Unpacking the Mobile Gaming VC Mega Round

Investment into mobile gaming start-ups has ballooned in recent years. In 2021 - VCs invested $1.1Bn into early-stage deals and $4.8Bn into later-stage deals - a total of $4.54Bn. This is up from a total of $3.44Bn in total financing in 2020 (source InvestGame Gaming Deals Activity Report 2021).

As mobile gaming founders raise ever-larger rounds, keen to take advantage of the buoyant market for VC funding, a primary reason cited to justify the size of the round is the sheer costs of user acquisition (UA) and how much capital is required to achieve true scale.

Let’s look at the implications of this trend from both perspectives - VCs (and that of their LPs) and also studio founders. And we’ll also take off our rose-tinted spectacles and look at these different viewpoints through a slightly more bearish lens, and how things might play out down the line as capital markets tighten.

VCs (and their LPs)

VC funding for hot mobile gaming studios is very competitive and a big-money game.

The average mobile gaming seed round in 2021 was $7.9M, up from $4.5M in 2020 and we’ve even seen seed rounds announced greater than $50M. The current trend is that the sizing of VC rounds is increasing at all stages and also more money is being invested at earlier stages.

But the sheer size of the rounds being announced are causing some to pause for thought and look to play forward the economics for the fund, and what exit valuations would need to be achieved in order to return the sort of fund economics expected across their portfolio to achieve their target IRR returns for their LPs.

Let’s unpack the economics of the fund returns using a hypothetical example.

Example Scenario

Seed stage studio raises a mega $50M seed round based on a strong team and strong early metrics. Let’s say the funding is for a promising merge game with an expected 10 month (d300) breakeven period on its ad spend, and a 2 year LTV recovery timeframe. In order to propel a game into the top charts, they expect it will take $100k daily ad spend. Pause for a second and consider then that the studio would need to spend $30M in ad spend before the first cohort starts to break even, hence justifying the size of the round, right?

Let’s assume the founders give away 20% of the company, valuing the seed stage company at a whopping $250M post-money.

If the company achieves its goals (and does not need to raise any further round of funding - very unlikely in today's environment), the company would need to achieve an exit valuation of $2.5Bn for the VC to receive a 10x return on their investment.

This sticker price is more than Embracer paid to acquire Gearbox ($1.378Bn), EA paid for Glu ($2.1Bn) or Netmarble paid for SpinX ($2.19Bn). As a benchmark indicator, the average exit valuation in 2021 was $196M.

Now let’s think about Founders

Founders often cite the costs and competitive nature of the user acquisition space as a primary factor in justifying the size of VC rounds. Basically, this is just a direct transfer of funds from VCs to Facebook, Google and other leading ad networks, just like across the rest of the tech sector where an estimated 40 to 50% of all VC funds raised is spent to acquire users.

Starstruck by the high sticker price on the valuation achieved, founders often don’t think through capital efficiency and use alternative financing methods, which could result in them raising significantly less equity to achieve their goals.

Depending on the monetisation profile of the game, the same level of spend could be achieved on a much smaller round size if the founders use debt-based financing instruments such as revolving credit facilities to fund the UA spend.

Winter is coming

Let’s remember that economies are cyclical, though thanks to a lot of fiscal stimuli and the pandemic we seem to have missed out on an economic downturn since the 2008 financial crisis. However as the world wakes up to paying for costs endured through the pandemic and the economic impact of the war against Ukraine, interest rates are rising and inflation is at record highs in the US and UK.

If the free flow of capital into venture capital funds dries up, how will this play forward for startups and their exit opportunities?

The reality is - and this is particularly true of later stage rounds - is that most VC funding raised will be deployed into funding long-term UA cycles. This is a highly inefficient way to deploy venture capital when alternative financing instruments are available and should raise alarm bells not just for the VCs but also their invested LPs.

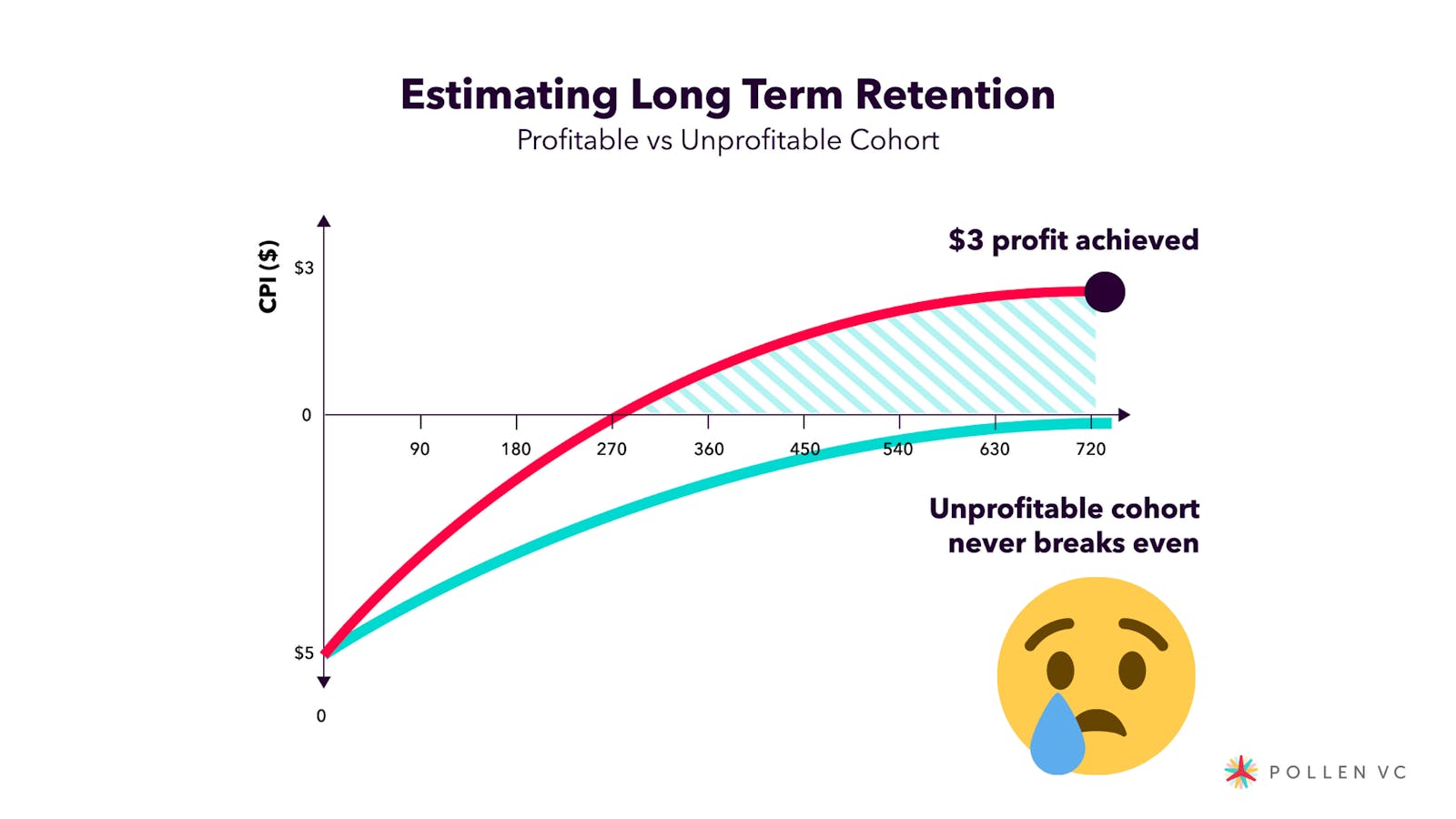

These are big money bets on user acquisition returning the expected LTV over long time horizons. If the studio happens to make the wrong bet on their long-term retention and monetization projections and the expected LTV is not recovered, then the spend on advertising is unprofitable and the company takes a direct hit to its P&L - all funded courtesy of their VC.

So why do founders and VCs not fund their UA spend in a more capital-efficient way? In other words, introduce leverage to fund somewhat predictable LTV cycles, using a combination of AR financing and loans against future receivables instead of dilutive equity?

The company then requires less upfront capital to achieve its lofty scale-up plan. The same level of acquisition can be done with considerably less capital just by introducing some flexible debt into the capital mix.

Founders and VCs may argue that the high valuation sets the bar high for exit valuation, with gaming acquirers continuing to pay top dollar for mobile gaming startups based on some ambitious lofty projections.

But as soon as the froth comes off the market, attention will quickly turn to how much liquidity preference exists in a downside scenario - in other words, VCs will almost always have a preferred return which will see them recoup at least 1x their investment first.

Acquirers will also know what they need to pay to get a transaction done, which can bring the amount of VC funding raised and associated liquidity preference to the forefront of the valuation discussion and can end up working against the founders.

Capital efficiency

A capital-efficient approach benefits everyone. For founders, it means that they are not over-raising (therefore needlessly diluting themselves) and deploying their venture capital funding in a smarter way.

For VCs it helps optimize fund returns, enabling them to deploy capital into more promising companies, diversify their risk, using leverage to optimize the capital mix of their portfolio companies.

There is of course an argument which is to say the VC funds want to “bear hug” the founder and load them up with as much equity as possible to maximize their ownership stake. But in reality, most founders are waking up to the concept of capital efficiency in their fundraising plans to get their mix of capital right based on risk/reward profiles of how they deploy capital in their business.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!