UA managers tend to focus on a set of core metrics: CAC, ROAS, LTV etc. These are the metrics that enable them to measure success or otherwise in their campaigns.

For those working in larger companies, there is a tendency always to focus just on P&L - the accounting period in which revenues are earned, as UA managers are normally isolated from the finances of the company. But for anyone working in a growth stage company who has to be mindful of the overall health of the business, should be laser-focused on cash as well their P&L.

What’s the difference and why does it matter?

In accounting terms, P&L is revenue earned (and expenses incurred) recognized in a particular time period, e.g. a month. Cash is when the funds actually hit the bank account.

It matters because there are payment terms from the app stores and ad networks which insert a payment delay of between 15 and 60 days after the end of the accounting period in which P&L is recognized before funds are actually received.

Depending on the time it takes you to break even on your ad spend (achieve 100% ROAS recovery), this can make a huge difference to your ability to fund additional user acquisition.

How do payment terms work?

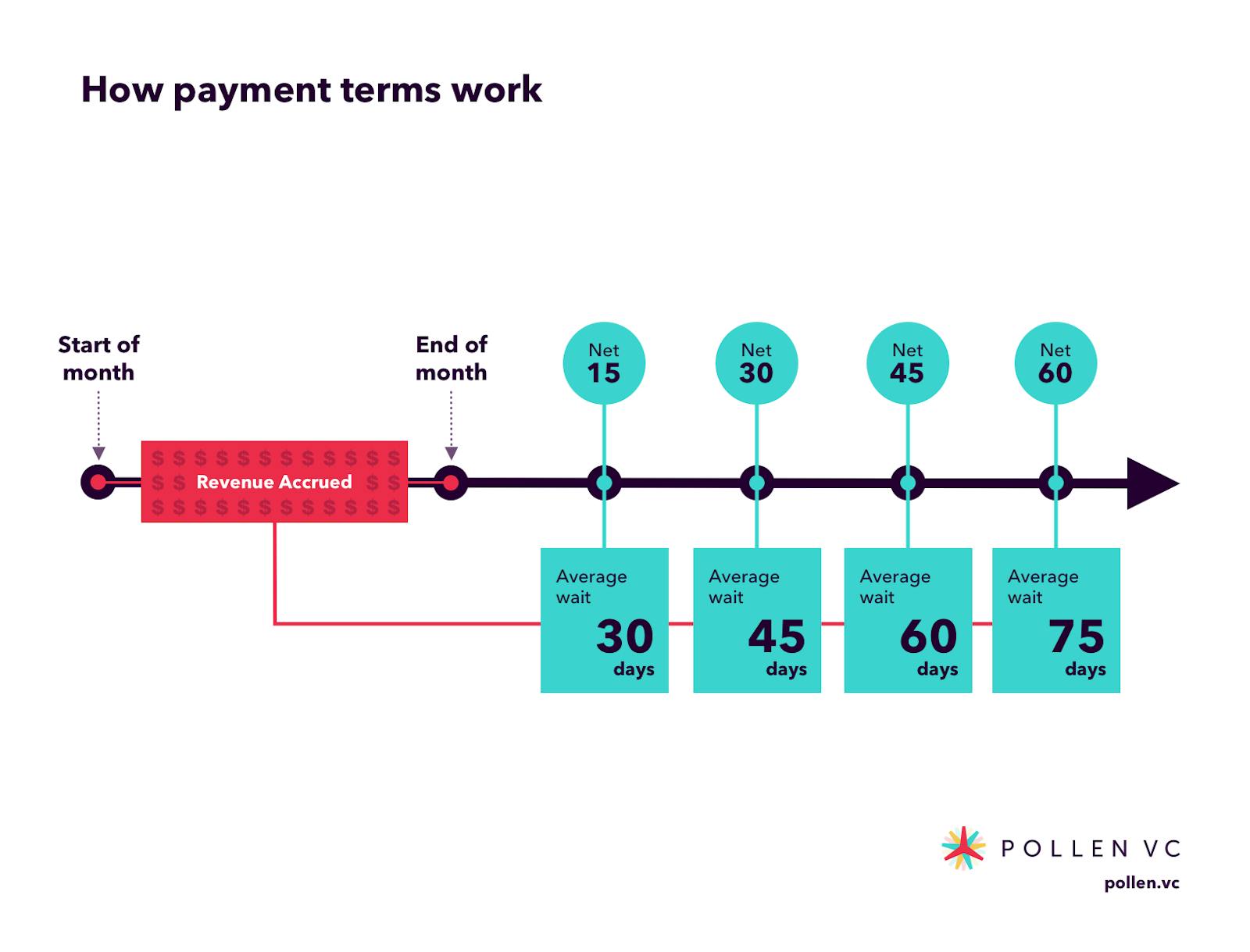

App stores and mobile ad networks can have very different payout schedules. Typically the month’s revenues accrue over the monthly billing period and then are “fixed” at the end of the month. Sometimes there is a self-billing invoice generated by the platform this is a form of proxy invoice to help the company enter the figure in their accounting system.

There is typically a delay after the end of the month before the payouts actually occur. You will often see language like Net15, Net30 or Net60, which means the number of days after the end of the month when a payment will actually be made into the company’s bank account.

Average payables days

Why is it important?

In all but the very largest cash rich advertisers, payment terms are a crucially important factor in the overall UA process as it sets the tone on how quickly funds can be reinvested back into more user acquisition, provided the company has figured out an ROI positive way to spend and is confident in its own unit economics of acquisition.

In order to increase spend there needs to be either sufficient headroom on available credit lines, or most often earlier stage companies ad spend is funded on credit/debit cards and/or using venture capital funding.

When a UA manager is not able to increase their ad spend because of a cash constraint issue, this is where the payment delays start to impact the pace of user acquisition that can be achieved.

If the company has to wait until it has actually been paid before it can reinvest back into UA (for example loading up the company card used to handle its Facebook and Google ad spend), then the UA managers are leaving money on the table and should work with their finance teams to explore additional sources of funding for UA.

Developers seeking to grow in a capital efficient way use accounts receivable (AR) lines of credit as a way of solving the problem. This can be a low cost capital efficient way of freeing up the cash that is trapped in the receivables cycle to allow UA managers to reinvest and keep up their pace of UA, without having to resort to raising additional, dilutive equity financing.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!