Blueprint for success

In our previous posts, we explored some of the key challenges facing gaming and app studios outside of the US/UK/EU with regard to company formation, raising capital, running day-to-day operations, and user acquisition.

In this final post in the series we will share some best practices we have observed over the last eight years of providing debt financing to app and game studios across the world. We’ll also share our insights on how to achieve success on the global stage regardless of where you’re based in the world.

Whilst there are many different flavors of possible structures, the most common is to establish an entity in a jurisdiction with a commercial environment more conducive to doing business internationally. This will act as the main corporate entity which publishes the app/game and contractually faces the app stores and advertising networks.

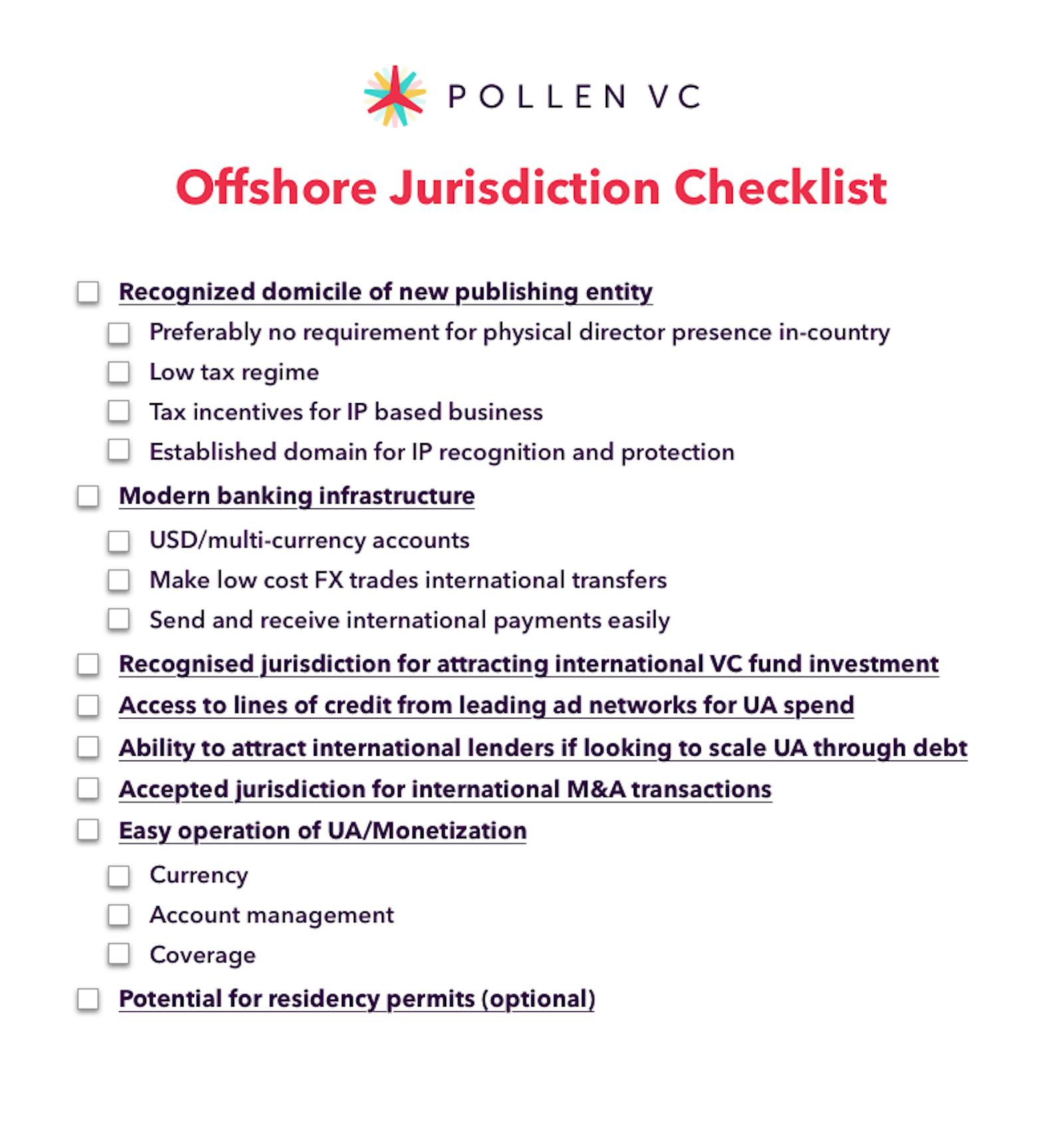

Let’s start with some high-level criteria we should be aiming for when thinking about how we want to structure our operations. For clarity we’ll refer to “domestic” jurisdiction where the key team and development activities are located, and “offshore” as the jurisdiction where the new publishing entity is set up to contractually face the app stores and ad networks.

The studio may then also look to incorporate a local entity domestically which handles locally incurred costs such as salaries, payroll taxes, office costs etc. This entity effectively becomes an operational satellite of the main publishing entity. In today’s increasingly remote first world, having an office is less of a priority, so it may be that the team ends up contracting directly with the offshore entity, and makes their own tax arrangements wherever they live and are tax residents.

There are two primary IP ownership scenarios to consider:

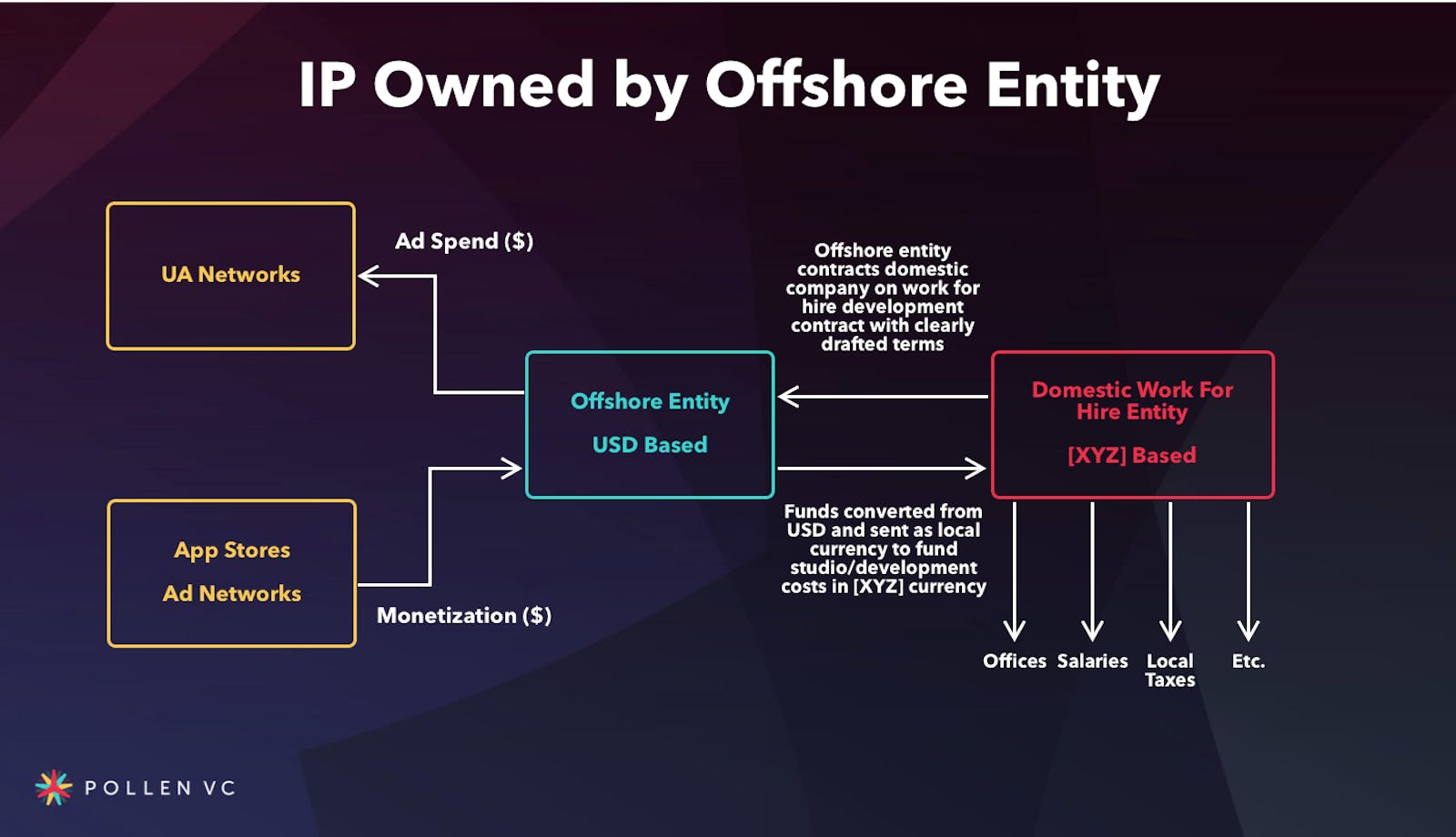

IP owned by offshore entity

If you’re at an early stage in your evolution, you may wish to establish the ownership of IP within your offshore entity. Research the rules of each jurisdiction you’re considering regarding any specific concessions offered. Many governments are keen to establish IP-based businesses and are prepared to offer tax incentives to achieve this.

It’s important to have the contractual relationship clearly documented to make the ownership clear from day one. Contractually the domestic entity should have either a development or consulting agreement with the offshore entity, to make sure that the ownership of IP can be clearly proven through documentation and payments.

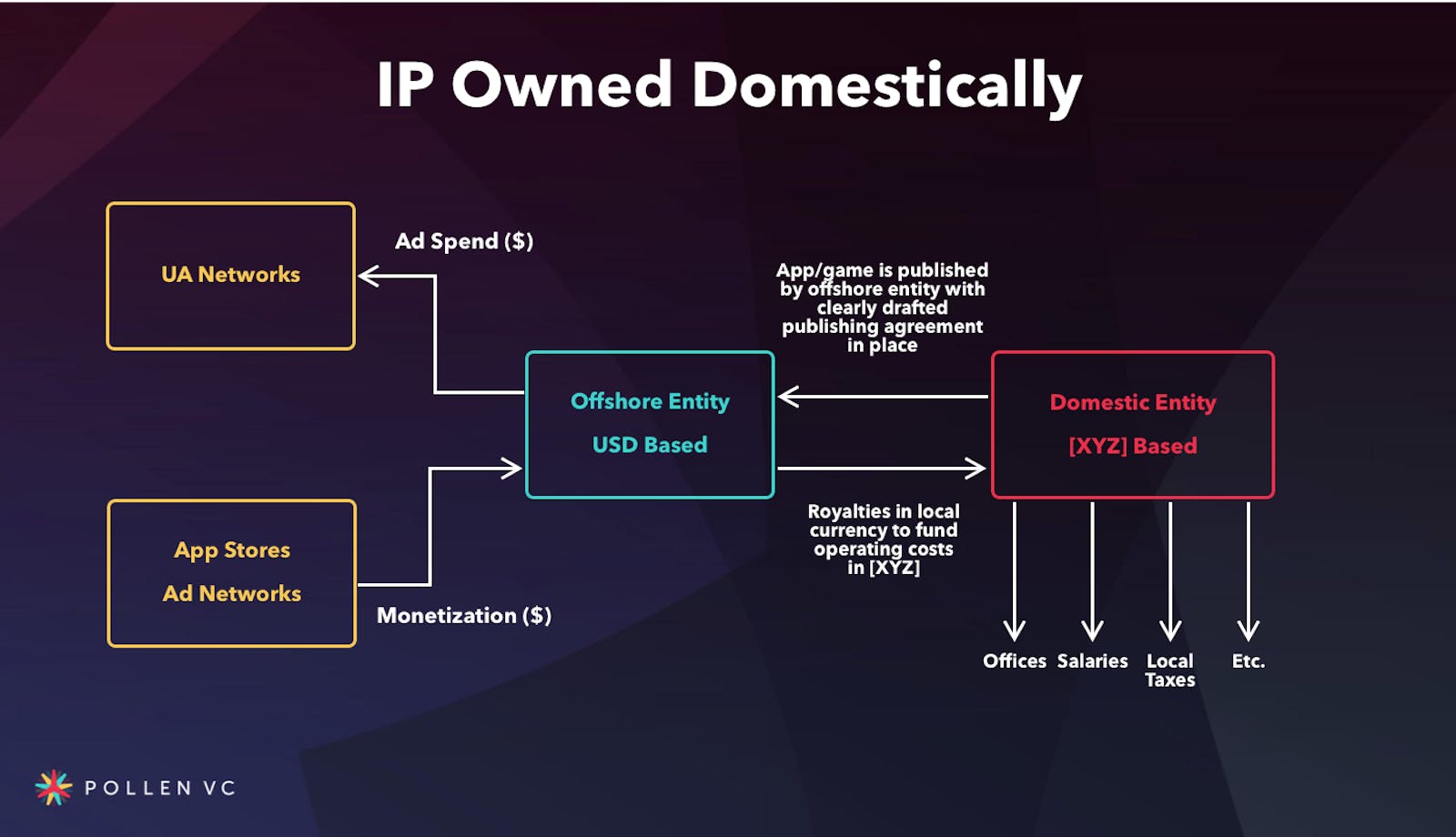

IP owned by domestic entity

If the IP is owned by the domestic entity and the transfer of IP ownership to the offshore entity would be problematic, the domestic entity can enter into a publishing agreement with the offshore entity which then acts as the publisher of record. This can be a very standard agreement between a developer and publisher, just as if the domestic entity was signing a game/app publishing deal with a well-known US publisher. The economics would of course be different, and the funds required to meet the running costs of the domestic entity can be transferred by way of a royalty.

This scenario can also help a studio take advantage of domestic tax breaks for the creation of IP and operation of the studio, even though they only earn publishing royalties back from the offshore publishing entity.

It’s important to consider if any withholding taxes (WHT) must be applied by the offshore entity on royalty payments. Some countries, for example Malta, offer 0% withholding tax (WHT) on IP-based royalty payments. If IP is to be owned domestically, this is important to get right.

The worldwide tax summaries, published by global accounting firm PWC, are extremely comprehensive and provide a very useful resource for founders considering different jurisdictions in which to domicile, helping articulate different countries tax treatment of royalties, dividends, interest payments, etc.

Where to establish your offshore jurisdiction

Outside of the main jurisdictions of the USA and UK, Cyprus has emerged as a favored location, in part because of its generous tax regime relating to IP and also its EU status. Malta and Estonia are also contenders in Europe, whilst Singapore is the jurisdiction of choice for many operating out of Asia. Some jurisdictions require a physical presence of directors in-country, others do not and can be operated remotely, normally with a nominated local director who has certain fiduciary responsibilities in-country. There are of course many other options - we are just highlighting a few popular choices.

It really comes down to your own research to make sure all the boxes can be ticked for your specific situation. It’s important to seek the right advice from lawyers, accountants and formation agents to make sure that the structure you set up is going to meet all of your needs and comply with local laws in both jurisdictions.

SPV publishing entities

If your studio is publishing multiple apps or games, you may want to consider an SPV (special purpose vehicle) structure where each app or game is published under a different account. This can sometimes have advantages for tax reasons (e.g. each company can separately apply for tax credits) and can be considered good hygiene in case one app falls foul of changing app store or ad network policies and suffers some kind of take-down or is prevented from monetizing in its anticipated way. A segregated SPV structure helps to avoid any cross-contamination between apps.

KYC and due diligence process

It’s important to have all your Know Your Customer (KYC) information to hand to avoid slowing down the process. Likewise you will need to have capitalization tables and shareholder information. Information on Ultimate Beneficial Owners (UBOs) who own either more than 10% or 25% of a company’s share capital will be in for extra scrutiny, but sometimes all shareholders will have to be diligenced, so it’s important to have this information available.

From the banking side, compliance checks will include usual KYC checks, but also understanding where inbound payments are originating from, and outbound payments are made to, as well as an understanding of the overall business model to comply with anti-money laundering (AML) regulations. In addition, they will run PEP, OFAC, and other international sanctions checks.

The platforms rely to some extent on the financial institutions doing the diligence on companies, before providing bank accounts. That said, they will also do their own checks before providing credit facilities for user acquisition, including evidencing ability to pay from bank statements, tax returns, etc.

Operational considerations

In almost all cases, the operations of the offshore entities tend to be conducted in USD, minimizing the need to convert inbound payments funds, and also being the primary currency of advertising. Choosing a bank who has good multi-currency capabilities and online banking is essential. For more information on why USD is currency of choice for gaming and app studios, please check out this post on the topic.

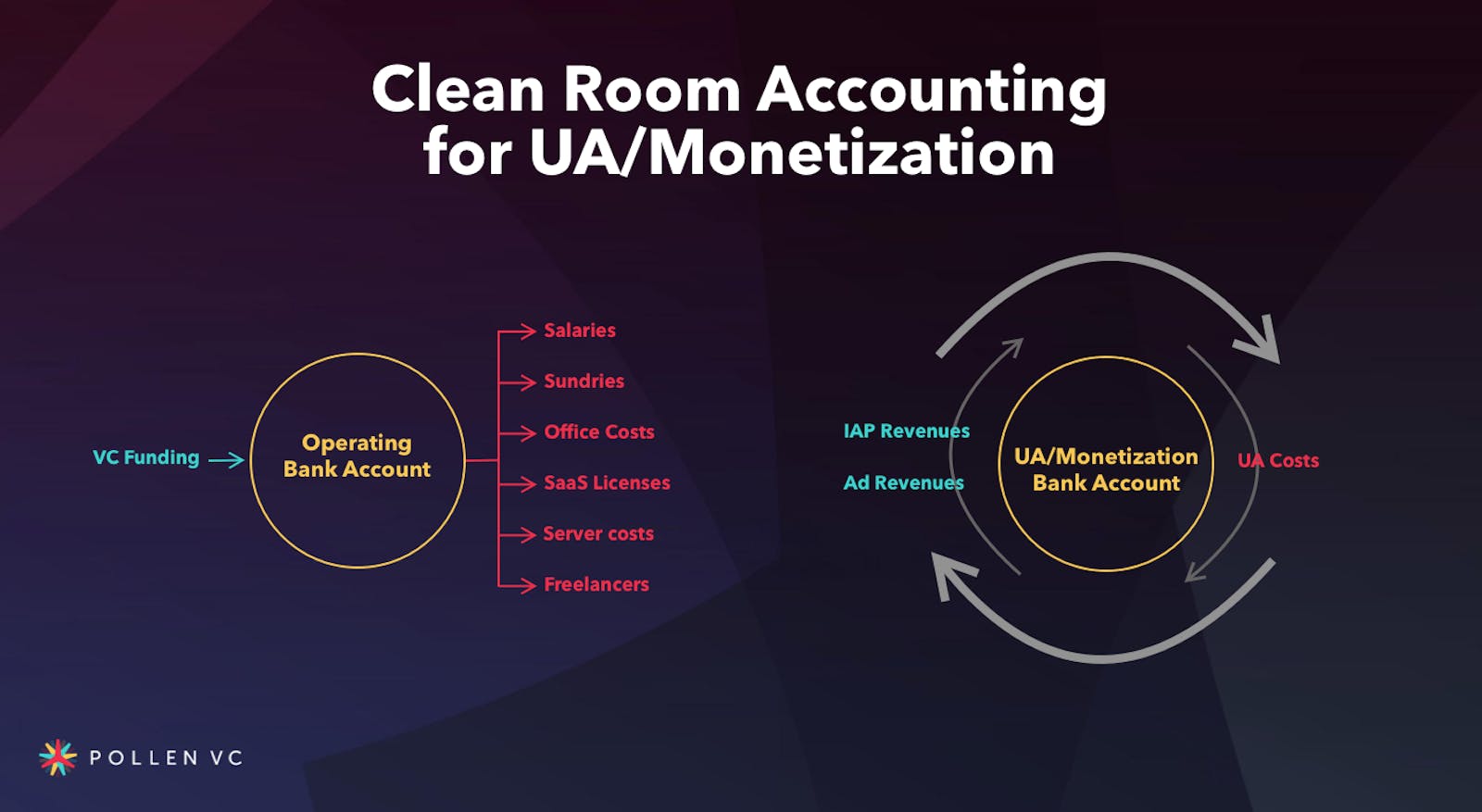

It’s also worth highlighting that in terms of best practice, studios should look to employ a clean room accounting approach to their UA/monetization, segregating them away from the day-to-day operating costs of the company. This makes it significantly easier to track the effectiveness of the user acquisition machine over time, as funds are not co-mingled with operating capital.

To read more on clean room accounting, please check out this post.

Summary

Take time and research whether an offshore structure is the best thing to do for your business. It’s important to think through your own requirements and then work towards a structure that will accommodate your needs. There is no one size fits all approach here - everyone’s requirements are different and need to be tailored separately.

Having someone that can help you on the ground is essential, whether this be lawyers, accountants, or company formation agents. It makes the process much easier if whoever you engage to help has experience working with app or gaming companies, so they are already aware of the operating model and the potential challenges faced. Talk to other founders and companies who have been through this journey as recommendations in this space are golden.

Creating the right structure and operating it diligently will help you set up for success and enable you to achieve success on a global stage, regardless of where you and your team are physically based.

To go back and read part 1 on domicile and location, click here.

To read part 2 on accessing capital, click here.

Thank you for enjoying this series with us!

Disclaimer: Nothing in this post is intended to constitute legal or tax advice. You should always seek advice from professionals operating in jurisdictions you are considering and make sure that all local laws are complied with and all taxes are paid in a timely way to the relevant authorities.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!