For mobile app and game founders looking to fund user acquisition (UA) on Facebook, Google, and other ad platforms, venture debt can seem like an attractive non-dilutive alternative to equity. We have spoken to a number of companies who used venture debt as a way of funding their growth through mobile user acquisition, but where the results did not pan out as expected. This post highlights the pros and cons of using venture debt specifically to fund UA.

In this article, you will discover:

- What is venture debt - pros and cons

- The pitfalls of using venture debt for user acquisition

- When to use venture debt to its best effect

- Venture debt vs AR financing

- Using AR financing to leverage ad network credit lines

What is venture debt?

Venture debt is often provided by technology-focused banks and also by non-bank specialist lenders. Typically, companies who are eligible for venture debt are VC-backed and/or later-stage companies that have predictable cash flows and evidence of being able to service and repay the debt.

Venture debt is often introduced at the time of a venture capital round or soon thereafter, and also sometimes as a way of extending cash runway between venture capital rounds, giving the company time to execute further milestones before fundraising.

If debt is being raised alongside an equity round, the amount of debt available would normally be ~20% of the round size, so a company which has recently raised a $10 million Series A could look to raise an additional $2 million of venture debt in the immediate aftermath, normally repayable over 2-3 years.

How venture debt works

Repayment periods can be anything up to 5 years, but 2-3 years is the norm. Venture debt is normally structured as a term loan which means that you receive all the money upfront and then have to pay down the loan over the term in regular agreed installments, including both principal and interest payments, just like a personal loan or a small business term loan.

Often you will have to pay additional setup and legal fees depending on the complexity of your business and the level of due diligence required. Venture debt lenders will also require equity warrants in the company (typically 0.25-2%) to give them additional upside if the company is sold or listed.

Using venture debt to fund user acquisition

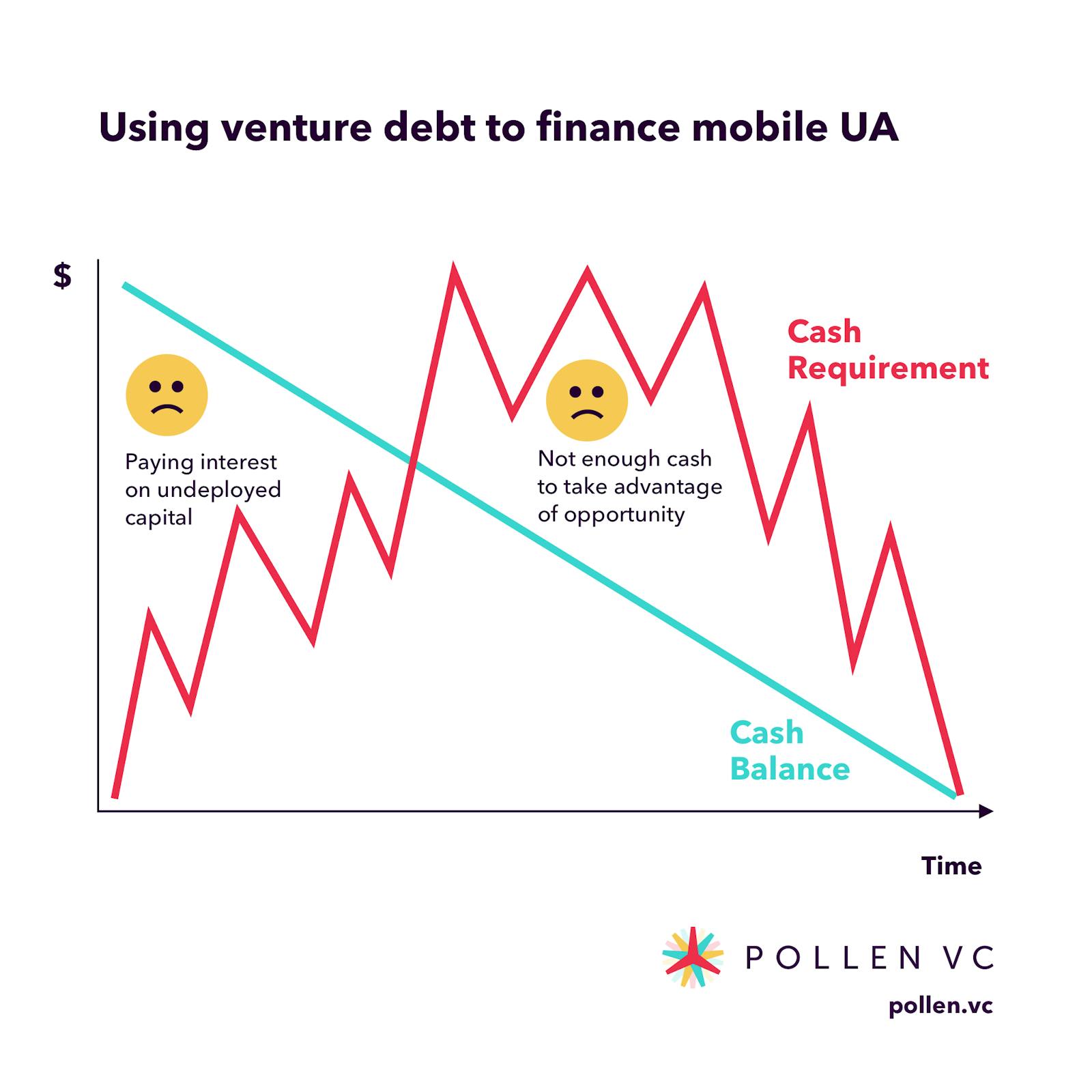

Some venture-backed companies consider venture debt to fund UA, but having spoken to multiple founders and CFOs, this does not always work out as expected due to the inherent unpredictability of the UA landscape and a mismatch in cashflow timeframes.

For example, if you raise a $2 million venture debt investment, it is impossible for you to spend it in one go. It will be spent over a matter of weeks, more likely months, in order not to send your short term UA costs sky high.

It is important to look at the revenue profile (LTV recovery) where you are actually earning cash through monetization of the app/game, when you get paid by the platforms, and when you have to pay interest on the loan. As a capital-efficient CFO, you are trying to match your investment horizons (i.e. your incoming and outgoings).

CFOs should be aiming to minimize cash drag - paying interest on debt financing that is sitting around in their bank accounts without being deployed doing anything useful for the company.

Many companies have been left with unnecessary debt burden by having taken venture debt loans that cannot be properly used for UA.

Unless venture debt can be deployed efficiently within the company, it will just be sitting in the bank, earning a fraction of the interest it will be paying away each month, and with needless dilution through equity warrants. Some companies look at venture debt as a rainy day fund in case things don’t go to plan - this can be a really sensible approach as if the company is running out of cash then raising debt will be significantly harder, if not impossible. Think of it as buying an umbrella as an insurance policy when it’s not raining.

In the UA world, there are multiple factors affecting whether companies can spend profitably or not. The customer acquisition costs (CAC) are run as dynamic auctions by Google and Facebook, with the costs varying significantly based on multiple external forces, and are not easy to forecast. Seasonality, competition from other brands for the same audience, and changing monetization characteristics affecting LTVs, all play into the calculations which must be re-run on a daily basis.

When the opportunity is open to spend on ROI positive UA, analytical marketing teams want to dial up spend right up to the point at which LTV=CAC or in demand economics speak, where Marginal Cost equals Marginal Revenue (MC=MR). This is inherently incompatible with a term loan structure that offers little or no flexibility on draw or repayment schedules.

In short, if user acquisition is the primary motivation to raise venture debt, it is often not a great fit for funding UA cycles, which are subject to external factors and have very different payment schedules to the debt repayments.

When to use venture debt

Venture debt can be a great source of additional lower-cost capital than raising equity and can be used to great effect in a number of scenarios.

For example, if you are looking to acquire a new game or a title from another publisher with a predictable cash flow that can be serviced and paid down over time, and you need to fund the acquisition upfront, then venture debt could be an extremely efficient way to do that.

Alternatively, you may be looking to fund the development of a new game or a new app and you already have existing cash flows from your business to service the debt. Using venture debt to invest in creating new intellectual property and using existing cash flows to pay the interest is a smarter alternative to raising additional equity for a company concerned with capital efficiency.

Venture debt vs AR financing

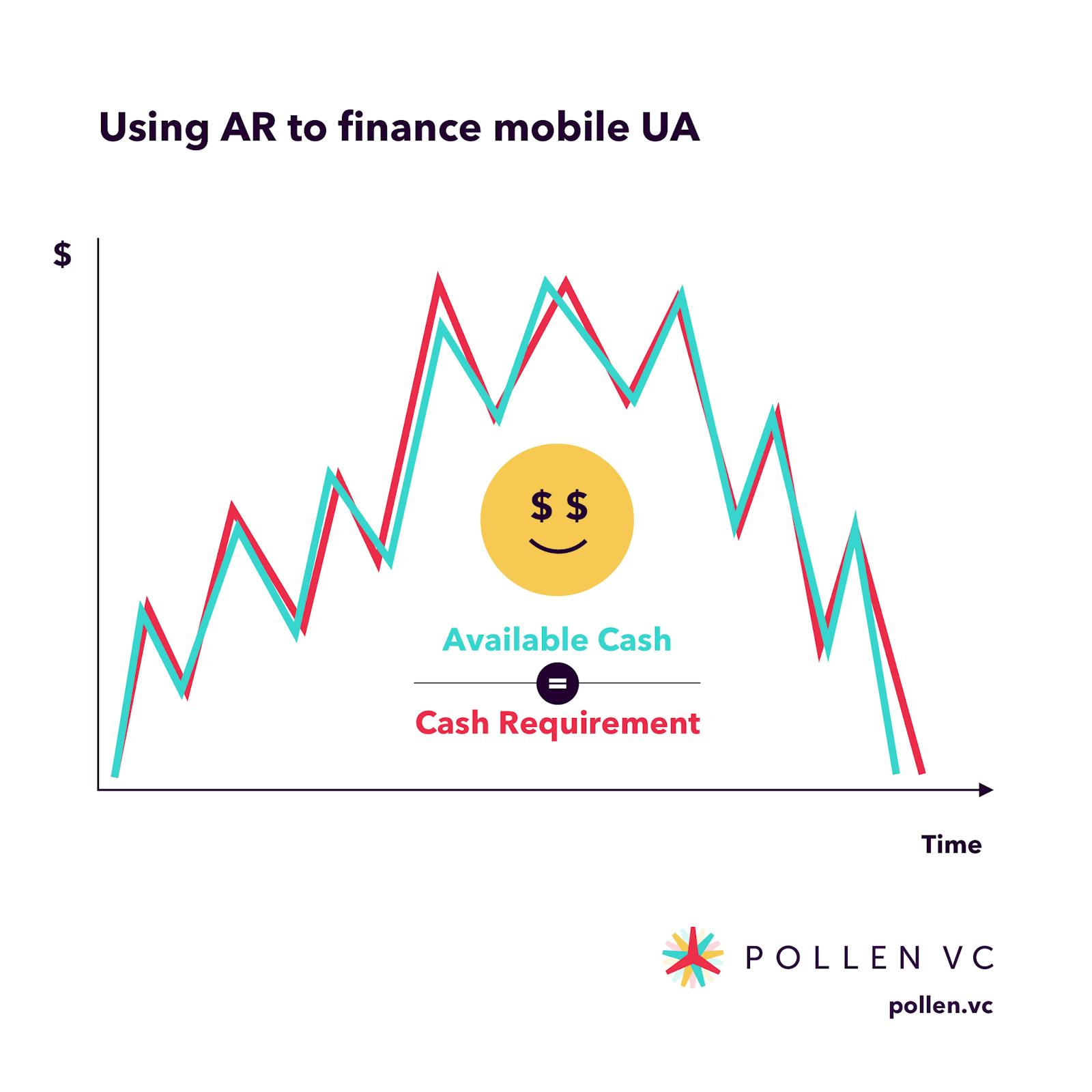

AR financing is a very flexible source of capital that is secured against accounts receivable (e.g. revenue from the App Stores and Ad Networks). AR financing works as a flexible line of credit that is secured by earned but unpaid revenues.

It is an elastic form of credit that you can easily dial up or dial down as quickly as you need it. Because of that inherent flexibility, it can be a very efficient way of funding user acquisition campaigns.

If the UA trade is working, then AR lines can be drawn on and maxed out as quickly as the accruing sales permit. And as the UA opportunities wane, CFOs can dial back the amount drawn on their AR facility to be in line with the level of cash requirement.

AR lines are typically much more scalable than venture debt. For example, if your AR is growing rapidly and the facility is working well, lenders will have much more flexibility to increase line limits than going through a new diligence process to restructure/replace existing venture debt facilities. AR financing also limits cash drag (lazy cash sitting on a balance sheet on which the company is paying interest) and enables a much closer matching of the funding needs for user acquisition.

In summary, there are pros and cons to any form of financing - venture debt, AR financing, venture capital, etc. Founders and CFOs should always research and model all the options and seek the form of capital that best matches their needs.

This article was first published in February 2020, and has since been updated.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!