Revenue-based finance (RBF) has seen a strong increase over the last 24 months and is becoming an increasingly popular funding option for certain types of tech companies as an alternative to VC funding.

The model works by lenders connecting up data sources including banking, accounting and digital advertising platforms, then calculating an amount to lend based on recurring revenues, growth trajectory and effectiveness of marketing campaigns. Loans are made with a fixed percentage of revenue to be repaid each month until the loan is repaid in full plus an agreed fee - typically 6-12%.

Whilst the sector is enjoying a lot of love as a new non-dilutive funding model, there are a bunch of caveats to be mindful of for both lenders and founders. Is the model applicable for mobile gaming companies looking to fund efficiently? As with pretty much everything in mobile gaming it comes down to the numbers...

LTV duration is critical

These days it’s fairly easy to estimate LTV of users, thanks to a clear consensus on metrics to focus on, the availability of online calculators and where mobile measurement partners make it possible to track performance of historical cohorts.

In essence, the longer the LTV cycle of the game the more comfortable lenders are with the recovery risk which enables them to fund over long time horizons at reasonable rates. The shorter the LTV recovery period however, the greater the risks of non-recovery if customer acquisition spend is unprofitable, which is reflected in the pricing for the loan.

LTV recovery timeframes depend very much on genre. On one hand, consider hyper casual games, where a well performing game could break even on their ad spend in 3-5 days and have a non-recurring LTV cycle of less than 21 days.

At the other end of the spectrum, you have games with incredibly long LTV cycles: think about match3 franchises or social casino games where breakeven periods can be 6-12+ months and LTV can be measured in years.

In genres where LTV recovery is short, unless there is continuous investment into UA then the revenues will flame out very quickly. If the UA formula stops working and does not return the expected ROAS/LTV then the journey from hero to zero can be lightning quick.

Conversely, if there is a predictable path to ROAS breakeven of months not days, and a higher margin LTV recovery then revenue based loan could be a better fit for the revenue based lending model.

Matching the investment horizon to the LTV cycle is key - both for lenders to protect themselves, and for gaming companies wanting to ensure their success.

The rule of thumb is that the shorter the LTV cycle, the riskier the investment for the lender and the higher the cost of capital for the company.

Understanding cohort dynamics

In order to properly assess the residual value of the long tail of cohorts, it is necessary to understand both the expected duration of the cohort, but also the constituent components of the cohort based on its age.

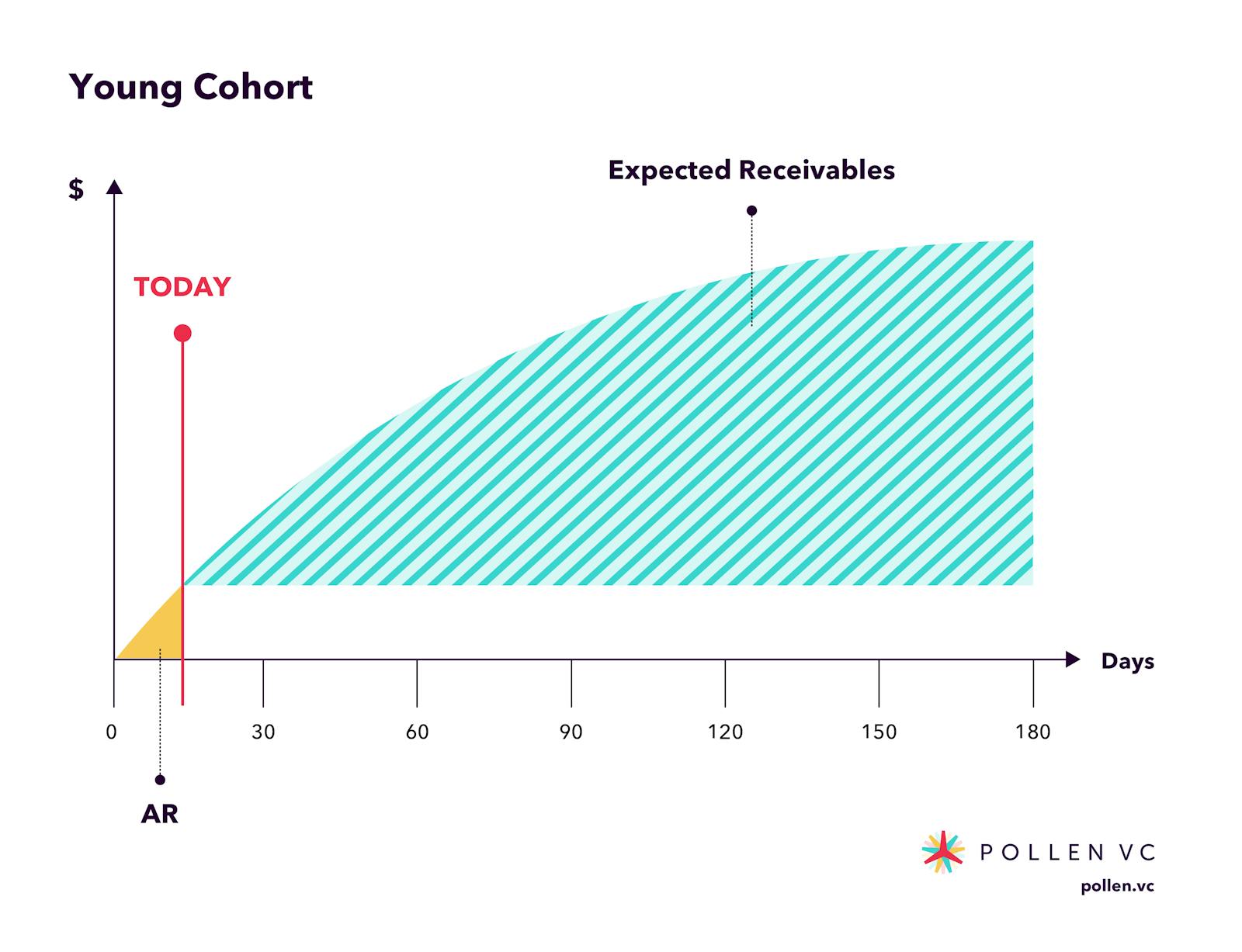

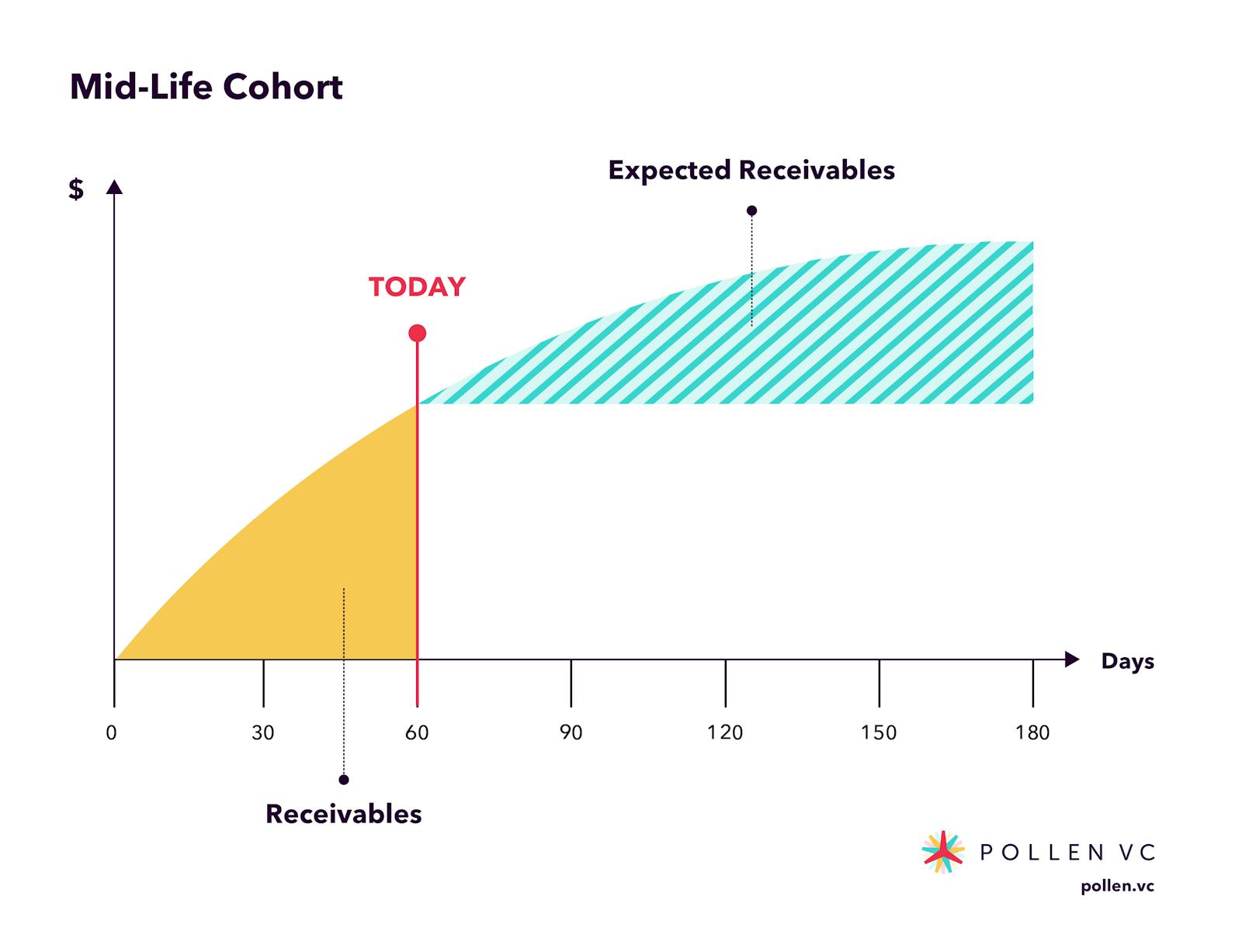

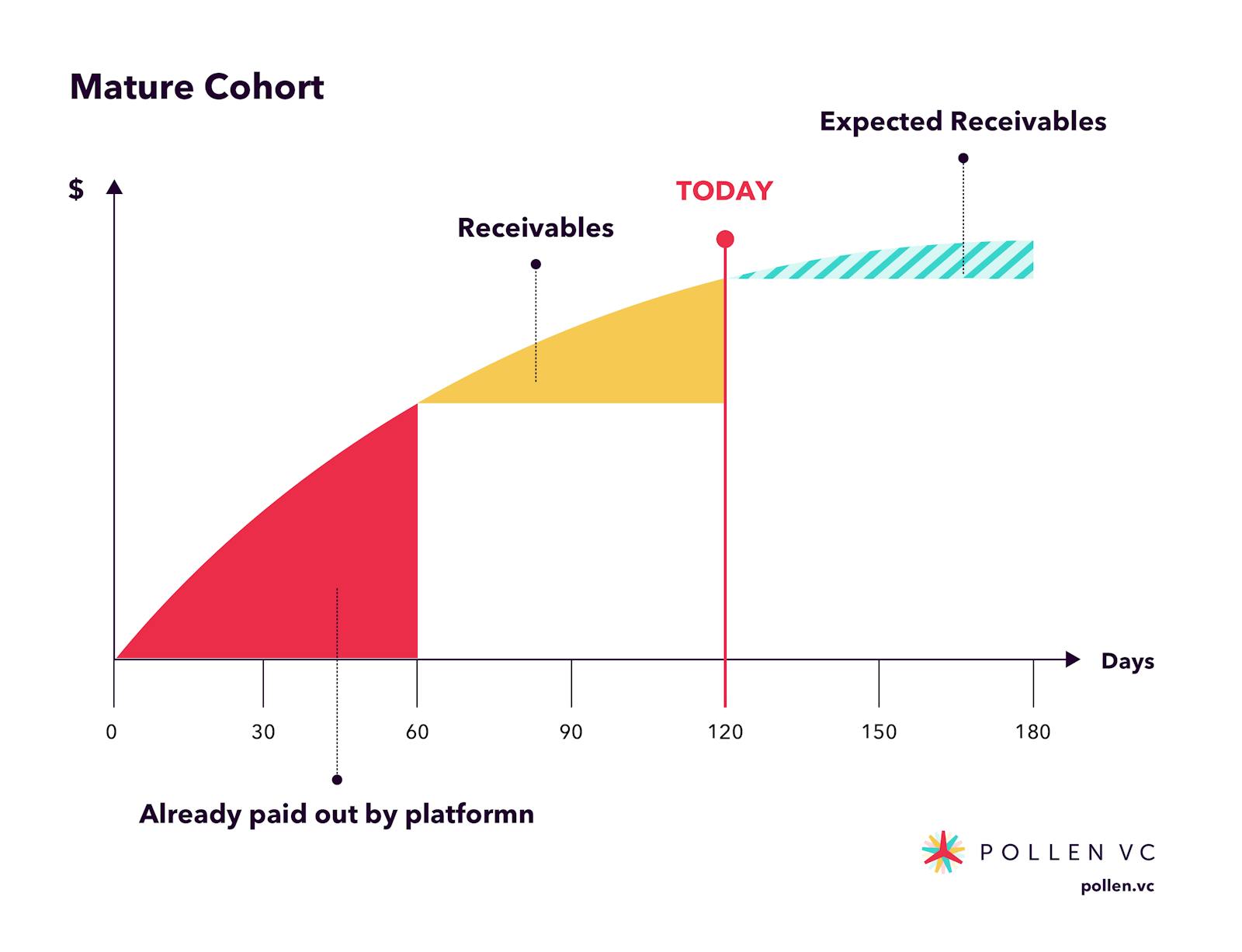

Depending on its age, any given cohort can consist of three different classifications of revenue.

- Revenues already paid out from platform

- Accounts receivable (AR) - has been verified with platform, but has not yet been paid out

- Expected receivable - the cohort is expected to deliver additional revenue according to a predictable pattern

Now consider 3 different scenarios for cohorts with a 180d LTV at different points in time, showing how these three scenarios can be understood.

What happens if the loan can’t be repaid?

Revenue based loans are typically unsecured, and are repaid by an expected stream of revenues earned by the company on a fixed percentage basis each month. If the revenues dry up and the company is unable to pay, then the lender will look to see what recovery is available. In some cases they may be secured against the assets of the company, in which case could take over ownership of IP etc. In other cases if unsecured, the lender can still seek to recover invoke wind up/liquidation of the company and force a sale of assets. So it’s important to understand the downside scenarios if things don’t pan out as you expect.

The question gaming founders should be focused on is ‘after all the loan has been deployed into user acquisition, what would happen if all UA stopped on that same day’? Is there enough residual value in the live marketing cohorts to repay the revenue based loans they are taking within the agreed time frame to repay the loan?

Is a revenue based loan right for my gaming company?

Given we have established that a typical cohort pattern is going to include an element of accounts receivable (AR) as well as an element of expected receivables, founders should consider a few different factors when making the right funding choices.

- Have I modeled the true cost of the revenue based loan to feed into my UA calculations? If not, try our handy RBL calculator that breaks down the cost of the revenue based loan into an APR which makes it easy to compare cost vs return on capital of funds invested into ad spend.

- Could an AR facility provide me enough additional revenue to meet my UA ambitions at a lower cost? If my AR constitutes approx 1.5x monthly revenues, does this give me a lower cost option with more flexibility?

- If a revenue based lender is prepared to lend me a larger multiple of my monthly revenues, what are the expected time horizons for repayment, and does this match my expected LTV recovery cycle?

- If I take a revenue based loan, can I take new loans each month as I grow, or do I need to wait until the first is fully repaid?

- If I take a revenue based loan, can I put an AR facility in place too?

It’s great to see more funding choices available for founders than straight up equity, and RBL definitely has a helpful role here. As with any financial product, founders need to avail themselves of all the options and understand their costs and implications in order to make the most informed choice for their business.

Pollen VC provides flexible credit lines to drive mobile growth. Our financing model was created for mobile apps and game publishers. We help businesses unlock their unpaid revenues and eliminate payout delays of up to 60+ days by connecting to their app store and ad network platforms.

We offer credit lines that are secured by your app store revenues, so you can access your cash when you need it most . As your business grows your credit line grows with it. Check out how it works!