When we launched Pollen VC in 2014, you could pretty much count the VCs who invested in gaming studios on one hand. Fast forward to 2021 and studio founders were spoilt for choice, with billions raised as the gaming sector became a glamorous investment opportunity. This, off the back of a better understanding of the mobile gaming economy, and some notable mega-exits drawing attention to the sector from more generalist investors.

Now that everything has cooled off again, we can pause for thought as to what makes a good VC investment into a gaming studio, and how studios should be funding themselves into the next economic cycle.

The VC Mega Round

One notable trend over the last few years was the raising of later-stage “growth” rounds. Many VC rounds touted as Series B or later, typically more than $10 million in size were announced by companies. This happened particularly in the casual, puzzle, and merge genres, often with founders citing the “high cost of user acquisition” as a justification for the size of the round required.

Others raised large sums just because investors were chasing them down, keen to find a way into the “hot” gaming sector when valuations were sky high, thus giving the studio lots of dry powder and an acquisition war chest to take advantage of opportunities in the future.

And a handful just raised because the market was hot and they believed it would set a new high bar for their valuation and would force exit valuation higher. This is reasonable logic in a bull market with a strong current of M&A deals, but seems like a suboptimal strategy now the market has turned. Now, founders find themselves further away from any sale proceeds, due to the additional liquidity preference granted to their most recent investors.

Personally, I never understood why these companies raised these rounds after their Series A and came up with the following hypothesis:

If a game relies on additional equity funding to scale UA then it’s normally because either:

1. The period to break even on ad spend is so long that it requires a huge amount of equity financing in order to scale the game as cohorts can take up to one year or even longer to break even (think games with a long ROAS recovery and multi-year LTV. E.G. puzzle games, match 3, merge games, etc.)

Or

2. The VCs consider the financial return profile of a game and the expected Internal Rate of Return (IRR) it generates as sufficiently high and convince the founders to take their equity capital over other less dilutive options.

Before investing in these late-stage rounds, VCs would typically diligence their existing user cohorts and figure out how much residual value was left, how good the UA “machine” is, and how much that machine could be theoretically scaled before the unit economics flattened out.

In a strong market, founders often don’t consider other options to finance their growth such as introducing debt into their capital mix, because the perceived uplift in raising at a high valuation is expected to outweigh the impact of equity dilution.

But as the wider gaming market continues to cool, and acquirers wake up to the fact they have overpaid for studios over the last few years, there is a recalibration going on in the market that will put some of those who have raised these later-stage rounds in a tough spot when considering future exit options. The mis-pricing of the value of existing and potential future users is gradually coming home to roost and will continue to do so over the coming months.

Reading the tea leaves

Founders and CFOs of gaming studios should understand the return profiles of their investment in UA and be able to articulate this on a basis where they can make an informed decision about how best to finance it. Many are calculating their monthly ROI (mROI) as a metric that gives a time-based measure of their UA returns and then can figure out the optimal financing instrument for it.

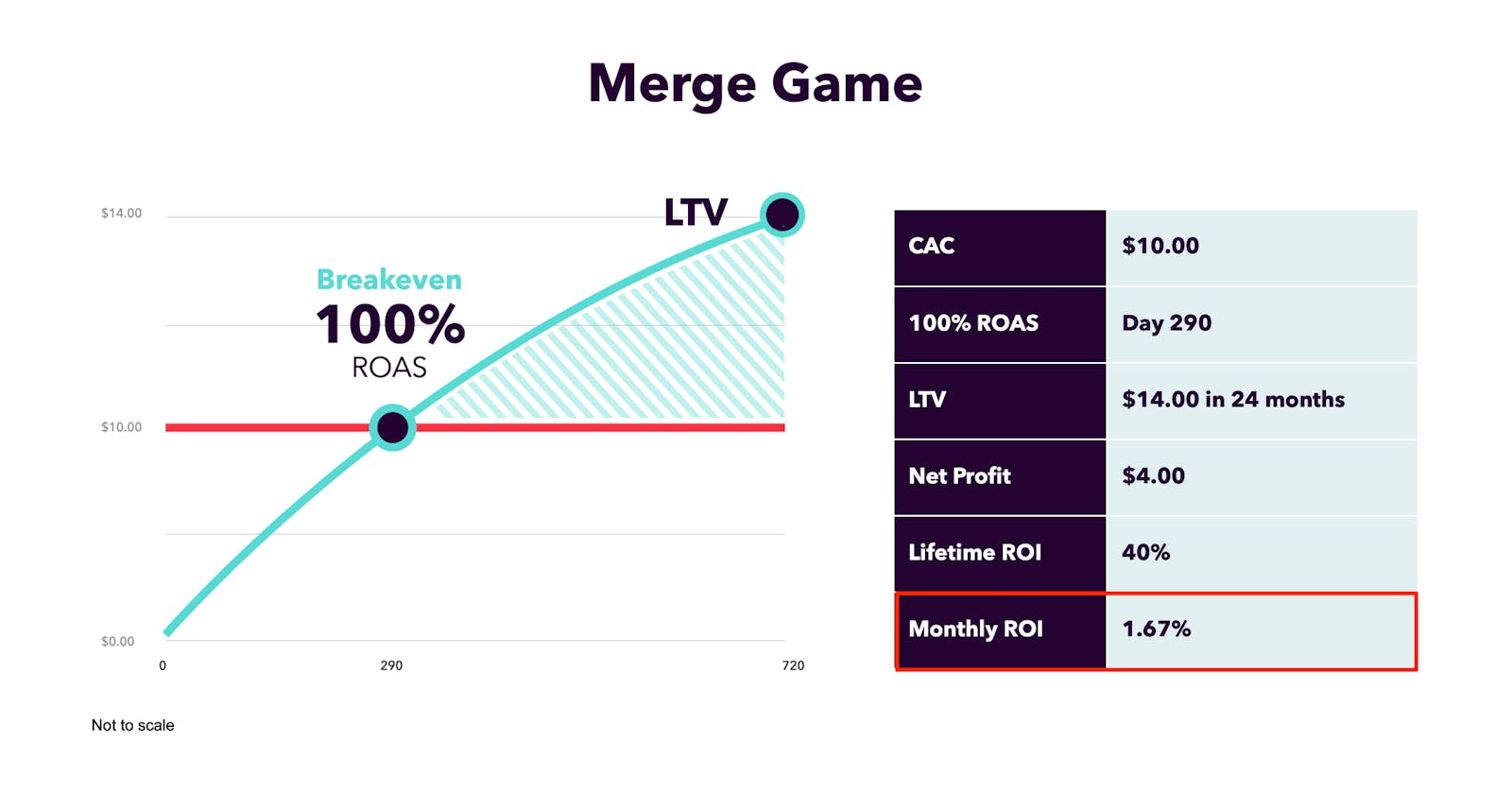

Take an example of a merge game with an acquisition cost of $10, and expected LTV of $14 over a 24 month timeframe. A 40% return over 24 months equates to a mROI of just 1.67% per month, or 20% per year (ignoring the convexity of the LTV curve). Most VCs target an annualized IRR for their own funds of 40% or higher, so continuing to invest into studios delivering low returns could impact their overall fund return economics as acquirers are surely getting better at valuing mobile gaming studios.

Founders and CFOs are increasingly looking at more capital-efficient alternative solutions to fund continued user acquisition such as revolving credit facilities and revenue-based loans, where they can profitably fund their own UA without any (or as much) equity dilution. By comparing their monthly cost of capital as an interest rate against their mROI return on ad spend, it will be obvious if the studio can use debt to scale instead of relying on equity financing.

VCs have also realized that in a much cooler funding environment, funding UA to scale games with equity is not going to give them the kind of returns they are looking for, and have pulled back significantly. Whilst seed and selective Series A rounds are still relatively unaffected, the bigger, later-stage rounds for UA investment have very much dried up as the hangover sets in.

Founders need to consider all options when thinking about their capital structure, now more so than ever in these testing market conditions. Right now it’s about doing more with less, so there is a real focus on unit economics and alternative financing methods to ensure survival and set up for success.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!