Debt and revenue based finance options for early/growth stage businesses has become much more mainstream over the last few years, as founders seek alternative sources of capital to fund their growth. Rather than relying purely on equity financing which is dilutive to their ownership positions, they are increasingly seeking more capital efficient ways of funding growth.

But lenders often try to disguise their pricing as “revenue shares”, or “simple fixed fees” in order to seem more attractive to founders who may not have the financial skillset to analyze the different financing options and make the most informed decisions around which product to use to best achieve their goals.

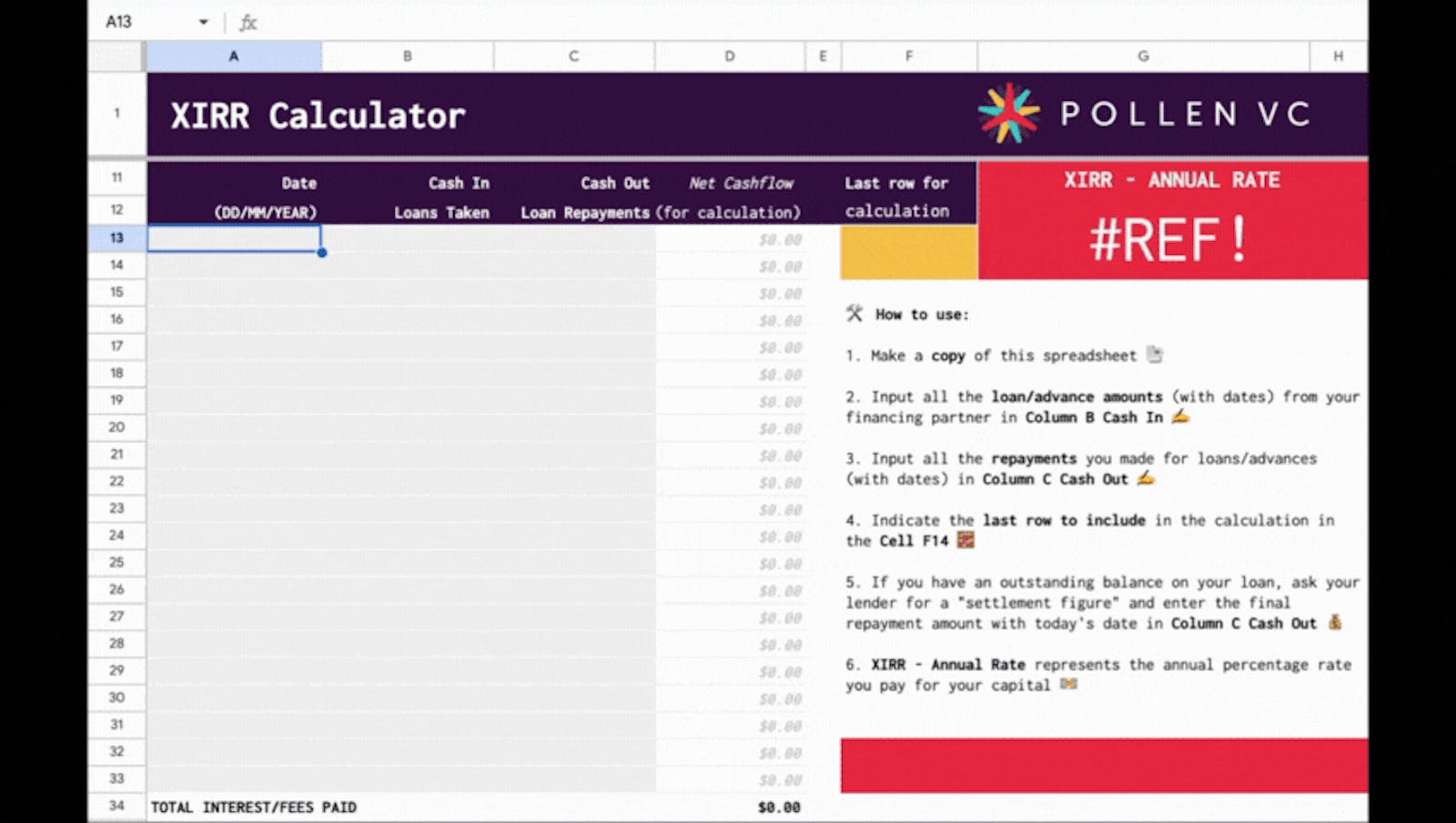

We created this XIRR calculator that takes any series of cash flow and associated dates and expresses them as an internal rate of return (IRR), or an effective annualized interest rate (APR) so you can understand what you’re really paying for financing.

The only true way to compare the cost of financial products is to evaluate them on a like-for-like basis. Fortunately, any financial product can be broken down into a series of cash flows and then compared side by side, by understanding the cash flows of funds received, spent, and the corresponding dates.

Any financial product can be understood using this methodology, including revenue based loans, invoice factoring, venture debt, term loans, revolving credit facilities, etc.

How to use it

Simply enter each cash flow IN (e.g. a loan received), or OUT (e.g. a loan repayment) and the corresponding dates for each payment. If you still have any outstanding payment/s then you should obtain a payoff/settlement amount from the lender. In other words, get a figure (fixed to a certain date e.g. today/tomorrow) which the lender would require to receive in order to fully repay/terminate the facility. This number should be entered with the correct date as the final repayment amount before calculating the IRR.

What is it telling me?

The output number is known as the Internal Rate of Return (IRR), which is an expression of the annualized interest date of the stream of cash flows entered. This shows you your effective cost of funds of the financial product as a simple interest rate, enabling you to really understand what you are paying for the capital borrowed.

This knowledge should help you better understand real financing costs of different types of products and make better informed decisions to help you choose the right product to fit your needs.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!