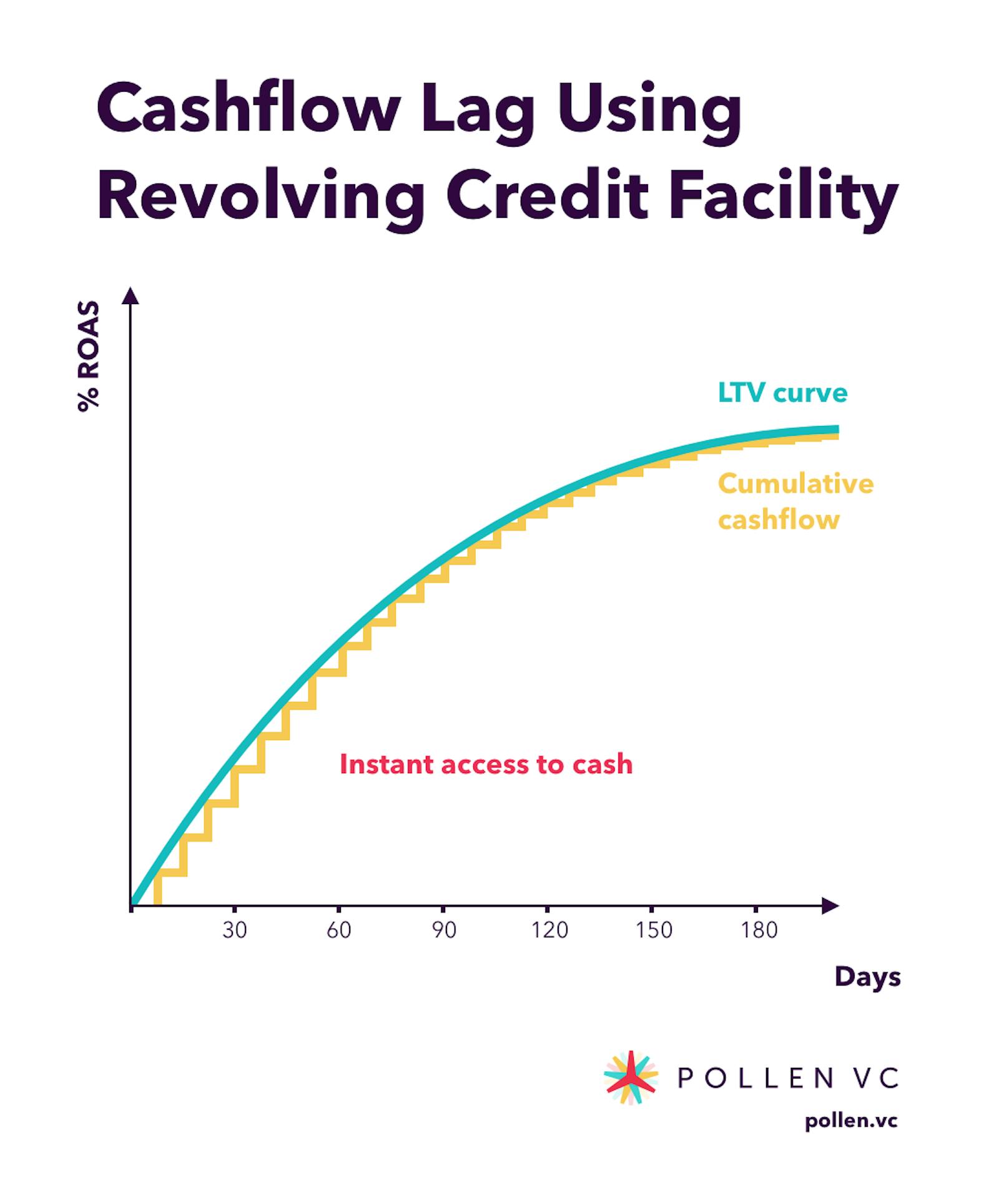

When you exhaust internal sources of capital and you want to use debt funding to continue to keep spending, you need a product that allows you to do this consistently, such as a revolving credit facility from Pollen VC. This type of credit product enables gaming studios to continually reinvest into UA by taking out loans every week (or even more frequently), which are based on a combination of the funds trapped up in the payment systems of the platforms (up to 90 days) and the amount of expected future value trapped in existing user cohorts. Both of these are digitally re-verified every day, and determine the available capital that can be borrowed to fund continued reinvestment. The size of available credit scales in line with the growth of the business, so you don’t need to keep going back to renegotiate new loans.

Revolving credit facilities are paid down via inbound payments from the app stores and ad networks. Provided the UA efforts continue to be ROI positive, then the amount available to borrow each week will increase, allowing the facility to be quickly redrawn and reinvested. For as long as the return on ad spend cycles exceeds the cost of borrowing, it can be a highly effective strategy to scale F2P games.

Conclusion

Not all debt products are created equal. Studios looking to scale their games should always review all available options and model the outcomes, picking the best fit product to achieve their objectives. Please visit pollen.vc/calculators for a suite of online calculators to help you make your decision. If you are considering debt financing for UA you may also like our Definitive Guide to Selecting a UA Financing Partner which is available for download at pollen.vc/ua-financing-partner-guide.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!