Founders and CFOs of gaming studios are increasingly introducing "clean room" accounting for all of their UA spend and ad monetization. They do this to cut out some of the accounting function noise and more accurately track their UA profitability.

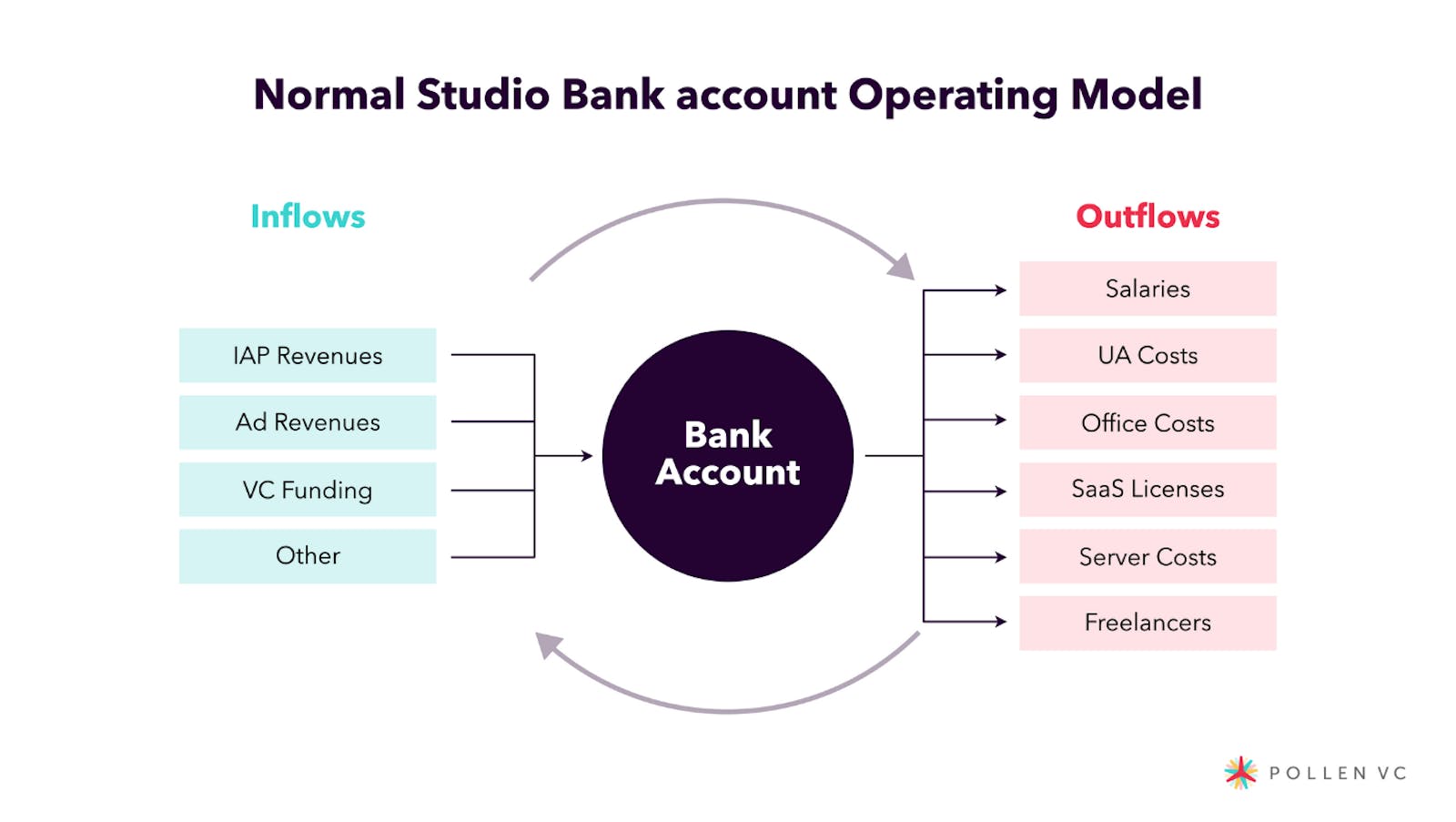

Typically, an early stage company will run all of their accounting through a single company bank account. Salaries and office costs will be mixed with user acquisition spend and IAP/ads monetization revenue.

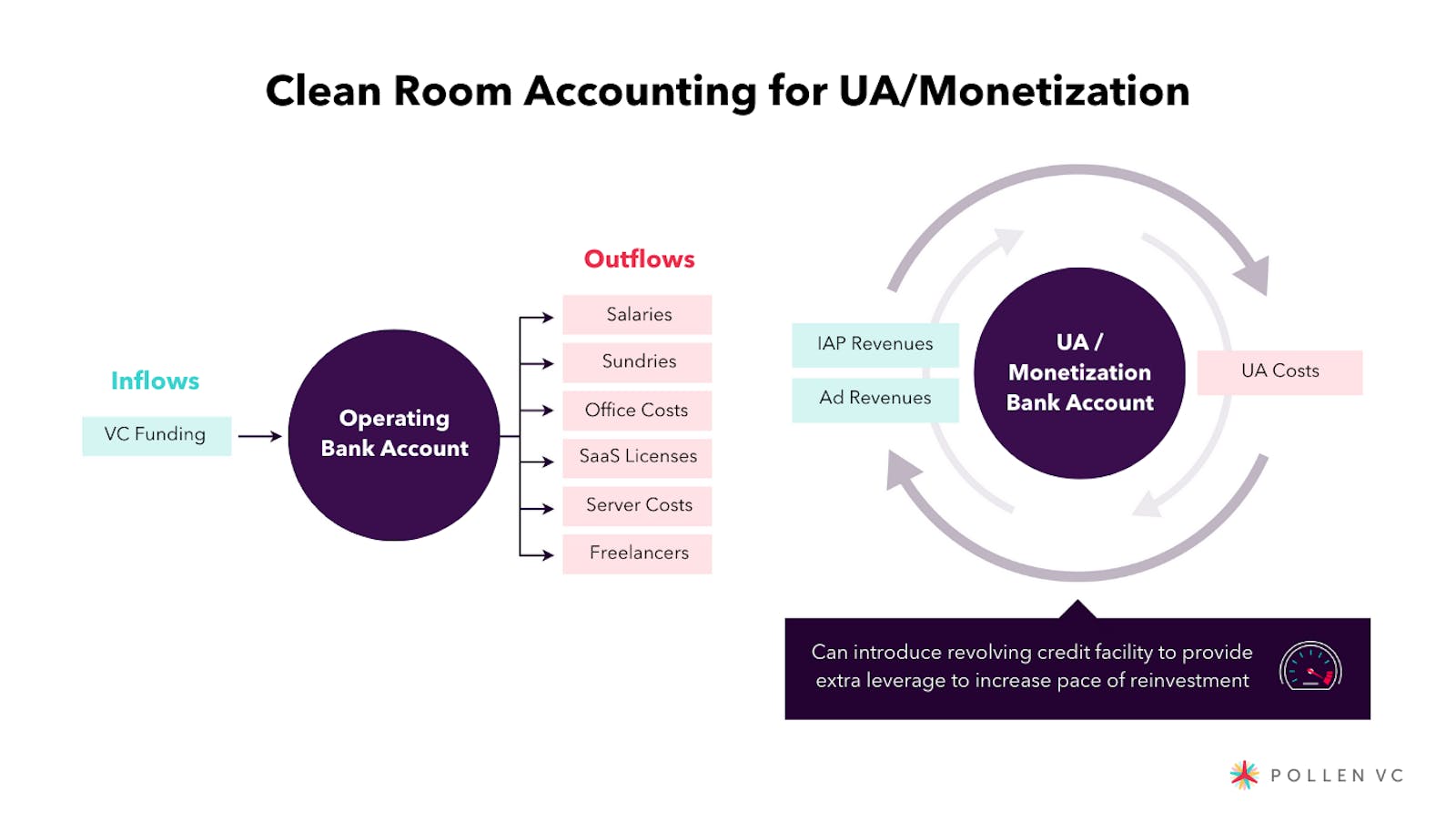

As your studio starts to scale it’s important to better track the efficiency of UA spend. This is a sensible point to introduce clean room accounting for your UA spend and monetization revenues. What this means is you will segregate day-to-day studio running costs from UA/monetization cash inflows/outflows by using a separate bank account.

Studio running costs are generally predictable in terms of:

- Salaries

- Offices

- SaaS

- Server costs

- Freelancers

- Etc.

UA/monetization can be much less predictable due to fluctuating UA costs, seasonality, and performance variations between cohorts of users.

Looking at the economics on a clean room basis allows finance and UA teams to work better together to exploit the UA opportunity when it's available. They can double down on spend when it makes sense to do so, and pull back when the market conditions are not optimal, without polluting the UA/monetization machine.

Let’s get practical

Actually, it’s really simple. All you need to do is set up a separate company bank account, and think of this as the account which fuels your UA/monetization machine.

All revenues flow into this account, whether IAP revenues from the app stores, or mobile ad revenues (and any other relevant monetization channels). All UA spend is also paid from this account, whether via credit card, direct debit, or invoiced payment terms.

This way everything related to UA/monetization is locked in a closed loop. As your UA returns profits, they are returned back into this account as monetization revenue. Then, you can use this additional available cash to feed your UA machine.

The logic is simple. If your UA is profitable, then the amount of available capital to keep reinvesting will grow. If you’re not spending profitably, the ability to reinvest will diminish over time.

Fixed vs dynamic UA spend

As progressive gaming studios move on from the idea of fixed monthly budgets for UA, segregating the accounting makes this methodology easier to manage. The planning process becomes more fluid with a more dynamic UA spend regime. When this is working, CFOs can work with UA teams to allocate all available capital into the UA cycles when the opportunity exists. They can also put in place revolving credit facilities to further fuel the cycle. For as long as the ROI on the ad spend exceeds the cost of capital, your studio should keep scaling until your unit economics flatten out.

What about operating capital?

Of course, your studio needs capital to run and pay the bills, so this can be achieved in a couple of different ways.

- You set aside an amount of money (for example from a VC round) to cover the studio running costs for a period of time (let’s say 12 months) at which point you reevaluate

- You withdraw a fixed amount each month to cover the cash flow of the business (ideally in one payment), after which all remaining proceeds can be allocated towards UA as free cash flow

Again the segregated bank account approach here helps separate the economics of UA and financing LTV cycles, away from the operating cash flow cycles of the studio. It also has an accounting benefit, as it’s easier to isolate, and therefore report against the efficiency of the UA machine.

For your internal reporting you could also consider a running yield of your UA/monetization machine. This means netting all the cash inflows and outflows together, and expressing these as an Internal Rate of Return (IRR), showing a live yield of UA spend over time. For longer duration games this may be negative for a while as it takes time for the ROAS to breakeven and profits to be generated, but it may be an interesting metric to track.

Clean room accounting can also help you more accurately measure the cost vs return of financing your ad spend if you’re using an external credit facility to provide leverage to your UA operations. Removing transactions that are not relevant to the UA/monetization cycle makes it easier to calculate returns on capital. That is the ROI that an external credit facility brings. This is normally expressed as a leverage ratio:

X times return on ad spend per $ of interest paid

The higher the leverage ratio the greater the capital efficiency of using a credit facility.

Summary

Clean room accounting can be a very helpful way for growing studios to think about and account for their UA/monetization cycles. It doesn’t make much sense until a game or app is coming out of soft launch into a scale up phase. That said, studios hoping to scale should definitely consider this approach ahead of time.

There are also obvious benefits from the accounting/reporting side. Greater granularity into financial returns of UA, and helping studios move towards dynamic allocation of UA budgets based on performance, where feedback cycles can be further shortened with revolving credit facilities to provide additional leverage to scale more efficiently.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!