In collaboration with Silicon Valley Bank, we at Pollen VC put together an event – “Finance & Growth in the App Economy”. Here is a recording of the finance panel with experts from Silicon Valley Bank, Pollen VC and Gossamer Consulting Group to share how to efficiently fund your app's growth.

You are about to discover why venture capital is bad for user acquisition, what types of companies VCs are looking to invest in, the most attractive business models, and much more.

Thanks to Josh Burns, Founder at DigitalDevConnect, for moderating this panel.

Special thanks to the panelists for sharing their knowledge:

- Joe Werner, Managing Director at SVB Financial Group

- Martin Macmillan, Founder at Pollen VC

- Eric Kress, Principal of Gossamer Consulting Group

Be sure to check out our UA expert panel with DraftKings, N3TWORK, and Game of Whales.

Watch the discussion

Introductions

Josh Burns: Awesome, so welcome, thanks to everyone for coming, so I think we'll start with intros, Martin do you want to reintroduce yourself?

Martin Macmillan: Very, very quickly: Martin Macmillan, Founder of Pollen VC. We provide AR financing to app and game developers helping them grow through paid UA.

Eric Kress: I'm Eric Kress, I am an independent consultant for investors, primarily related to the Pollen affiliated companies: EA, Activision, Take 2, et cetera. And I do a lot of consulting on the side, but I have experience in EA for 7 years — 7 long years — and Kabam for 2 years, so where I learned about the mobile side of it.

Joe Werner: Great, Joe Werner from SVB, so thank you all for coming. This is awesome that everyone showed up. I heard it's raining outside. Been at the bank for 14, 15 years focused on our consumer internet sector here. That's anything from the city down to sales A, and gaming definitely falls under that, so I'm excited to be here.

How to fund different areas of your business

Josh Burns, moderator: Awesome, and I've been working on my own freelancing in the gaming space for a very long time now through social games if anyone remembers those, and mobile games. So yes, excited to talk about this topic, because I think it's very close to user acquisition as well as product development.

We'll start with Martin, with your topic, thinking about funding, generically and the different options. We're here in Silicon Valley, where I think the default is looking like, “Go raise money from venture investors.” I'd love to hear your comments around kinds of funding for different areas of the business, from a mobile app perspective, when you should think about the different options, and what those options are.

Martin Macmillan: Sure, I'll take this. I guess we think of it as different horses for different courses, right? So, wind the clock back a few years: It was very much what we think of as like alphabet funding.

You raise a seed, you raise an A, you raise a B, et cetera. And then I think the world has changed a little bit over the last few years in terms of the different gamut of options that are available, so one stage you see now is instead of just pure equity all the way along to exit, which was the traditional path, there are different options that you can raise different sorts of financing for different sorts of things, right?

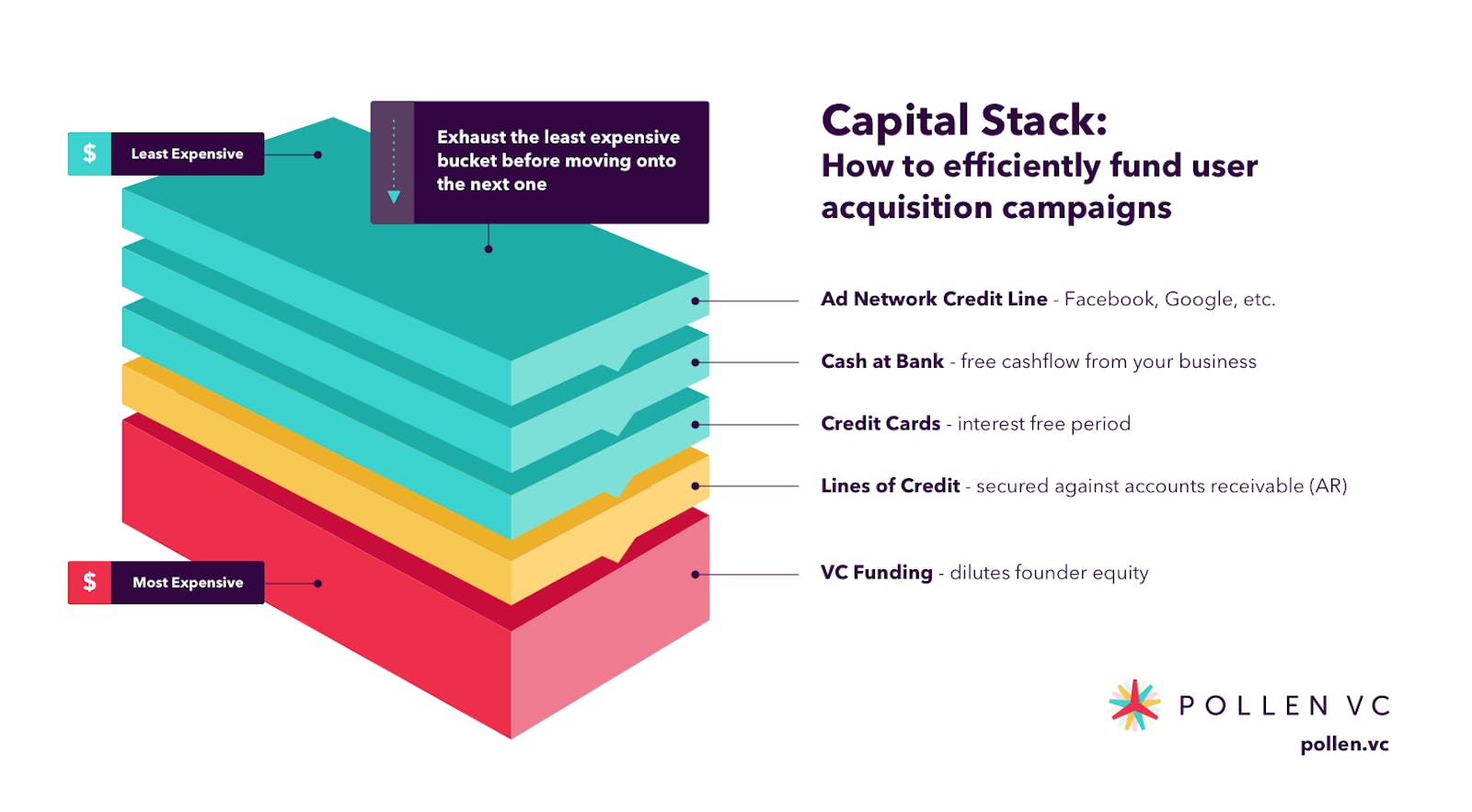

And when we're working in funding companies, we always preach this idea of capital efficiency, that is, to use the right form of capital for what you're actually trying to achieve with it.

So, if you were doing something that's completely at risk, sure, go and raise equity. If you have a bat-shit crazy idea and you want to go and see if people want to buy and build this game, you need to raise equity to do that.

And at the other end of it, if you've got really good established cash flows, then you've got a lot more options, so you could just go and raise equity. Or, you're probably going to raise a combination of debt plus equity as well, and the point of raising debt over equity is basically you suffer less dilution as a founder.

And then there's the mid-row, in terms of just isolating. Don't just say, “We need to raise money, so let's go and talk to VC and raise some money.” It's like we need to raise money for this and have an understanding of what the risk profile of that is and what the reward profile is. So, if you were raising money, if you're raising equity capital to go and hire a new team and open an office and build a studio in Helsinki, then great. If you were just using money to increase your pace of user acquisition that's got a 60-day payout window, with a high degree of certainty, maybe there's a better way of funding than with a debt product, as opposed to equity. So in every stage of it, think about, “what am I raising money for?” “What's the risk and reward profile of that?” And then, “What are the different options along that spectrum?”

When to use venture debt

Josh Burns, moderator: So, Joe, I'm going to turn to you next. You guys obviously are coming in at specific times in the life cycle of the business. Can you talk about where you're usually coming in and what's the profile of companies that you're working with?

Joe Werner: Yes, that's a good question. To piggyback off Martin's comment that there are just a ton of capital sources out there - venture capital is one source but that's not the only avenue, nor is it that the capital source that's for everyone. I think there's a lot of expectations from VC firms, from the partners that you guys potentially add on to your company, that the clock starts ticking once they write the check for you guys. They want an exit of 3 to 5 times what they're putting in, and that may not fall in line with your long-term vision of how you want to build the company out.

I think the way we look at it is that it's more of an art than a science and how we get comfortable lending from a debt standpoint, rough math, series A, series B, equity, et cetera. We're open to doing 25 to 30 percent of that equity with debt.

Venture debt is the easiest, smoothest way from a runway extension. Think of it as a blank check that you get to have as an insurance policy. It's there when you need it, it's X amount. Typically, it will afford you a quarter or two of runway if you need it, and that could be for product launches, it could be for fund-raising to the next round, it's used at the discretion for yourself. If you don't use it, no harm, no foul; it just goes away.

But typically, that's the more common avenue. Any time there's assets that we can leverage, I think we're open to doing that. The way we think about it is that it matches the purpose of your spend with debt. So, sales and marketing spend we're able to finance, and if you do raise equity, which is super-expensive — if you're giving up 10, 20, 30 percent ownership of your company, that's a lot — why use equity at all if you can find somebody that maybe finance that runway for you, at a much cheaper, lower cost to capital?

Josh Burns, moderator: So usually the profiles of the companies are in sort of a lifecycle: they've built a product that's in the market, they're generating revenue. Is that usually where you would come in with these different...

Joe Werner: Yes that's fair, typically there's traction, there's visibility, you guys are onto something that's working. We're definitely okay with cash-burning companies. That's the mantra for a lot of our early-stage lending, it's Series A, Series B, Series C. A lot of public companies, as we see, are still printing a lot of money so that doesn't get us, I think, uncomfortable, I think we like to be an advisor.

We don't want to lend too much money so that if things take a little bit longer to come together if there are macroeconomic factors that just no one foresaw, we don't want the debt to be a hindrance especially when you go to fundraise for that Series B, Series C, you don't want growth investors looking at the debt and saying, “Are we funding money that you already spent, or are we really giving you fresh equity to go spend and grow the company?” So, it is a balancing act and we try to advise on the pros and cons of using debt.

What companies are VCs looking to invest in

Josh Burns, moderator: Awesome, so Eric, I'm going to return to you next, so from the sort of VC perspective, which is obviously appealing to a lot of companies, what insights would you share around what companies are looking for?

I think there seems to be a sort of, we're moving up from the trough of interest, for VCs investing in gaming, people creating content, if it's games or maybe non-gaming apps, what are they looking for, what are they interested in and how are they evaluating opportunities?

Eric Kress: Yes, I would say there is a long history of venture capital for the video game space, starting with the PC space and the console space. Then we saw this brief window of the Facebook game space, and then we saw mobile and VR.

And now we are in the Fortnite space is what I would say, from what I have seen now — this is not my expertise, I'll just be honest — but I have been talking to most of the biggest venture capital funds over the last year, working with a few of them and all of their strategies are somewhat unique and different and a spin on things.

But ultimately, I think what a lot of them are looking for, first off, is a strategy of trying to take advantage of something that's not in the marketplace that you can build upon. It's not a single product, but it's an actual host of products that can be built from the original product, so building an engine that could be replicated across different either platforms or different games, a series of games that would be unique in the marketplace, that's one big theme.

The other big themes are all the buzzwords that you hear these days, but — and I hate to perpetuate it, in some ways — but cloud-based stuff, cloud-based tech that is unique, things like what Roblox is doing, where all their stuff is running in the cloud and it's all being fed, all their users around the world on every platform.

Cross-platform is obviously the other buzzword that is running around now. Cross-platform means a lot of different things to a lot of different people, but ultimately the ability for players to play wherever they are, right? And experience the content in a unique way based upon what the platform provides.

Social is a big, huge thing: I think if you don't have social in your game, you're not going to be able to get that much interest from anybody at the VC community.

And then the free-to-play stuff that we see all the success with Fortnite and Pub-G, and Apex to a lesser degree. But, understanding the free-to-play model and how that will work and how that will translate to console and PC that way that the games have been successful on mobile.

Those are the major themes that we look for, and then user-generated content, that's the other one: so Roblox, Minecraft, those types of things, that's also very big. I mean if you look at the guy at Roblox, he's a genius, right? And he wants to build the Ready Player One metaverse, right? I mean the guy's out of his mind, but he's actually doing it, as we speak, and those are the type of big ideas that I think they are getting interested in.

And In-Reason, in particular, is getting super aggressive right, so there's money coming back, right? And it's been a long time… we haven't really seen the VR stuff — it was just such a flash in the pan, that was the last funding thing and AR is in that realm too.

By the way, just for the record, Pokemon Go was not AR, can we just all agree on that one? So, AR is in its fledgling state right now, I wouldn't go there, but anyway so that's the thing where you think about what Roblox is doing, Minecraft and some of these other more platform-style gaming companies, I think that's what's really attractive.

Why venture capital is bad for user acquisition

Josh Burns, moderator: Awesome. So, turn back to Martin here with different sorts of funding needs for different sorts of parts of your business. You have actual building experience for the game, whatever app, and then obviously the marketing-side scaling, so I think we've touched a little bit on this idea of, venture money for UA equals a bad idea.

Can you go into a little bit more detail about why that is and comment in more detail about what other avenues people should pursue? Because I've seen game studios raise money specifically for this purpose and maybe a lot of the options didn't exist then. But talk us through: Why is that, usually?

Martin Macmillan: So yes, some of this journey came from me as a founder of a music app company with this exact problem. And I talked to VCs about it. They said, “Oh, we don't want to fund marketing spend or something you actually do,” because they are effectively getting an equity return for a debt risk.

Essentially, like everything in life, it comes down to something very, very simple: it's just being on top of the metrics of acquisition, but also the time, so people will often talk about, CAC and LTV, now there's rightly so a much greater focus on ROAS, right? Return on your Ad Spend.

But if you just take one step back from all of the different kinds of jargon, UA is basically one thing. It's an investment equation, how much invested in, how much invested out, how much returned after how many days, or if you're in social casino, how many years or whatever right?

The time frame is really important and also the degree of certainty. So if I can figure out that I've effectively got a money-printing machine, every time I'm putting a dollar into Facebook ads or Google ads, I'm returning $1.50 after 90 days, and I'm actually breaking even after 20 days. If you were to go into any investment manager or hedge fund manager or whatever and say, “Hey, these are my numbers, I'm making a 50% return every 90 days, this is insane,” the question then becomes, “Okay, so do you have a money-printing machine and is it replicable?”

So if you were in a really niche market, what you're going to have is, “Great, I think I've got a machine,” but what's going to happen is, “I spend 1,000 bucks a day, and I acquire 1,000 users, but by the time I spend 2,000 bucks a day, I'm only acquiring 1,500 users so my demand curve is super steep on that.”

Or, if you're in hyper-casual, you've got this enormous addressable market and you can just spend. For every cent or two cents, you've got an extra couple of tens of millions of people you can go after, so understanding first of all the shape of that demand curve and how many people you can acquire at what different levels is super important.

It really comes down to, “if I can invest a dollar, I can get more than a dollar in a number of days with a high degree of certainty,” right? So if you can do that at, 80, 90, 90-something percent certainty, depending on how good you are, then you're taking a lot of the risk out of the equation. So, why go to a VC — the same guy who is going to fund your crazy idea — to then say, I've got this dead certain proposition, and with a 90 degree, 90-odd percent confidence interval, I'm going to return this in this many days.

Why would you use the same sort of capital for that? So then, you can approach debt providers that understand and know how to price, are on top of the numbers, can model the data and say, “yes, you guys are good at what you're doing.” And we can put progressively large amounts of capital in provided this equation keeps returning, that's going to be a much better way.

So we obviously ask or get people to think about just the specific user acquisition spends, isolate it away from the rest of the business, just look at the unit economics of it. Are those scalable? And basically it comes down to this.

A million years ago, I studied economics. I'll never forget my first economics lecture, which was basically the demand economics, demand and supply curve, and that's basically what UA is. Your demand curve is how quickly does the cost of acquisition scale as you start to put your foot on the grass, and your supply curve is basically, what's the gradient of that. As I keep continuing, will people still continue to spend the same amount of money or will it tail off the more people I buy?

And really what you're trying to do is you get down to one thing, which is cost and revenue. Economic theory says if your marginal revenue is exceeding your marginal cost, keep doing it as much as you can until basically all the profit has gone away.

And it's really just down to that. It's how much in, how much out, over a period of time. Look at it as an isolated use case, and once you've figured out, if you've got the machine, figure out how you're going to fund it.

And 9 times out of ten, you're probably better to fund growth through debt, if you can prove to an investor that you're really on top of the numbers, rather than going back to your same equity investors. The good thing is that your equity investors should be totally supportive of that because they don't want to be funding it, and decreasing their fund returns, getting the same return for more and more money in is bad for that. So it's better for founders as well.

What quantitative and soft metrics are you evaluating before backing a company?

Josh Burns, moderator: Awesome, so Joe, I'm going to come back to you. So, we talked about evaluating opportunities here and risk profile, so when you're talking to, I don't know, say, a mobile app, mobile gaming company... I mean, you talk about the art and the science and the evaluation: What are the sort of main periods of focus within those in terms of, maybe, “art is like the product,” what the science is… What quantitative measures are you looking at and what's the sort of soft stuff that you're evaluating?

Joe Werner: Yes, a lot of the variables are really the experience here, like “what you guys have as background?” and how many times that you've done this, “is there a track record that we can get behind”? Being an entrepreneur can be really hard and lonely, so understanding the ebbs and flows, the ups and downs, we want to be able to get behind someone that's done it before.

Over the long trends, where we've gotten into trouble is to hear that the first-time entrepreneur is in over their head, doesn't know what's going on, is trying to solve everything alone. That doesn't mean that we don't do that, but that gets harder and harder.

Typically, if you are raising money, who are those investors? More importantly, who are the partners at those firms that are on the board? And then, what is the dollar amount? Quite frankly, like I mentioned how Series A, Series B relates to that growth capital runway, it's that 25% debt-to-equity ratio, and that's just a jumping-off point. As it relates to the core metrics within the business, we understand there are, again, ebbs and flows, especially early on.

I think the retention numbers are super important, acknowledging that equity dollars are really expensive, making sure those are being put to use as best as can be. The average revenue per daily active user is just a good barometer for companies that either have a free product, as well as one that's looking to generate revenue, so it's a good barometer for us to see how trends are going. It's a good barometer to see it for the companies testing new initiatives, new marketing channels. You can see any ebb or flow there.

Outside of that, we do want to provide guidance on the point in time where that debt becomes due, and so from a debt service standpoint — which is when the principal and interest is beginning to amortize over, and these loans typically work like a home mortgage, typically over 30, 36 month period — the debt service really shouldn't be more than 15, 20 percent of the total operating expenses of the business. If things are going well, the company is crushing it, that's moot because most investors will be lining up to give money.

So, when things hiccup, slow down, and then that becomes a larger dollar amount, that just becomes a bigger headache. You're spending something you already used to grow and that dip works, so now you still have to repay this over time for an issue: that dip help get you what you wanted and that then becomes the burden that I mentioned earlier. And we just try to avoid those situations, at least provide guidance. That could be the con to take on debt, and so it is trying to find the right dollar amount, based on what initiatives I think are trying to be achieved.

The most attractive business models

Josh Burns, moderator: What about business models? Historically, we're focused a lot on in-app purchases. Advertising has obviously become a huge revenue stream now, subscriptions... Do you evaluate those differently these days, assuming one of those is more attractive to you? Obviously, there's a lot of stability with subscriptions, but what do you guys think about that business model?

Joe Werner: Yes, companies that are working with Google, Apple, that's great. Accounts receivable for us, it's steady. Typically, terms are probably net 30, net 45 and that's pretty handy there in terms of something we get comfortable lending on. I think where the value add is if there is a small working capital at times.

Depending on if those balances grow, or we can easily unlock that for a lot of companies and that gets to be an easy thing which is typically our bread and butter — we can customize that depending on the dollar amount.

If you have intra-quarter or intra-monthly swings, those lines of credit are definitely super helpful, and again you only get charged if you use it. It's really just there as that insurance policy if and when there is that ebb or flow. It really does come down to: what is the debt amount, coupled with where is the scale and traction and what are companies trying to achieve? I think for companies that are really trying to crush top-line — and that comes with typically a high burn — you hate to see.

Then that becomes a no-man's-land where you're too far away from the cash flow break-even standpoint, which some investors like to see, and you're not getting the super aggressive top-line growth that's going to attract investors. So, it really comes down to, what's the strategy and what's the intent of the company.

Is it to be a Fortnite, is it to try to get the market recognition, or is it, “Hey, we found a niche, we know who our core users are, we're really doubling down and listening to what they want, what they see, we're iterating, and we're not putting a ton of money in, we're reinvesting the net income into the business and we're just going to be slow and steady” company that has a good market appeal and that people organically are going to come to. I think the test for us is that product-market fit. If you guys turn off sales and marketing spend, are people still going to come to the game? And a lot of companies think they can organically turn that off and people are still going to play. That really is a true test if people are going to do it.

How to set-up a company for a successful acquisition

Josh Burns, moderator: Awesome. So, Eric, thinking about the journey of a business here... Obviously people raising capital are usually looking for some type of exit all the time. We're going to talk about it some more detail after this, but would love to hear, from the perspective of setting a company up for success for M&A opportunities, what advice and insights would you share in that perspective? From what you've seen in the market and the people you're talking to?

Eric Kress: From an exit perspective, as in getting acquired, the bigger acquisitions that we've seen — we're going to talk about this in the next one, with Zynga, Gram Games, Small Giant — just built money-making machines.

These games and they actually fit that profile of games that can be replicated under different themes and potentially stake on top of each other, which is basically what Zynga hopes happens anyway. They're ultimately scalable and the profitability is critical these days.

There's no market for companies out there that are not in some way driving profit from their games.

That has changed over time, but Zynga is looking for those types of companies in particular. But again, let's talk to the expert in a minute. Maybe, coming from Kabam, I'm a little biased, but I think the high-LTV games are much more interesting to the market than low-LTV games and high downloads.

I think those are far more valuable to companies because they feel that they can scale them, the hyper-casual stuff. And so, I apologize if anybody does a lot of hyper-casual stuff, but I think that's a race to zero, right? I don't really feel that that's where the market is likely going to be heading anytime soon. I don't think it's very interesting though.

Josh Burns, moderator: So “high LTV” usually means that long life cycle games that can be operated for years essentially are more attractive?

Eric Kress: And more core-oriented, capturing that audience that spends lots of money.

Be sure to check out our UA expert panel with DraftKings, N3TWORK, and Game of Whales.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!